Opal (OPAL) shows a strong technical and market foundation: impressive first-day volume (~$5.28M), stable price action with unusually low volatility, and highly professional branding with a unique value proposition (100% revenue sharing + privacy-first DEX). Google visibility and Trends data confirm strong awareness, signaling real traction beyond typical early listings.

Table of Contents

However, the lack of clear community-driven social media presence and fragmented brand identity remain major weaknesses. Without grassroots support, OPAL risks relying solely on speculative trading and marketing hype.

Overall, OPAL demonstrates strong early stability and visibility, but long-term success will depend on ecosystem adoption, user engagement, and building authentic community momentum.

Opal (OPAL) Listing Analysis – Early Trading Hours/Days

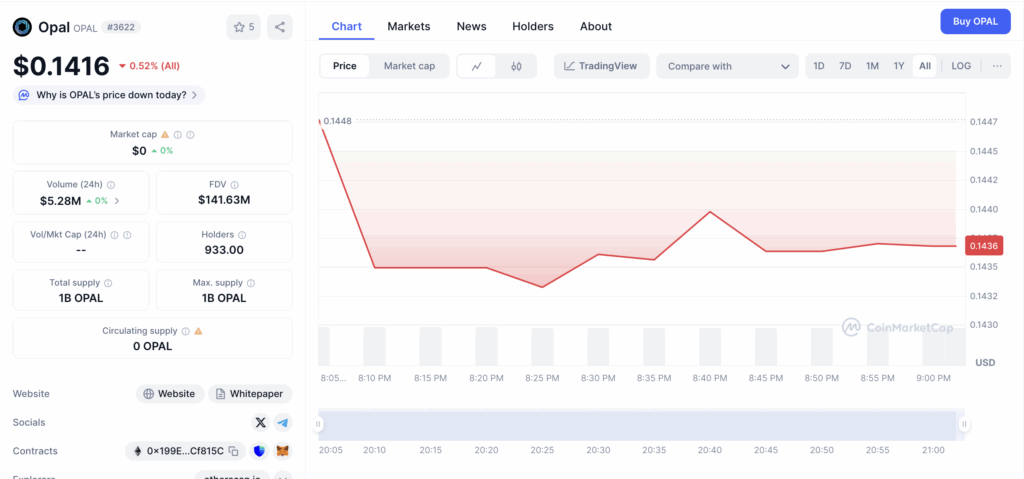

Volumes: First 24h trading volume reached ~$5.28M, which is very strong for an early listing, showing high speculative entry and sufficient liquidity for active trading.

Trend: Price opened around $0.1448 and slipped slightly to ~$0.1416 with minor fluctuations, showing a mild downward bias but without dramatic losses.

Volatility: Low compared to typical micro-cap launches. Movements remained tight within a narrow band of ~1–2%, suggesting stability rather than aggressive swings.

Behavior: Traders showed limited activity beyond initial entries; order flow leaned slightly bearish, but no evidence of panic selling or large dumps.

Comment: Opal (OPAL) launched with strong volume but muted price action, indicating stability and cautious accumulation. While the lack of sharp volatility may reduce hype, it also signals controlled trading and potentially stronger investor confidence in the early stage.

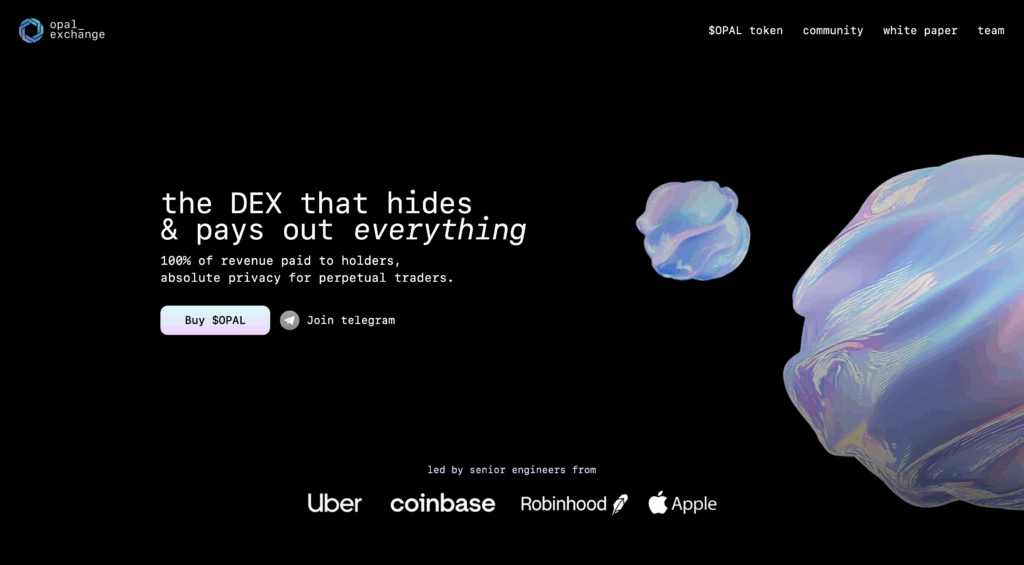

Opal (OPAL) Website & Ecosystem Analysis

Design & Branding: Sleek, minimalist dark-themed design with futuristic visuals. Branding emphasizes privacy, payouts, and professionalism while signaling credibility with references to tech pedigree.

