Alpha Arena (ARENA) shows a technically impressive concept but a weak early market structure. Despite strong visibility with over 1.3M search results and a full Google Trends spike to 100, the token’s trading behavior reflects heavy speculation, high volatility, and no accumulation base. The ecosystem’s AI-driven financial simulation adds credibility, but the token itself lacks clear utility or community traction. In its current phase, ARENA is a high-risk, high-hype asset with potential only if fundamental adoption follows its media momentum.

Table of Contents

Alpha Arena (ARENA) Listing Analysis – Early Trading Hours/Days

Volumes: ~$6.64M in 24h vs ~$1.03M market cap – ~640% Vol/Mkt Cap showing hyper-active turnover and short-term flows.

Trend: Opened near ~0.00178 and drifted down to ~0.00110 with only brief lower-high bounces – persistent post-listing downtrend.

Volatility: High – 30-40% intraday swings with sharp wicks and no sustained recoveries.

Behavior: Early sellers and bots hit bids, bounces were faded quickly, liquidity pockets thin – no clear accumulation footprint.

Comment: ARENA launched into heavy churn and a classic post-listing dump – until higher lows form and volume quality improves, downside risk and whipsaws remain elevated.

Alpha Arena (ARENA) Website & Ecosystem Analysis

Design & Branding: Alpha Arena’s interface combines a clean financial dashboard aesthetic with technical visuals inspired by trading terminals. The design communicates credibility and professionalism, targeting users familiar with analytics and AI-driven performance tracking.

Token Positioning: $ARENA is positioned as the core asset within an AI-based financial simulation ecosystem, representing participation in AI investment benchmarking and performance-based economies. It likely functions as a governance or access token within the platform’s trading and leaderboard systems.

Ecosystem Features: The platform simulates real-world AI trading competitions where different models manage equal capital and compete based on performance. It integrates real-market data, transparency, and public results to measure intelligence in financial contexts.

Goals: To establish a standardized, transparent benchmark for testing and comparing AI models in live trading environments, bridging the gap between artificial intelligence research and practical financial application.

Unique Hook: Alpha Arena gamifies AI investing by allowing real capital-based competitions among top models like GPT, Claude, Gemini, and DeepSeek – turning algorithmic performance into a public and verifiable sport.

Comment: Alpha Arena uniquely blends DeFi, AI, and gamified trading into a data-driven experiment for measuring intelligence through markets. Its innovation lies in turning performance benchmarking into an open, real-time, and competitive financial simulation.

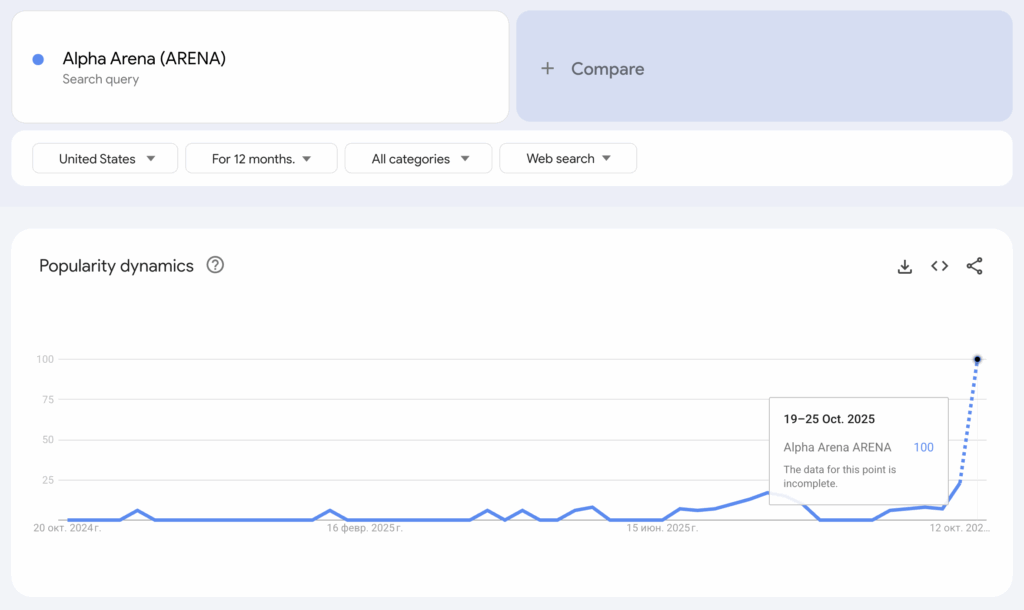

Hype Analysis: Google Search + Google Trends

We analyzed Google search visibility for “Alpha Arena (ARENA) crypto” and found approximately 1,330,000 indexed results. From an analytical standpoint, this is a strong indicator of significant online presence and growing awareness. Such a high number of mentions suggests that the project is already gaining traction across multiple media sources and crypto platforms. In general, the more search results a token has, the higher its credibility and visibility in the market. For a newly listed asset, this level of coverage positions Alpha Arena as a well-recognized and actively discussed project with rising trust potential.

We analyzed Google Trends data for “Alpha Arena (ARENA)” and found a sharp spike reaching 100 in the latest period. From an analytical standpoint, this indicates a surge of public interest and growing visibility. The token moved from near-zero awareness to peak attention levels, suggesting that its recent listing or events have strongly boosted its popularity. Such momentum usually reflects viral exposure, influencer mentions, or community-driven hype – a highly positive signal for early growth and market recognition.

