ANOA (ANOA) demonstrates a strong initial market performance marked by a sharp 154% price surge and controlled volatility, signaling early speculative enthusiasm. Its regulated status under BAPPEBTI and CertiK audit gives it rare institutional credibility in the crypto space – a major differentiator from typical unregulated tokens.

Table of Contents

However, the absence of transparent trading volume, limited ecosystem functionality, and complete lack of organic community engagement highlight structural weaknesses. The token’s success currently depends on centralized investor activity and regulatory branding rather than genuine market adoption.

In summary, ANOA shows short-term bullish potential but remains a high-risk, low-liquidity asset with uncertain long-term sustainability unless it expands real-world use cases and community traction.

ANOA (ANOA) Listing Analysis – Early Trading Hours/Days

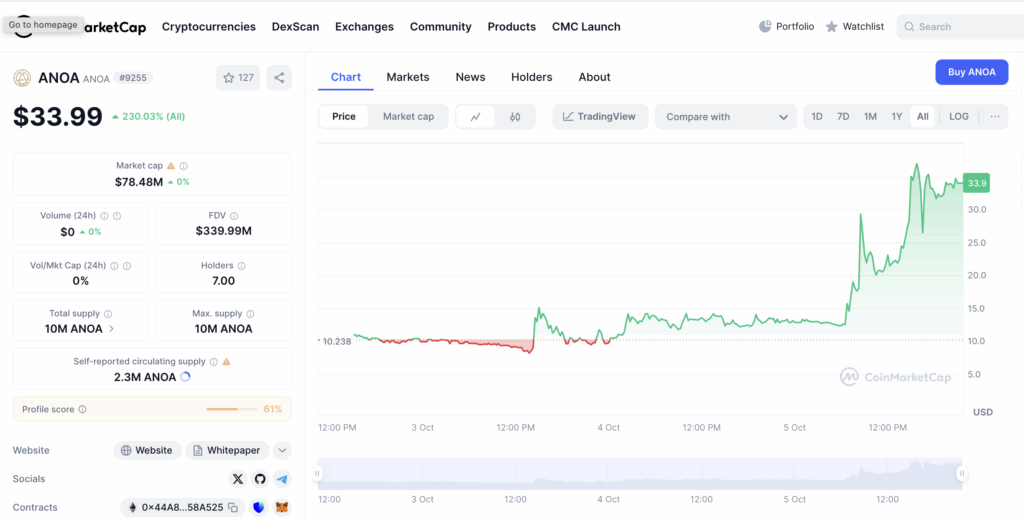

Volumes: Reported trading volume shows as $0, indicating either incomplete data or off-chain/private transactions. Despite this, the market cap surged sharply, implying price movement driven by limited liquidity and concentrated buying activity.

Trend: ANOA opened near ~$13.28 and climbed aggressively to ~$34.28 – a 154% intraday gain. The chart shows a clear bullish breakout after a period of flat trading, establishing a strong upward momentum.

Volatility: High volatility is evident, with multiple sharp spikes and pullbacks. However, each correction was followed by renewed buying, suggesting controlled yet speculative volatility rather than a chaotic dump.

Behavior: The pattern suggests accumulation followed by a coordinated price push, typical of low-liquidity launches. Early holders appear to be holding rather than dumping, with price support forming around the $30-32 range.

Comment: ANOA’s early trading shows an aggressive, low-liquidity pump with strong bullish sentiment and minimal selling pressure. The absence of volume data limits transparency, but price action reflects concentrated investor control and speculative enthusiasm – a promising yet high-risk start.

ANOA (ANOA) Website & Ecosystem Analysis

Design & Branding: The ANOA website presents a sleek, professional aesthetic with a dark theme and gold branding that conveys trust and authority. The inclusion of a cartoon mascot adds a touch of approachability, balancing corporate credibility with retail appeal.

Token Positioning: ANOA positions itself as a regulated cryptographic token issued by PT. Algoritma Teknologi Nusantara and sanctioned by Indonesia’s BAPPEBTI – highlighting legitimacy, compliance, and transparency. Unlike typical meme or speculative assets, ANOA promotes itself as a formally approved financial token.

