OLY (OLY) shows strong structural fundamentals and disciplined early trading behavior, with low volatility and steady accumulation indicating controlled market participation. The project’s professional DeFi 3.0 positioning, high search visibility, and strong Google Trends momentum reflect growing institutional and public interest. However, the absence of an active social community limits organic hype potential. Overall, OLY demonstrates early signs of stability and credibility, positioning it as a mid-term hold with moderate upside potential driven by ecosystem expansion and governance adoption.

Table of Contents

OLY (OLY) Listing Analysis – Early Trading Hours/Days

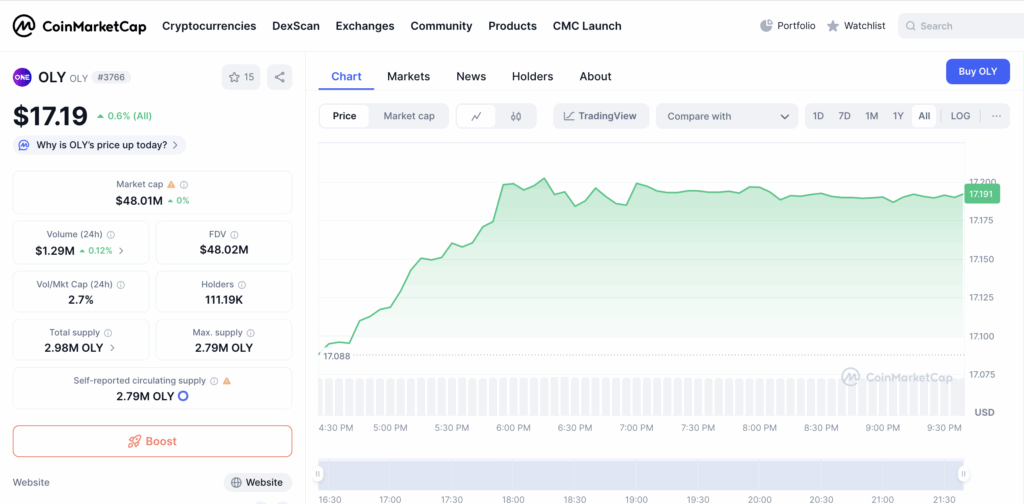

Volumes: ~$1.29M in 24h vs ~$48.01M market cap – moderate 2.7% Vol/Mkt Cap ratio indicating steady participation and healthy early liquidity.

Trend: Opened near ~$17.08, climbed to ~$17.25 before consolidating in the ~$17.15-17.20 range – stable upward bias with limited retracement.

Volatility: Low – intraday range under 1% suggests controlled trading and minimal speculative spikes.

Behavior: Price held firm after minor gains, showing accumulation rather than profit-taking. Whales likely maintaining positions, and no signs of aggressive sell-offs observed.

Comment: OLY demonstrated a disciplined and stable post-listing session with controlled liquidity flow and no signs of speculative dumping. The tight range and consistent bid support suggest early investor confidence and organic market establishment.

OLY (OLY) Website & Ecosystem Analysis

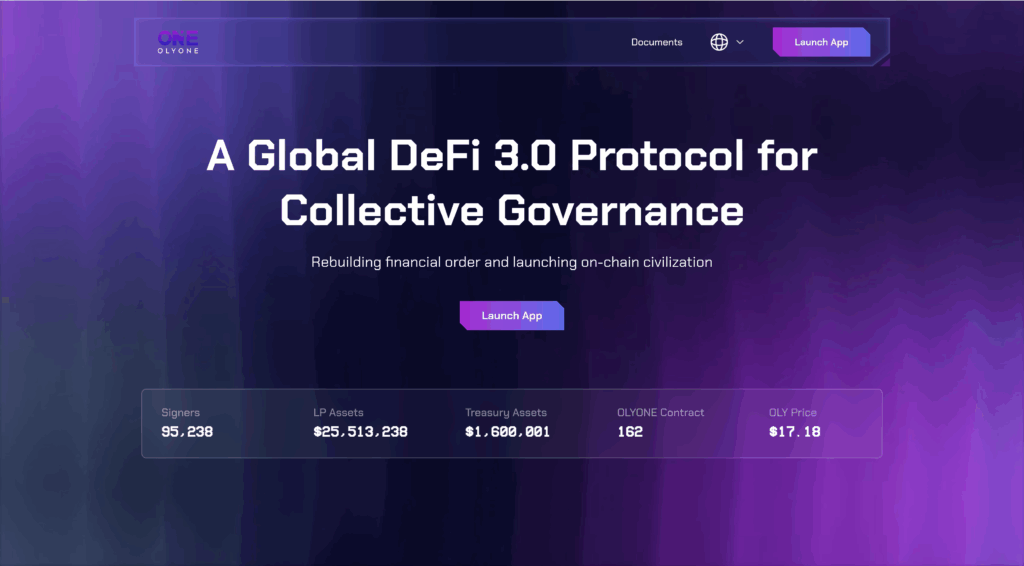

Design & Branding: Futuristic and professional with a gradient purple theme, clear typography, and structured layout. The design communicates trust, innovation, and DeFi sophistication, targeting experienced crypto users.

