Credia Layer (CRED) demonstrates a healthy and balanced market debut supported by moderate liquidity, controlled volatility, and early accumulation behavior. The project presents strong fundamentals with a clear AI-driven Web3 utility and professional branding, but its visibility and community engagement remain minimal. From an analytical standpoint, CRED is a technically solid but early-stage asset with long-term potential tied to adoption of its AI trading ecosystem. In the short term, limited exposure and retail activity cap upside momentum, positioning it as a mid-risk, innovation-driven token in its growth phase.

Table of Contents

Credia Layer (CRED) Listing Analysis – Early Trading Hours/Days

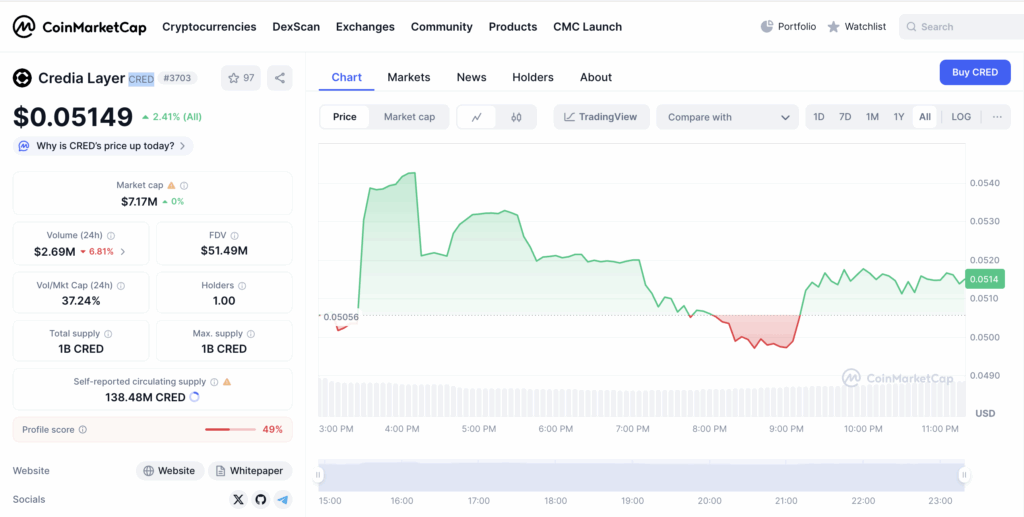

Volumes: ~$2.69M in 24h vs ~$7.17M market cap – a healthy 37% Vol/Mkt Cap ratio showing moderate trading engagement and balanced liquidity.

Trend: Opened near ~$0.0505, saw a quick surge above ~$0.054 before retracing slightly to stabilize around ~$0.051 – indicating early accumulation and mild profit-taking.

Volatility: Moderate – price fluctuations stayed within a 7% range, suggesting controlled market activity without major speculative pressure.

Behavior: Buyers dominated the early phase, pushing the price upward before consolidation. Selling pressure appeared but remained limited, indicating a steady order flow.

Comment: CREDIA Layer (CRED) showed a healthy post-listing performance with strong liquidity and limited volatility. The consistent bid support and gradual stabilization imply early investor confidence and a balanced market structure.

Credia Layer (CRED) Website & Ecosystem Analysis

Design & Branding: Sleek, futuristic, and professional with a strong emphasis on AI-driven visuals and deep-blue cyber aesthetics. The interface reflects credibility and high-end fintech identity targeting data-oriented traders.

Token Positioning: $CRED functions as a utility token within the AI-powered Web3 intelligence ecosystem, used to access analytics tools, mining features, and signal-based trading insights.

Ecosystem Features: Integrates real-time social, on-chain, and market data into actionable trading signals. Offers a “Signal Chat,” mining tools, and an AI-driven analytics dashboard for Web3 traders.

Goals: To empower traders with AI-generated insights and eliminate information noise by converting raw market and sentiment data into clear, tradable signals.

Unique Hook: The combination of AI-powered sentiment analytics, on-chain data integration, and community-driven intelligence creates a unique hybrid between trading infrastructure and AI research.

Comment: Credia Layer positions itself as a next-gen AI trading ecosystem blending Web3 analytics and community intelligence. Its strong design and data-centric approach enhance credibility, though long-term success will rely on adoption of its trading tools and real-time AI accuracy.

Hype Analysis: Google Search + Google Trends

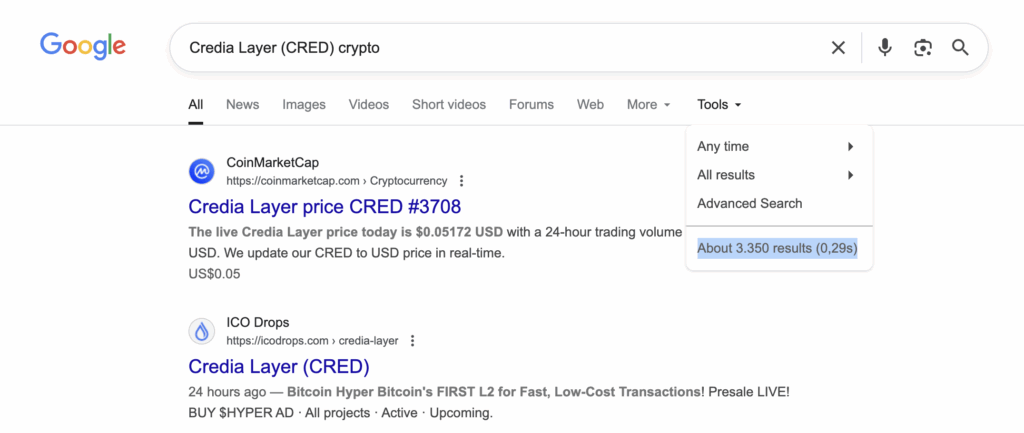

We analyzed Google search visibility for “Credia Layer (CRED) crypto” and found approximately 3,350 indexed results. From an analytical standpoint, this is a very low level of online presence. Such a small number of indexed mentions indicates that the project is still in its early exposure phase with limited media coverage and public awareness.