Ecosystem Features: The ecosystem emphasizes regulatory backing and smart contract security (audited by CertiK). Integrations with Coinstore, CoinMarketCap, and Etherscan demonstrate real utility and transparency. However, there’s limited detail about functional applications, staking, or DeFi mechanics beyond compliance-driven assurance.

Goals: The project’s primary goal is to establish a compliant, secure, and government-recognized token ecosystem that aligns blockchain innovation with financial regulation – appealing to institutional and risk-averse investors.

Unique Hook: ANOA’s differentiator is its formal government registration and regulatory endorsement by BAPPEBTI – a rarity in the crypto space. This sets it apart from unregulated tokens and strengthens its institutional trust factor.

Comment: ANOA combines regulatory legitimacy with modern design and credible partnerships. While it stands out for compliance and audit transparency, the lack of visible utility or ecosystem depth may limit adoption unless expanded use cases are introduced.

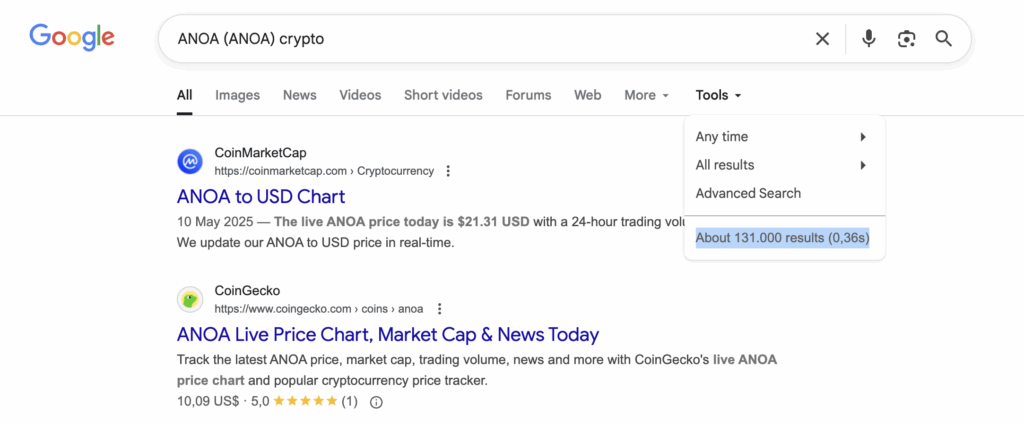

Hype Analysis: Google Search + Google Trends

We analyzed Google search visibility for ANOA (ANOA) and found approximately 131,000 indexed results. From an analytical standpoint, this represents a solid mid-tier visibility level for a relatively new cryptocurrency. While not massive compared to top-tier assets with millions of mentions, it still indicates growing traction and active media indexing across crypto platforms.

This level of coverage suggests that ANOA has begun to establish recognition and credibility within the digital asset space. The volume of indexed results also implies that the project is gaining public attention and trust, which could support investor confidence and help sustain its market visibility if the project continues to deliver consistent development and transparency.