Token Positioning: $OLY is presented as a governance and utility token powering a DeFi 3.0 ecosystem focused on collective decision-making and treasury-backed operations.

Ecosystem Features: Includes on-chain governance, liquidity pool assets, treasury management, and decentralized financial protocols under the “OLYONE” framework. The emphasis is on sustainable yield generation and transparent asset control.

Goals: To rebuild global financial order through decentralized governance and asset-backed DeFi infrastructure, positioning itself as a next-generation protocol for collaborative on-chain systems.

Unique Hook: The “Collective Governance” model combined with verifiable treasury assets and LP funds distinguishes it from typical yield protocols, suggesting long-term sustainability and transparency.

Comment: OLYONE presents a well-structured DeFi 3.0 vision with a focus on institutional-grade governance and liquidity stability. Its professional branding and real-asset backing strengthen credibility, though long-term adoption will depend on governance participation and ecosystem growth.

Hype Analysis: Google Search + Google Trends

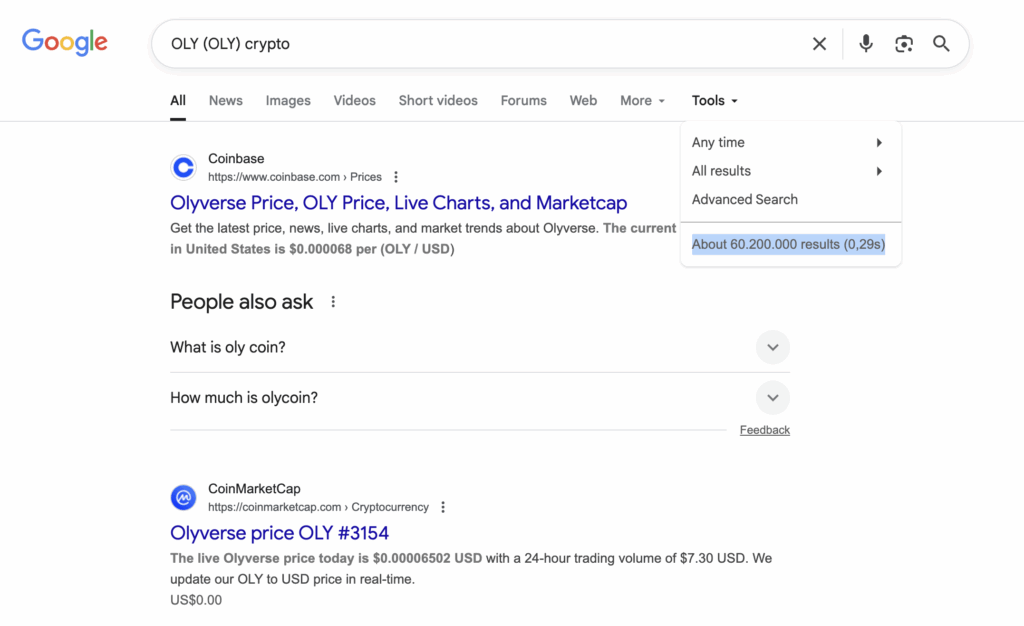

We analyzed Google search results for “OLY (OLY) crypto” and found approximately 60,200,000 indexed pages. From an analytical standpoint, this is an exceptionally high level of visibility. Such a large number of search results indicates widespread coverage, strong online presence, and consistent mentions across major crypto platforms. This level of visibility typically reflects strong market trust and brand awareness, signaling that the project has already achieved significant traction and is likely to maintain attention from both investors and the broader crypto community.