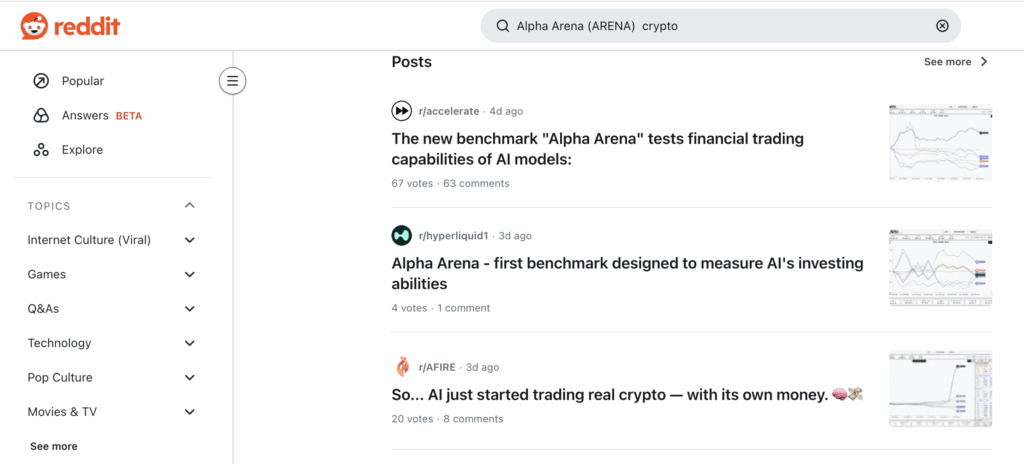

Reddit & Social Media Opinions

The social media footprint for “Alpha Arena” on Reddit is strong and engaged, but the focus is clearly on the utility of the name as an AI-testing platform for financial models, not as a standalone, speculative crypto token with the $ARENA ticker. The conversation is driven by technical interest, with the most active post generating 63 comments in just four days, signifying a healthy debate within the relevant tech and trading subreddits.

The key takeaway is the potential for a token to be launched later in association with this high-interest AI benchmark platform. However, at present, there is no evidence of retail chatter, price speculation, or memecoin hype for an $ARENA token. From an investment perspective, any $ARENA token currently available would be highly speculative and disconnected from the positive social sentiment surrounding the “Alpha Arena” benchmark itself, which is focused on technological advancement rather than tokenomics.

Alpha Arena (ARENA) Price Prediction Matrix

| Factor | Observation | Analyst Assessment | Impact on Price Forecast |

|---|---|---|---|

| Trading Volume (24h) | ~$6.64M vs ~$1.03M market cap (~640% Vol/Mkt Cap) | Extremely high turnover, driven by speculative and short-term participants | Slightly Positive – liquidity present but unsustainable |

| Price Trend | Dropped from ~$0.00178 to ~$0.00110 | Clear post-listing downtrend with no support formation | Negative – selling pressure dominates early action |

| Volatility | 30-40% intraday swings with sharp wicks | High volatility signals unstable sentiment and low conviction | Negative – high risk and unstable discovery phase |

| Market Behavior | Bots and early sellers dominating order flow | Speculative churn, no signs of accumulation or organic buyers | Strongly Negative – fragile and reactive market structure |

| Website & Branding | Clean fintech-inspired dashboard, AI-focused visuals | Professional design enhances credibility for AI and finance audiences | Slightly Positive – supports institutional perception |

| Token Positioning | Core asset of AI-based simulation platform | Positioned around AI-driven performance economy and benchmarks | Neutral – strong concept but lacks clear user incentives |

| Ecosystem Features | Real-market AI trading competition with public transparency | Innovative, educational, and gamified approach to finance | Slightly Positive – unique but niche use case |

| Search Visibility (Google) | ~1,330,000 indexed results | Strong media footprint and rapid awareness growth | Positive – high visibility supports long-term exposure |

| Google Trends | Sharp spike to 100 in latest data | Indicates massive short-term attention and viral traction | Positive – early-stage hype wave boosting recognition |

| Social Media (Reddit, etc.) | Engaged but tech-oriented discussion, minimal token focus | Strong interest in AI concept, weak retail speculation | Neutral – credibility high, but token traction unclear |

Alpha Arena (ARENA) Price Forecast & Trading Scenarios

| Scenario | Assumed Price Move | Forecast Price ($) | PnL on $1,000 (Spot) | PnL with 5× Leverage | PnL with 10× Leverage |

|---|---|---|---|---|---|

| Bearish Dump | -70% | 0.00031 | -$700 | -$3,500 | -$7,000 |

| Mild Correction | -30% | 0.00073 | -$300 | -$1,500 | -$3,000 |

| Sideways / Stable | 0% | 0.00105 | $0 | $0 | $0 |

| Moderate Pump | +50% | 0.00158 | +$500 | +$2,500 | +$5,000 |

| Strong Pump | +150% | 0.00263 | +$1,500 | +$7,500 | +$15,000 |

| Extreme Hype Run | +400% | 0.00525 | +$4,000 | +$20,000 | +$40,000 |