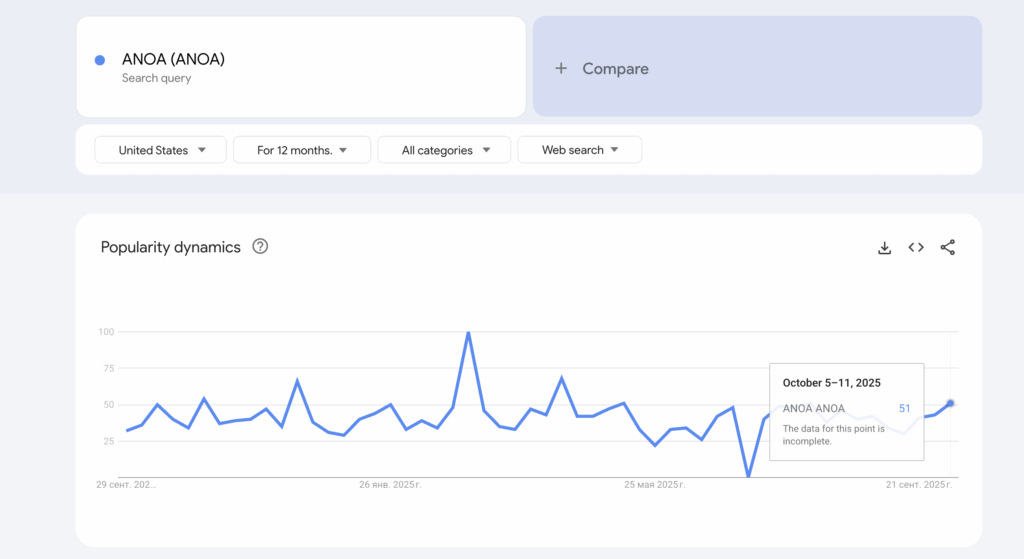

We analyzed Google Trends data for ANOA (ANOA) and observed steady search activity with consistent fluctuations between 30 and 70 points, occasionally peaking near 100. From an analytical perspective, this represents a moderate but stable interest level, suggesting that ANOA maintains continuous visibility and user attention.

While it doesn’t indicate viral momentum, such steady trend performance is a positive sign of sustained awareness rather than a short-lived hype spike. Overall, the project appears to have healthy, organic search traction, typical of a developing token with growing community engagement.

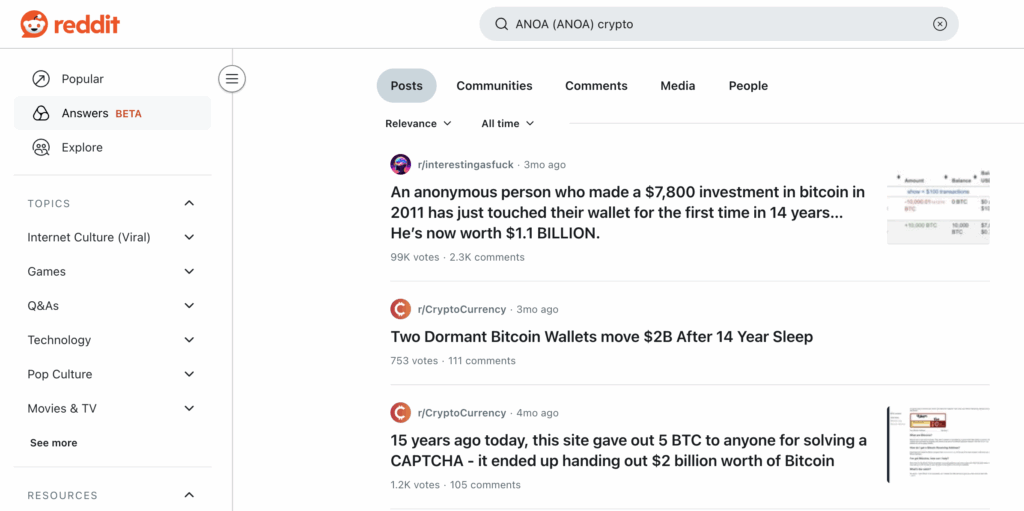

Reddit & Social Media Opinions

Based on the provided screenshot of the Reddit search results for “ANOA (ANOA) crypto,” there is zero discernible social media discussion on Reddit pertaining to the actual cryptocurrency.

The three visible posts are high-engagement, generic crypto news stories that simply contain the words “crypto” or “bitcoin” and are retrieved due to poor search specificity, not relevance to the ANOA token:

- User:

r/interestingasfuck. Date: “3mo ago” (3 months ago). Content: “An anonymous person who made a $7,800 investment in bitcoin in 2011 has just touched their wallet for the first time in 14 years… He’s now worth $1.1 BILLION.” - User:

r/CryptoCurrency. Date: “3mo ago” (3 months ago). Content: “Two Dormant Bitcoin Wallets move $2B After 14 Year Sleep.” - User:

r/CryptoCurrency. Date: “4mo ago” (4 months ago). Content: “15 years ago today, this site gave out 5 BTC to anyone for solving a CAPTCHA…”

No user on Reddit is discussing the ANOA token, its price action, or its utility.

