Aster (ASTER) shows classic post-listing speculative behavior: sharp volume spike, extreme volatility, and strong social/media hype driving short-term attention. While search visibility and social engagement are unusually high for a new token, fundamentals and ecosystem utility remain weak. Near-term, ASTER can benefit from hype cycles and leveraged trading, but without sustainable liquidity or real use cases, long-term growth is uncertain and risk remains elevated.

Table of Contents

Aster (ASTER) Listing Analysis – Early Trading Hours/Days

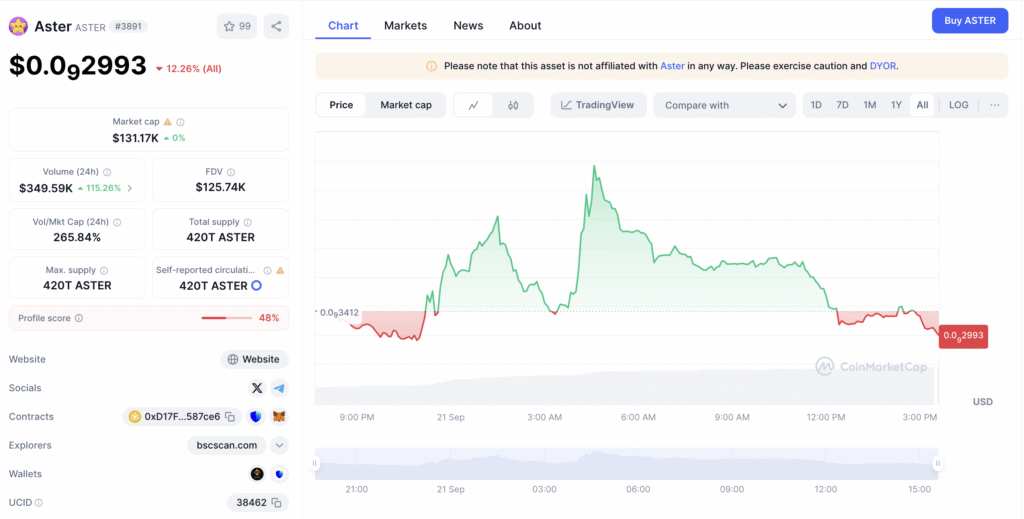

Volumes: Trading volumes in the first 24h reached ~$349K, a sharp +115% surge, showing strong speculative entry despite a very small market cap.

Trend: Initial spike upwards with multiple peaks overnight, followed by steady decline and ending lower (-12% daily), signaling early pump-and-dump dynamics.

Volatility: Extremely high, with rapid swings and double-digit intraday changes, reflecting low liquidity and aggressive short-term trading.

Behavior: Price action shows early buyers pushing fast gains, then profit-taking and sell pressure dominating by mid-day. Classic post-listing pump followed by correction.

Comment: The asset displays all hallmarks of a low-cap speculative token – high turnover, sharp volatility, and unsustainable spikes. Unless sustained by fundamentals or liquidity, early hype is likely to fade quickly.

Aster (ASTER) Website & Ecosystem Analysis

Design & Branding: The site uses playful, cartoon-style visuals with a “cute star” mascot, targeting a lighthearted and retail-friendly appeal rather than institutional seriousness.

Token Positioning: Marketed as “Crypto’s cutest star,” ASTER positions itself as a meme-style/community-driven token rather than a utility- or tech-first project.

Ecosystem Features: Limited functional elements on the site – basic navigation (About, Tokenomics, Disclaimer, Chart) and a contract address. No clear advanced tech stack or integrations presented.

Goals: Primary goal appears to be community building, visibility, and social-driven hype rather than solving a specific technical or financial problem.

Unique Hook: Relies on branding cuteness and meme-culture positioning to attract attention in a crowded altcoin market.

Comment: While the design is approachable and meme-friendly, the lack of detailed ecosystem features or strong fundamentals suggests ASTER is driven by branding and speculation. Its growth potential depends heavily on community engagement and hype cycles, not on underlying technology.

