Animus (ANIMUS) shows strong early liquidity but unstable market behavior typical of speculative post-launch phases. Despite a visionary concept merging AI and blockchain, its low visibility, weak community engagement, and high volatility limit short-term growth potential. The project’s minimalist branding and developer focus position it as an experimental infrastructure play rather than a retail-driven asset. Long-term success will depend on real adoption of its AI autonomy framework and broader awareness beyond the niche tech audience.

Table of Contents

Animus (ANIMUS) Listing Analysis – Early Trading Hours/Days

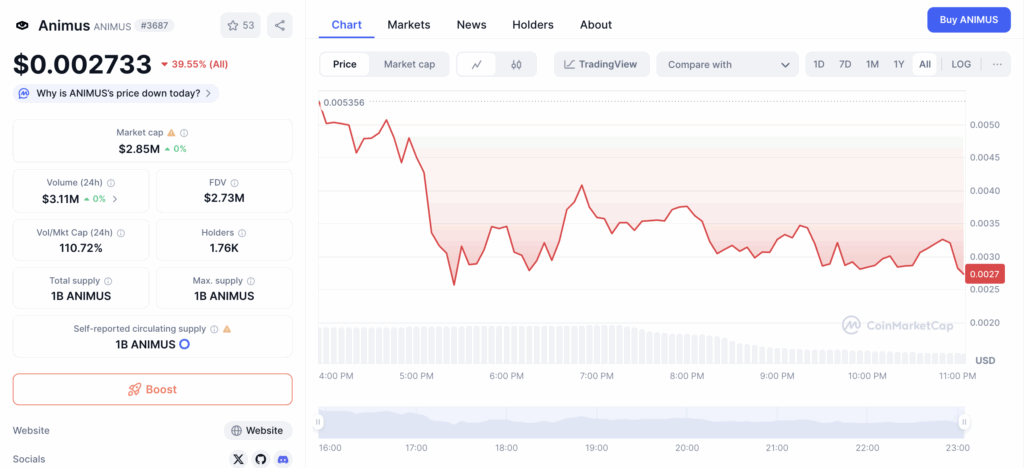

Volumes: ~$3.11M in 24h vs ~$2.85M market cap – an unusually high 110% Vol/Mkt Cap ratio showing heavy early trading activity and rapid turnover.

Trend: Opened near ~$0.0053, faced immediate selling pressure, and retraced sharply toward ~$0.0025 – a clear post-launch dump pattern with weak recovery attempts.

Volatility: High – price swings over 50% within hours indicate strong speculative behavior and lack of price stability.

Behavior: Early participants exited quickly while new buyers attempted bottom entries, leading to erratic rebounds and inconsistent order flow.

Comment: ANIMUS showed a classic post-launch fade pattern with excessive volatility and heavy profit-taking. While liquidity remains strong, sustained weakness below $0.003 signals fading momentum and short-term bearish sentiment.

Animus (ANIMUS) Website & Ecosystem Analysis

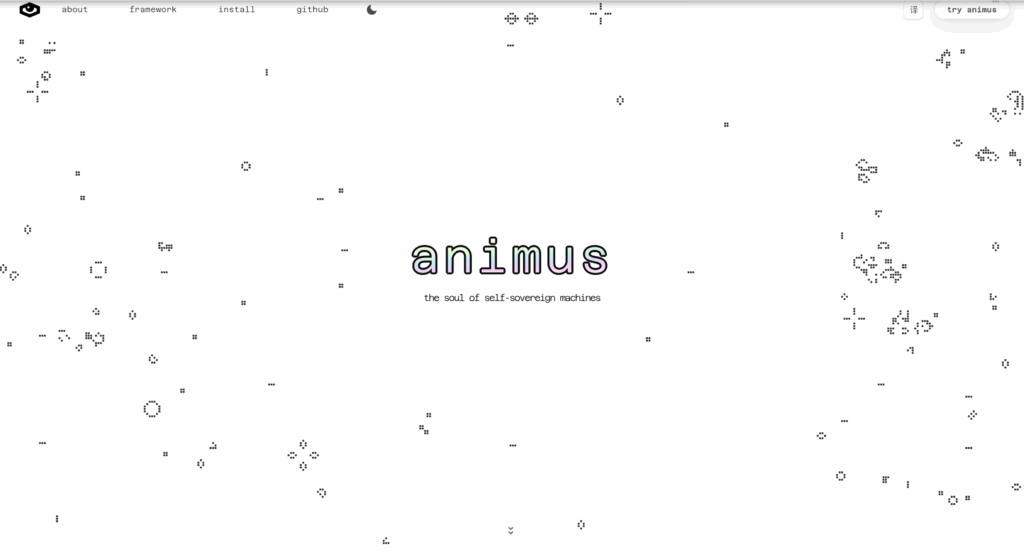

Design & Branding: Minimalist and futuristic with a monochrome aesthetic and subtle pixel animations. The design emphasizes technology, AI, and autonomy, creating a cybernetic and experimental feel aligned with the theme of machine intelligence.