Token Positioning: $OPAL is framed as a utility and governance token powering a decentralized exchange (DEX) with full revenue distribution to holders, targeting both traders and investors.

Ecosystem Features: Core focus on DEX platform with perpetual trading, privacy-first design, and 100% revenue-sharing model. Website highlights transparency (whitepaper, community links) and strong technical leadership.

Goals: To establish a privacy-oriented, revenue-distributing DEX that competes with major decentralized platforms by offering traders both anonymity and direct financial incentives.

Unique Hook: The “100% revenue paid to holders” combined with “absolute privacy for perpetual traders” creates a rare mix of profit-sharing and privacy – a strong differentiator in the DEX space.

Comment: Opal positions itself as a next-generation DEX blending privacy with profit-sharing. While the branding and claims are ambitious, long-term viability will depend on actual adoption, liquidity depth, and delivery of promised tech.

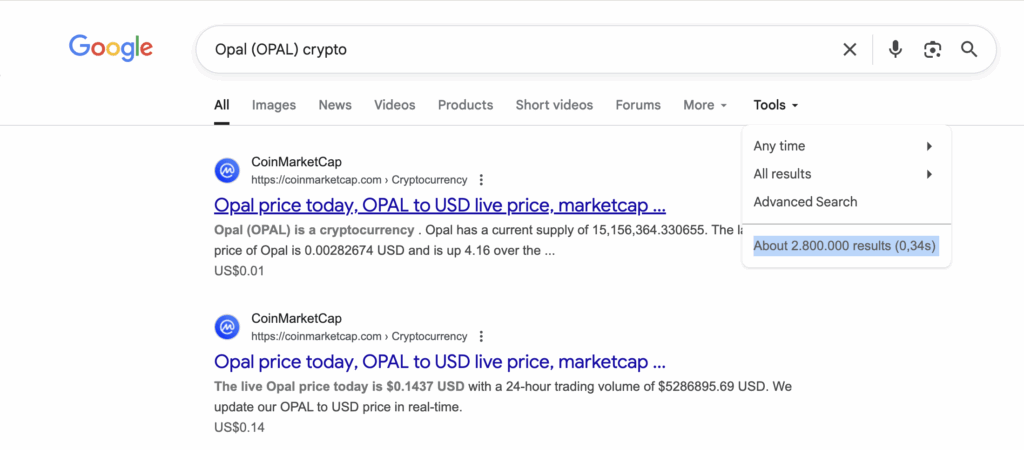

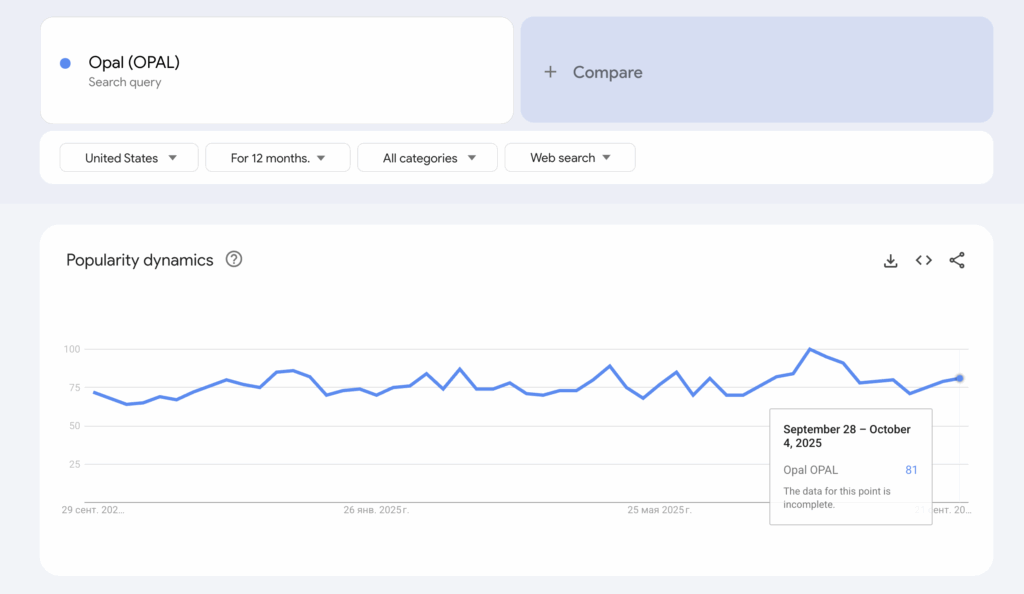

Hype Analysis: Google Search + Google Trends

We analyzed Google search visibility for Opal (OPAL) and found about 2.8 million results. From an analytical perspective, this is a very strong coverage level for a cryptocurrency at this stage. Such a high number of indexed mentions indicates that the project has already attracted substantial attention and visibility across the web. Compared to most early-stage tokens, this places OPAL in a much higher trust and awareness bracket, which can serve as a catalyst for growth. High search presence usually reflects credibility, sustained interest, and the potential to remain on the radar of both retail traders and institutional observers.