Despite the lack of a community presence on Reddit, external data indicates that the ANOA Token is a crypto asset with a defined mission. It is described as a stable, transparent, and user-friendly asset “tailored to the unique needs of the gaming industry” and is positioned as a pioneering stable token from Indonesia. The token has been recently listed on major data trackers, shows a defined price range (between roughly $10 and $35 across different listings), and has a minor 24-hour trading volume (around $76K on one listing).

Conclusion:

The cryptocurrency ANOA (ANOA) presents a significant disconnect between its apparent operational goals and its public visibility. The complete absence of organic discussion on Reddit signifies that the project has utterly failed to acquire retail investor interest or a grassroots community. Its primary audience appears to be concentrated in a specific, narrow niche (the Indonesian gaming industry and technical traders).

As an analyst, this asset should be viewed as a project where market activity is purely technical. While the stated goal of being a stable token for the gaming industry in Indonesia provides a clear value proposition, the total lack of social buzz suggests that adoption is either concentrated among private parties or non-existent in the public crypto sphere. The investment risk is high, as there is no community sentiment to gauge, and the token’s success relies entirely on its highly specific, non-viral business model.

ANOA (ANOA) Price Prediction Matrix

| Factor | Observation | Analyst Assessment | Impact on Price Forecast |

|---|---|---|---|

| Trading Volume (24h) | $0 reported; likely off-chain or low liquidity trading | Lack of visible volume limits transparency and reliability | Negative – limits investor confidence |

| Price Trend | Surge from ~$13.28 to ~$34.28 (+154%) | Strong bullish move, likely driven by concentrated buying | Positive short-term, speculative-driven |

| Volatility | Multiple sharp spikes and pullbacks | High but controlled volatility; typical for early-stage listings | Neutral to Positive – attracts traders but risky |

| Market Behavior | Aggressive accumulation, minimal selling pressure | Early holders seem committed; accumulation dominant | Positive – bullish sentiment under limited liquidity |

| Website & Branding | Professional dark-gold theme with mascot balance | Strong branding and regulatory tone; trust-oriented | Positive – increases credibility |

| Token Positioning | Regulated token approved by BAPPEBTI | Unusual legitimacy in crypto; institutional-grade positioning | Positive – strong long-term potential |

| Ecosystem Features | CertiK audit, regulatory links, limited functional details | Strong compliance but lacks real utility | Neutral – needs broader ecosystem use |

| Search Visibility (Google) | ~131,000 indexed results | Solid visibility for new token; growing traction | Positive – mid-level awareness supports adoption |

| Google Trends | 30-70 range with peaks near 100 | Moderate but steady public interest | Positive – sustained awareness |

| Social Media (Reddit, etc.) | No organic presence or discussion | Weak retail traction, zero community activity | Strongly Negative – limits viral and market momentum |

ANOA (ANOA) Price Forecast & Trading Scenarios

| Scenario | Assumed Price Move | Forecast Price ($) | PnL on $1,000 (Spot) | PnL with 5× Leverage | PnL with 10× Leverage |

|---|---|---|---|---|---|

| Bearish Dump | -70% | 10.28 | -$700 | -$3,500 | -$7,000 |

| Mild Correction | -30% | 24.00 | -$300 | -$1,500 | -$3,000 |

| Sideways / Stable | 0% | 34.28 | $0 | $0 | $0 |

| Moderate Pump | +50% | 51.42 | +$500 | +$2,500 | +$5,000 |

| Strong Pump | +150% | 85.70 | +$1,500 | +$7,500 | +$15,000 |

| Extreme Hype Run | +400% | 171.40 | +$4,000 | +$20,000 | +$40,000 |