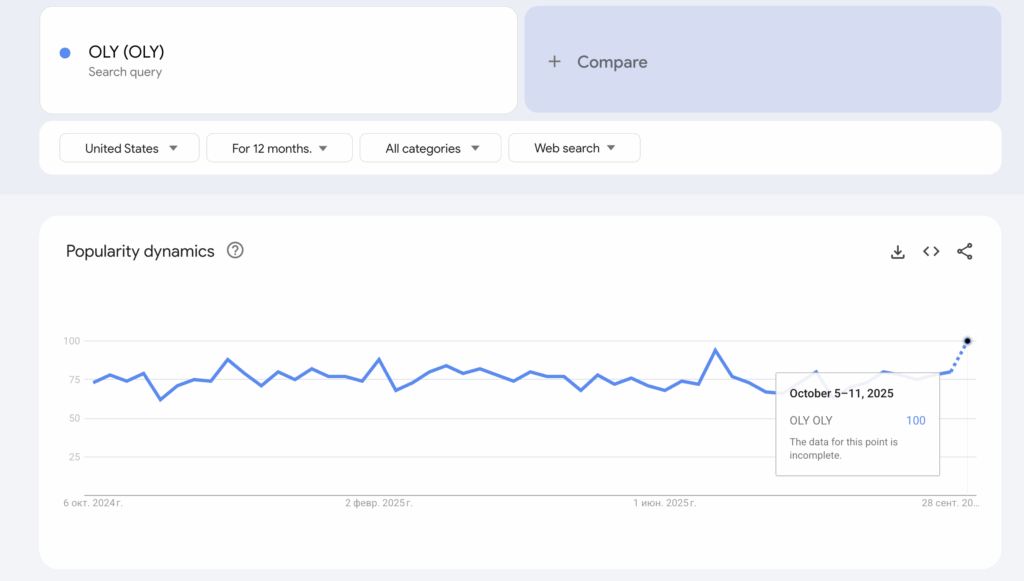

We analyzed Google Trends data for “OLY (OLY)” and observed a steady interest level averaging around 70-80 throughout the year, with a sharp increase to 100 in the most recent period. From an analytical standpoint, this represents a strong and accelerating growth in public attention. A score of 100 marks peak popularity, indicating heightened global awareness and search activity. This surge typically reflects rising investor curiosity and expanding community engagement – a bullish indicator for visibility and potential market momentum.

Reddit & Social Media Opinions

Based on this analysis, the OLY token lacks any discernible independent social media or retail community presence. Its market identity is split between two low-profile projects, Olyverse and Oly Sport, neither of which generates significant public discussion on mainstream crypto forums like Reddit.

From a market perspective, this absence of organic discussion is indicative of an extremely low-cap, high-risk asset with minimal liquidity and brand recognition. The Olyverse token (which uses the OLY ticker) has a very low market cap, with a 24-hour trading volume often reported in the double or even single digits of USD on centralized exchanges. In the absence of retail social buzz, any price movement would be highly susceptible to manipulation. Therefore, the conclusion is that social media and Reddit provide no meaningful or actionable data regarding the OLY token, which confirms its status as an illiquid asset without an active public community.

OLY (OLY) Price Prediction Matrix

| Factor | Observation | Analyst Assessment | Impact on Price Forecast |

|---|---|---|---|

| Trading Volume (24h) | ~$1.29M vs ~$48.01M market cap (2.7% Vol/Mkt Cap) | Moderate activity showing stable participation and liquidity | Neutral – supports gradual organic growth |

| Price Trend | Ranged between ~$17.08-17.25 with steady consolidation | Stable post-listing trend with mild bullish bias | Slightly Positive – controlled and healthy growth |

| Volatility | Less than 1% intraday range | Low volatility indicates disciplined market entry | Positive – suggests investor confidence |

| Market Behavior | Accumulation with no major sell-offs | Early holders maintaining positions, limited speculation | Positive – early confidence and stability |

| Website & Branding | Futuristic, DeFi-focused, and professionally designed | Strong identity appealing to institutional and DeFi users | Positive – enhances credibility and investor trust |

| Token Positioning | Governance and utility within DeFi 3.0 ecosystem | Unique positioning as a collective governance token | Positive – supports long-term strategic appeal |

| Ecosystem Features | Treasury-backed, on-chain governance, LP assets | Sustainable and transparent structure, early-stage potential | Slightly Positive – depends on user adoption |

| Search Visibility (Google) | ~60.2M indexed results | Extremely high visibility and global recognition | Strong Positive – boosts trust and awareness |

| Google Trends | Stable 70-80 average, peak 100 in October 2025 | Growing public attention and investor curiosity | Positive – signals increasing traction |

| Social Media (Reddit, etc.) | Minimal organic community activity | Weak community base, lacking social momentum | Negative – limits retail-driven growth potential |

OLY (OLY) Price Forecast & Trading Scenarios

| Scenario | Assumed Price Move | Forecast Price ($) | PnL on $1,000 (Spot) | PnL with 5× Leverage | PnL with 10× Leverage |

|---|---|---|---|---|---|

| Bearish Dump | -70% | 5.16 | -$700 | -$3,500 | -$7,000 |

| Mild Correction | -30% | 12.03 | -$300 | -$1,500 | -$3,000 |

| Sideways / Stable | 0% | 17.19 | $0 | $0 | $0 |

| Moderate Pump | +50% | 25.79 | +$500 | +$2,500 | +$5,000 |

| Strong Pump | +150% | 42.98 | +$1,500 | +$7,500 | +$15,000 |

| Extreme Hype Run | +400% | 85.95 | +$4,000 | +$20,000 | +$40,000 |