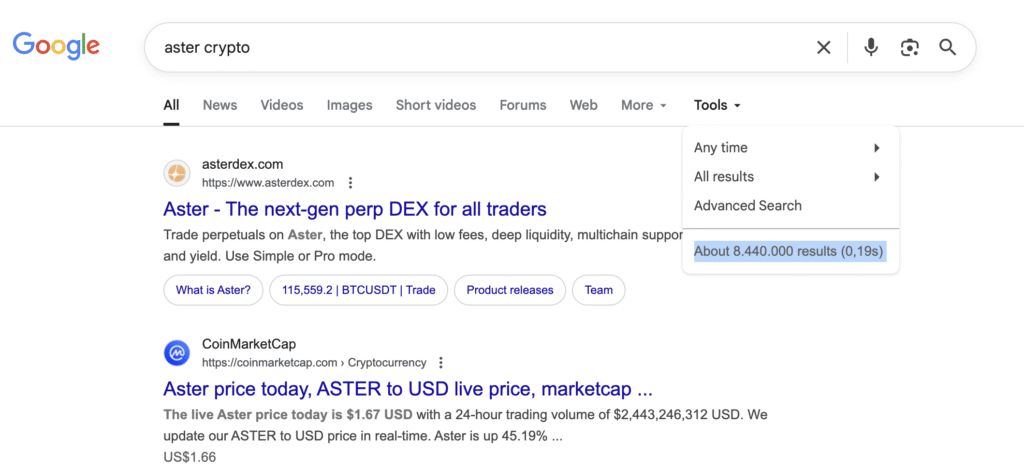

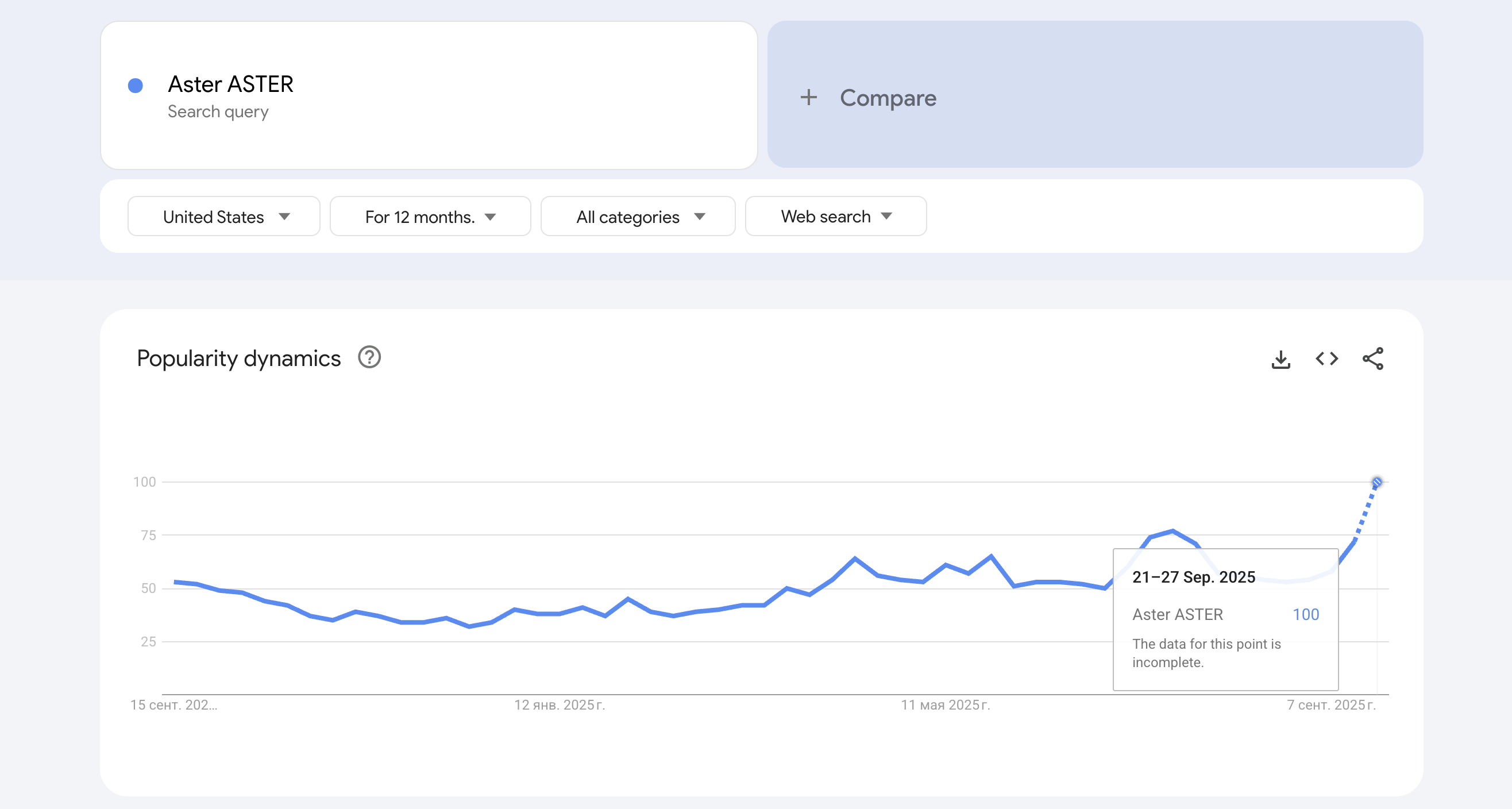

Hype Analysis: Google Search + Google Trends

We analyzed Google search visibility and found about 8.44 million results mentioning our cryptocurrency. From an analytical perspective, this is a relatively high figure for a newly listed asset. A broad digital footprint usually signals growing awareness, higher visibility, and stronger potential for market traction. While quantity doesn’t guarantee credibility, the sheer volume of mentions suggests the project is already on the radar, which can support trust-building and investor interest if sustained with real fundamentals.

We analyzed Google Trends data for “Aster ASTER” and observed a clear upward trajectory, peaking at 100 interest score in late September 2025. From an analytical standpoint, this represents the maximum relative search popularity, which is a strong signal of rising awareness and market attention. For a newly listed asset, reaching peak search