For comparison, well-established crypto projects typically have hundreds of thousands or even millions of indexed pages, reflecting broad recognition and trust. Therefore, while Credia Layer shows some initial visibility, it currently lacks mainstream traction. To strengthen market trust and attract more attention, the project will need to increase its PR activity, listings, and content distribution across major crypto media platforms.

We analyzed Google Trends data for “Credia Layer (CRED)” and found that there is currently too little data to display meaningful search dynamics. From an analytical standpoint, this indicates that public awareness and search activity around the project are still extremely low.

This lack of measurable search volume suggests that Credia Layer has not yet entered mainstream visibility and remains largely unknown outside of niche crypto circles. For early-stage projects, this is typical but highlights the need for stronger marketing exposure, listings, and community engagement to build recognition and attract investor interest.

Reddit & Social Media Opinions

The social media and Reddit analysis for the Credia Layer (CRED) token indicates a project focused on formal, platform-driven announcements, lacking significant organic retail discussion at this early stage. Credia Layer is an AI-powered intelligence infrastructure built on BNB Chain, designed to transform on-chain and social sentiment data into actionable trading insights. The project has recently been featured prominently through a Trust Alpha Reward Pool event on Trust Wallet, scheduled from October 9th to October 12th, 2025, which provides a 5,000,000 $CRED allocation to participants. This strong institutional support from a major crypto wallet within the Binance ecosystem highlights an official push for initial distribution and exposure. The token was also recently added to CoinMarketCap, approximately 8 hours ago as of the time of the search.

In conclusion, Credia Layer is exhibiting a typical early-stage trajectory for a project with institutional backing and a clear, utility-focused purpose in the AI/Web3 intelligence sector. The current social narrative is entirely platform-driven and centralized, centered on the Trust Wallet Launchpool and new exchange listings. While the project has secured initial distribution and exposure, the absence of organic retail discussion on major forums like Reddit suggests that speculative “hype” or community-led enthusiasm has not yet materialized. The market dynamics are likely being influenced by early investors participating in the launch and reward programs, rather than widespread public sentiment.

Credia Layer (CRED) Price Prediction Matrix

| Factor | Observation | Analyst Assessment | Impact on Price Forecast |

|---|---|---|---|

| Trading Volume (24h) | ~$2.69M vs ~$7.17M market cap (37% Vol/Mkt Cap) | Healthy liquidity and moderate engagement from traders | Positive – supports stable early growth |

| Price Trend | Opened at ~$0.0505, peaked at ~$0.054, stabilized near ~$0.051 | Controlled upward movement with limited retracement | Slightly Positive – steady post-listing momentum |

| Volatility | ~7% price range | Moderate volatility showing market balance | Neutral – stable but not yet bullish |

| Market Behavior | Buyers led early phase, followed by consolidation | Indication of accumulation and confidence | Positive – potential for gradual appreciation |

| Website & Branding | Futuristic, AI-driven design targeting traders | Professional presentation enhances trust | Positive – strengthens investor perception |

| Token Positioning | Utility token for AI-powered Web3 analytics | Clear functional purpose and ecosystem integration | Slightly Positive – solid use case foundation |

| Ecosystem Features | AI analytics, Signal Chat, on-chain data tools | Strong technical structure but early-stage | Neutral – long-term potential pending adoption |

| Search Visibility (Google) | ~3,350 indexed results | Very low online presence, early exposure stage | Negative – low awareness limits short-term growth |

| Google Trends | Insufficient data for trend tracking | Minimal search interest, early market stage | Negative – low public recognition |

| Social Media (Reddit, etc.) | Low organic discussion, mostly institutional news | Early-stage community, centralized communication | Slightly Negative – needs community activation |

Credia Layer (CRED) Price Forecast & Trading Scenarios

| Scenario | Assumed Price Move | Forecast Price ($) | PnL on $1,000 (Spot) | PnL with 5× Leverage | PnL with 10× Leverage |

|---|---|---|---|---|---|

| Bearish Dump | -70% | 0.01545 | -$700 | -$3,500 | -$7,000 |

| Mild Correction | -30% | 0.03599 | -$300 | -$1,500 | -$3,000 |

| Sideways / Stable | 0% | 0.05149 | $0 | $0 | $0 |

| Moderate Pump | +50% | 0.07724 | +$500 | +$2,500 | +$5,000 |

| Strong Pump | +150% | 0.12873 | +$1,500 | +$7,500 | +$15,000 |

| Extreme Hype Run | +400% | 0.25745 | +$4,000 | +$20,000 | +$40,000 |