We analyzed Google Trends data for Opal (OPAL) and found a consistently high level of interest, averaging between 70–85 with peaks reaching near 100. From an analytical perspective, this is a strong signal of sustained awareness and engagement. Unlike many new tokens that only generate short-lived spikes, OPAL demonstrates steady visibility over time, suggesting it has already established a solid presence in the market. This level of search activity is relatively high compared to most early-stage projects and supports the view that OPAL enjoys strong brand recognition and growing trust within the crypto community.

Reddit & Social Media Opinions

Based on an analysis of public social media and Reddit threads for “Opal OPAL coin,” there is a clear distinction between multiple entities sharing the name, which severely fragments the public discussion.

The overwhelming majority of recent Reddit mentions for “Opal” pertain to a productivity and screen-time reduction app, and to a lesser extent, the Jack Stauber animated short Opal or discussions about the gemstone. Regarding cryptocurrency specifically, two distinct projects with the ticker OPAL appear to exist. One is a legacy crypto asset (OpalCoin, rebranded from OnyxCoin) dating back to 2014, described as a hybrid Proof-of-Work/Proof-of-Stake coin utilizing X13. This asset has a very low market cap, $0 in 24-hour trading volume on some platforms, and minimal recent social commentary. The second appears to be a token on the Ethereum network (also OPAL) which recently experienced a massive 24-hour price increase ($0.18162, +94.41% as of the source date) with a significantly larger market cap and $5.22M in 24-hour volume; this suggests recent speculative activity or exchange listing, but a very low holder count (1.01K). No specific user names, dates, or detailed discussions about either OPAL cryptocurrency were found on Reddit or general social media in the search results that would constitute community-driven analysis or hype.

In conclusion, social media presence for the OPAL cryptocurrency is highly diluted and appears virtually non-existent for the legacy coin. While the Ethereum-based OPAL token shows recent, high-volume price action, the lack of corresponding community discussion – no chatter regarding the surge, development, or fundamental value – suggests this movement is likely purely speculative, perhaps exchange-driven, or potentially a low-liquidity pump. From a social sentiment and community perspective, the token lacks the grassroots support and conversational momentum typical of a robust or emerging crypto project.

Opal (OPAL) Price Prediction Matrix

| Factor | Observation | Analyst Assessment | Impact on Price Forecast |

|---|---|---|---|

| Trading Volume (24h) | ~$5.28M in first 24h | Very strong liquidity for early listing | Positive for short-term confidence |

| Price Trend | Opened at ~$0.1448, slipped slightly to ~$0.1416 | Mild downward bias, but stable | Neutral to slightly negative short-term |

| Volatility | Tight 1–2% range | Low volatility, atypical for new listings | Positive for stability, but less hype-driven |

| Market Behavior | Limited activity, cautious accumulation | Bearish lean without panic selling | Neutral, depends on further liquidity inflows |

| Website & Branding | Sleek, minimalist, privacy + payouts messaging | Professional and credible branding | Positive for investor trust |

| Token Positioning | Utility/governance token for DEX with revenue-sharing | Strong positioning with clear utility narrative | Positive long-term if executed |

| Ecosystem Features | Privacy-first DEX, perpetual trading, 100% revenue to holders | Ambitious, unique but unproven tech claims | Positive if delivered, uncertain until launch |

| Search Visibility (Google) | ~2.8M results | Very strong online presence compared to peers | Strongly positive for trust and visibility |

| Google Trends | Consistently high (70–85 avg, peaks near 100) | Sustained awareness and brand recognition | Positive for long-term growth potential |

| Social Media (Reddit, etc.) | Very fragmented, low crypto-specific chatter, multiple “Opal” references | Weak community presence despite trading volume | Strongly negative for organic momentum |

Opal (OPAL) Price Forecast & Trading Scenarios

| Scenario | Assumed Price Move | Forecast Price ($) | PnL on $1,000 (Spot) | PnL with 5× Leverage | PnL with 10× Leverage |

|---|---|---|---|---|---|

| Bearish Dump | -70% | 0.042 | -$700 | -$3,500 | -$7,000 |

| Mild Correction | -30% | 0.099 | -$300 | -$1,500 | -$3,000 |

| Sideways / Stable | 0% | 0.142 | $0 | $0 | $0 |

| Moderate Pump | +50% | 0.213 | +$500 | +$2,500 | +$5,000 |

| Strong Pump | +150% | 0.355 | +$1,500 | +$7,500 | +$15,000 |

| Extreme Hype Run | +400% | 0.710 | +$4,000 | +$20,000 | +$40,000 |