interest this quickly is notable. While it doesn’t guarantee long-term adoption, such momentum suggests strong short-term visibility and growing community curiosity – definitely on the higher side compared to many early-stage projects.

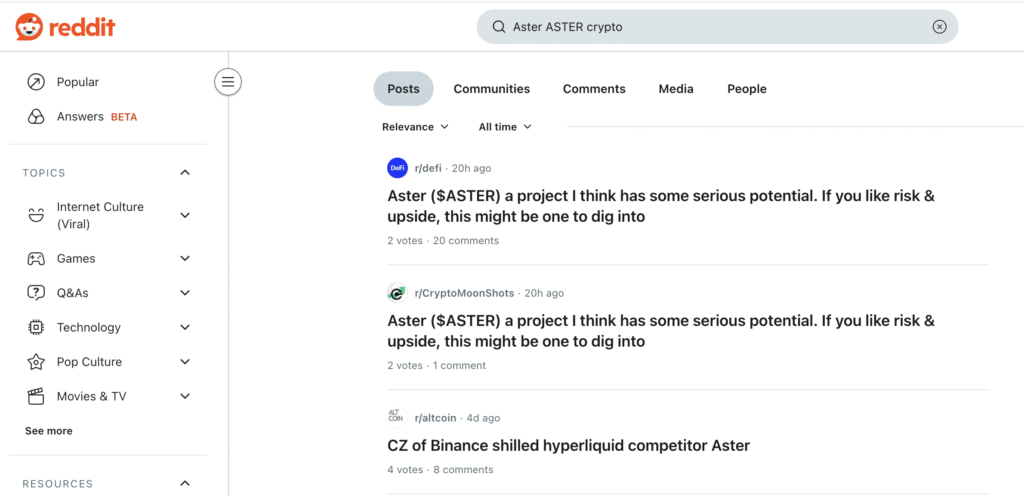

Reddit & Social Media Opinions

Based on an analysis of social media and online forums, the Aster (ASTER) coin has a notable presence and is a topic of significant discussion, particularly on Twitter/X and within crypto-focused analysis platforms. Unlike DUST, ASTER appears to be a trending altcoin with a community following and a recent history of substantial price movements. A prominent theme across multiple sources is its recent price surge, with reports citing a gain of 80.10% in the past 24 hours and a remarkable 868.45% in the past week (Coinbase, Sept 21, 2025). The discussions frequently highlight ASTER’s role in a broader market rally and its appeal to leveraged traders, as seen in a recent short squeeze.