Token Positioning: $ANIMUS is framed as a protocol token for autonomous, self-sovereign machines, blending AI and blockchain concepts. It positions itself as an infrastructure layer for intelligent, decentralized agents rather than a typical DeFi or meme asset.

Ecosystem Features: The site references installation frameworks, GitHub integration, and modular architecture, suggesting a developer-oriented ecosystem. The focus is on open-source collaboration, self-operating code, and machine-level autonomy.

Goals: To establish a foundation for decentralized, self-sovereign AI systems that can operate independently and interact economically without human intervention.

Unique Hook: The fusion of AI autonomy with blockchain governance – branding itself as the “soul of self-sovereign machines” – gives it a philosophical and technological edge over conventional crypto projects.

Comment: ANIMUS presents an avant-garde concept positioned at the intersection of AI and blockchain. Its highly technical presentation appeals to developers and futurists, but the lack of clear user-facing utilities or token economics may limit short-term investor understanding and adoption.

Hype Analysis: Google Search + Google Trends

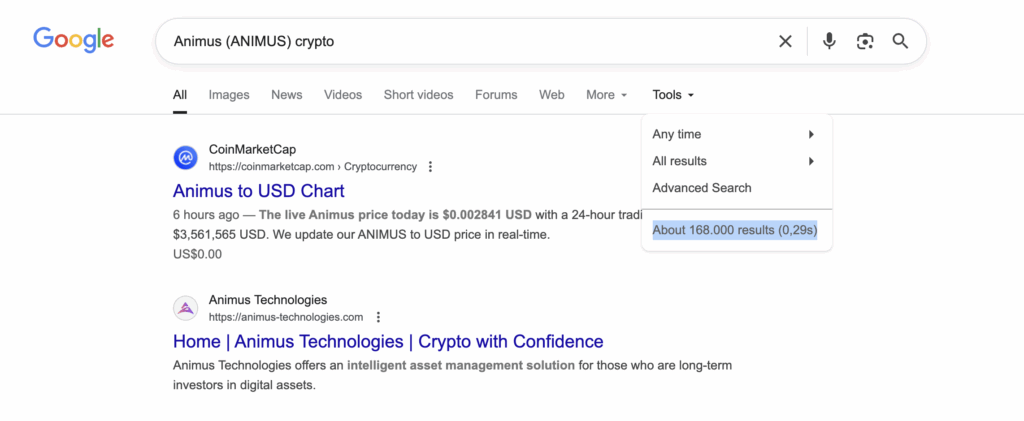

We analyzed Google search visibility for “Animus (ANIMUS) crypto” and found about 168,000 indexed results. From an analytical standpoint, this represents a relatively low level of online presence. Such a result count suggests that the project is still in its early exposure phase, with limited media coverage and brand awareness.

For context, established cryptocurrencies often exceed several million indexed results, reflecting broader adoption and trust. Therefore, while Animus has some visibility, it remains a niche project. Its future growth in search volume will largely depend on increased market activity, community engagement, and strategic partnerships.

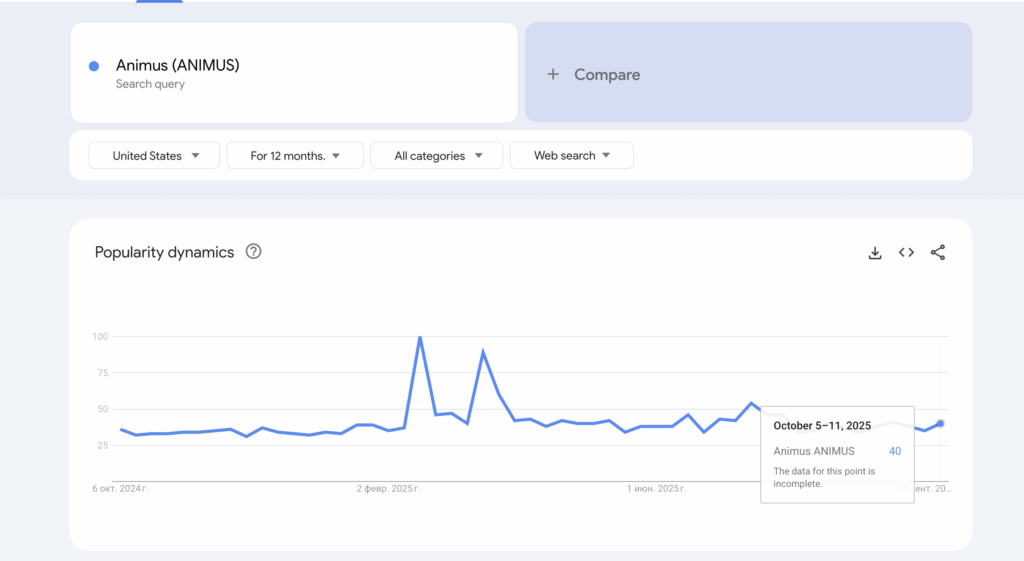

We analyzed Google Trends data for “Animus (ANIMUS)” and found an average interest level around 30-40, with a few short spikes reaching higher peaks earlier in the year. From an analytical standpoint, this indicates limited but consistent search activity.

A score of 40 suggests moderate visibility within niche crypto circles but not mainstream attention. While the token has achieved some recognition, it remains early in its awareness phase. Sustained marketing efforts or exchange listings would be required to boost visibility and move toward broader investor interest.

Reddit & Social Media Opinions

The social media footprint for the Animus (ANIMUS) token is primarily institutional and informational, with limited evidence of an active, organic retail discussion on major platforms. Key market data sites indicate that the project has official communities on Telegram, Discord, and Twitter, with the official Twitter handle listed as twitter.com/animusuno. Price tracking platforms currently report that the community is “bullish” about ANIMUS. Animus Technologies, a related entity, uses natural language processing and sentiment analysis to inform its own trading strategies, suggesting an internal focus on market sentiment, though this does not translate into high-visibility public discussion. No specific, detailed conversations from individual users about the token’s price action or utility were found on public Reddit or Twitter searches (outside of promotional links and news).

As of this analysis, the Animus (ANIMUS) token demonstrates a low-engagement public profile despite a robust technological foundation centered on AI agents and embodied AI. Market data highlights high trading volume and volatility, with a 1,101.60% increase in 24-hour trading volume and a 170.84% price increase observed recently. However, this high volume appears to be driven by trading activity on decentralized exchanges like PancakeSwap, rather than being fueled by viral retail excitement or widespread social media discussion.

The lack of focused, grassroots discussion on platforms like Reddit suggests the token’s price movements are not currently being influenced by typical “hype cycles” or broad public speculation. The low social visibility, combined with the project’s technical focus, suggests that current market activity is likely confined to informed traders or internal project dynamics, rather than a strong, publicly-driven community.

Animus (ANIMUS) Price Prediction Matrix

| Factor | Observation | Analyst Assessment | Impact on Price Forecast |

|---|---|---|---|

| Trading Volume (24h) | ~$3.11M vs ~$2.85M market cap (110% Vol/Mkt Cap) | Extremely high turnover showing speculative entry and exit activity | Neutral to Slightly Negative – supports liquidity but signals instability |

| Price Trend | Sharp drop from ~$0.0053 to ~$0.0025 with weak rebound | Classic post-launch dump pattern indicating early profit-taking | Negative – short-term bearish momentum |

| Volatility | 50%+ intraday swings | Excessive volatility driven by speculation and low conviction | Negative – deters long-term holders |

| Market Behavior | Early sellers dominating, inconsistent recovery | Distribution phase with limited accumulation | Negative – market sentiment remains weak |

| Website & Branding | Minimalist AI-themed design, high-tech aesthetic | Appeals to developers and futurists, lacks mass-market appeal | Neutral – strong identity but narrow audience |

| Token Positioning | Protocol token for AI and self-sovereign machines | Unique concept but complex for mainstream users | Slightly Positive – innovative but niche positioning |

| Ecosystem Features | Developer framework, GitHub integration, modular AI tools | Strong technological base with unclear practical adoption | Neutral – potential long-term value if adoption grows |

| Search Visibility (Google) | ~168K indexed results | Low online visibility and early awareness phase | Negative – low brand traction and exposure |

| Google Trends | Interest score around 30-40 | Limited but consistent attention, no mainstream growth | Neutral – stable niche visibility |

| Social Media (Reddit, etc.) | Low engagement, no viral discussions | Weak community presence, limited retail momentum | Negative – lack of organic social traction |

Animus (ANIMUS) Price Forecast & Trading Scenarios

| Scenario | Assumed Price Move | Forecast Price ($) | PnL on $1,000 (Spot) | PnL with 5× Leverage | PnL with 10× Leverage |

|---|---|---|---|---|---|

| Bearish Dump | -70% | 0.00082 | -$700 | -$3,500 | -$7,000 |

| Mild Correction | -30% | 0.00191 | -$300 | -$1,500 | -$3,000 |

| Sideways / Stable | 0% | 0.00273 | $0 | $0 | $0 |

| Moderate Pump | +50% | 0.00410 | +$500 | +$2,500 | +$5,000 |

| Strong Pump | +150% | 0.00683 | +$1,500 | +$7,500 | +$15,000 |

| Extreme Hype Run | +400% | 0.01365 | +$4,000 | +$20,000 | +$40,000 |