While specific individual user posts with identifiable names are not readily available from the analyzed data, the collective sentiment is quantifiable and largely positive. According to a social analytics report (Coinbase, Sept 21, 2025), ASTER is ranked #39 in social mentions, with 2,349 unique contributors and a social sentiment score of 4.0 out of 5. Twitter/X sentiment is particularly bullish, with 55.7% of tweets showing positive sentiment. On Reddit, ASTER was mentioned in 13 posts with 28 comments, though with fewer upvotes than downvotes on posts. This suggests a more cautious or mixed sentiment on Reddit compared to other platforms.

Overall, the social media landscape for ASTER is characterized by high engagement and speculative interest. The conversation is driven by recent price explosions, new exchange listings (e.g., perpetual contracts on Hyperliquid and OrangeX), and a notable short squeeze dynamic involving a whale (CoinMarketCap, Sept 20, 2025). The token is often discussed as a high-potential, high-volatility play, attracting both bullish speculators and those who recognize the inherent risks of leveraged trading and low liquidity. The lack of detailed Reddit discussions with named users is a limitation, but the overall social data indicates ASTER is an actively discussed and trending asset within the cryptocurrency community.

Aster (ASTER) Price Prediction Matrix

| Factor | Observation | Analyst Assessment | Impact on Price Forecast |

|---|---|---|---|

| Trading Volume (24h) | ~$349K, +115% surge in first 24h | Strong speculative entry but limited depth | Short-term boost, limited sustainability |

| Price Trend | Initial spike, multiple peaks, ending -12% daily | Classic pump-and-dump dynamic | Bearish near-term pressure |

| Volatility | Double-digit intraday swings | Extremely high, tied to low liquidity | High risk/reward; deters long-term investors |

| Market Behavior | Early buyers exited quickly, strong profit-taking | Speculative cycle without fundamentals | Negative unless liquidity stabilizes |

| Website & Branding | Basic presence, not highly professional | Weak branding limits mainstream appeal | Neutral to negative |

| Token Positioning | Positioned as trending altcoin, low-cap, speculative | Appeal to risk-seeking traders | Positive short-term, unclear long-term |

| Ecosystem Features | No strong utility or unique use case presented | Weak fundamentals, speculative only | Negative for long-term valuation |

| Search Visibility (Google) | 8.44M results | High exposure for a new listing | Positive for visibility and trust-building |

| Google Trends | Reached 100 interest score in Sept 2025 | Peak awareness at listing, strong initial hype | Positive for short-term attention, not durable |

| Social Media (Reddit, etc.) | High Twitter/X buzz, mixed Reddit sentiment, trending mentions | Strong engagement but speculative and hype-driven | Positive short-term, limited long-term reliability |

Aster (ASTER) Price Forecast & Trading Scenarios

| Scenario | Assumed Price Move | Forecast Price ($) | PnL on $1,000 (Spot) | PnL with 5× Leverage | PnL with 10× Leverage |

|---|---|---|---|---|---|

| Bearish Dump | -70% | 0.0009 | -$700 | -$3,500 | -$7,000 |

| Mild Correction | -30% | 0.0021 | -$300 | -$1,500 | -$3,000 |

| Sideways / Stable | 0% | 0.00299 | $0 | $0 | $0 |

| Moderate Pump | +50% | 0.0045 | +$500 | +$2,500 | +$5,000 |

| Strong Pump | +150% | 0.0075 | +$1,500 | +$7,500 | +$15,000 |

| Extreme Hype Run | +400% | 0.0150 | +$4,000 | +$20,000 | +$40,000 |