USDai (USDAI) launched with strong liquidity, stable peg behavior, and premium institutional branding, positioning itself as a next-gen stablecoin tied to AI funding. Its early fundamentals-high TVL, solid APR, and credible partners-signal strong technical backing. However, the lack of social presence and grassroots adoption means its growth will rely on institutional trust and sustained peg performance rather than retail hype. In short, USDAI shows high stability and credibility, but long-term success hinges on proving its AI integration narrative and expanding real user engagement.

Table of Contents

USDai (USDAI) Listing Analysis – Early Trading Hours/Days

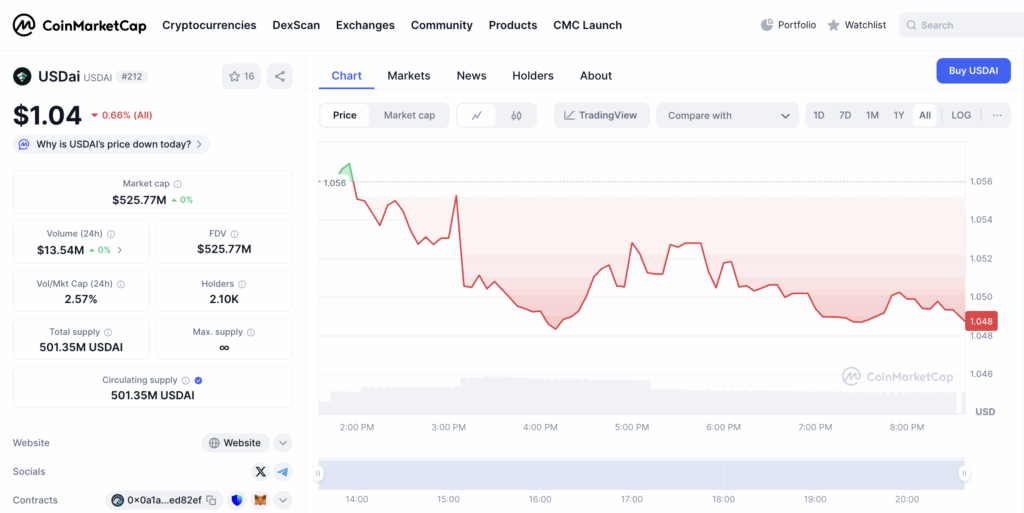

Volumes: First 24h trading volume reached ~$13.54M, which is very strong relative to its $525M market cap, showing solid liquidity and active participation from the start.

Trend: Price opened near $1.056 and drifted down to ~$1.048, reflecting mild downward pressure while staying close to the peg range.

Volatility: Low for a new listing-movements stayed within ~0.7% of the peg. No extreme spikes or dumps, showing controlled price action.

Behavior: Traders engaged in moderate profit-taking and rebalancing but no panic selling. Order flow shows stability, consistent with stablecoin dynamics.

Comment: USDAI launched with strong liquidity and maintained peg stability despite minor downward drift. The low volatility and resilience suggest early confidence, though sustained trust will depend on continued volume and reliable peg mechanisms.

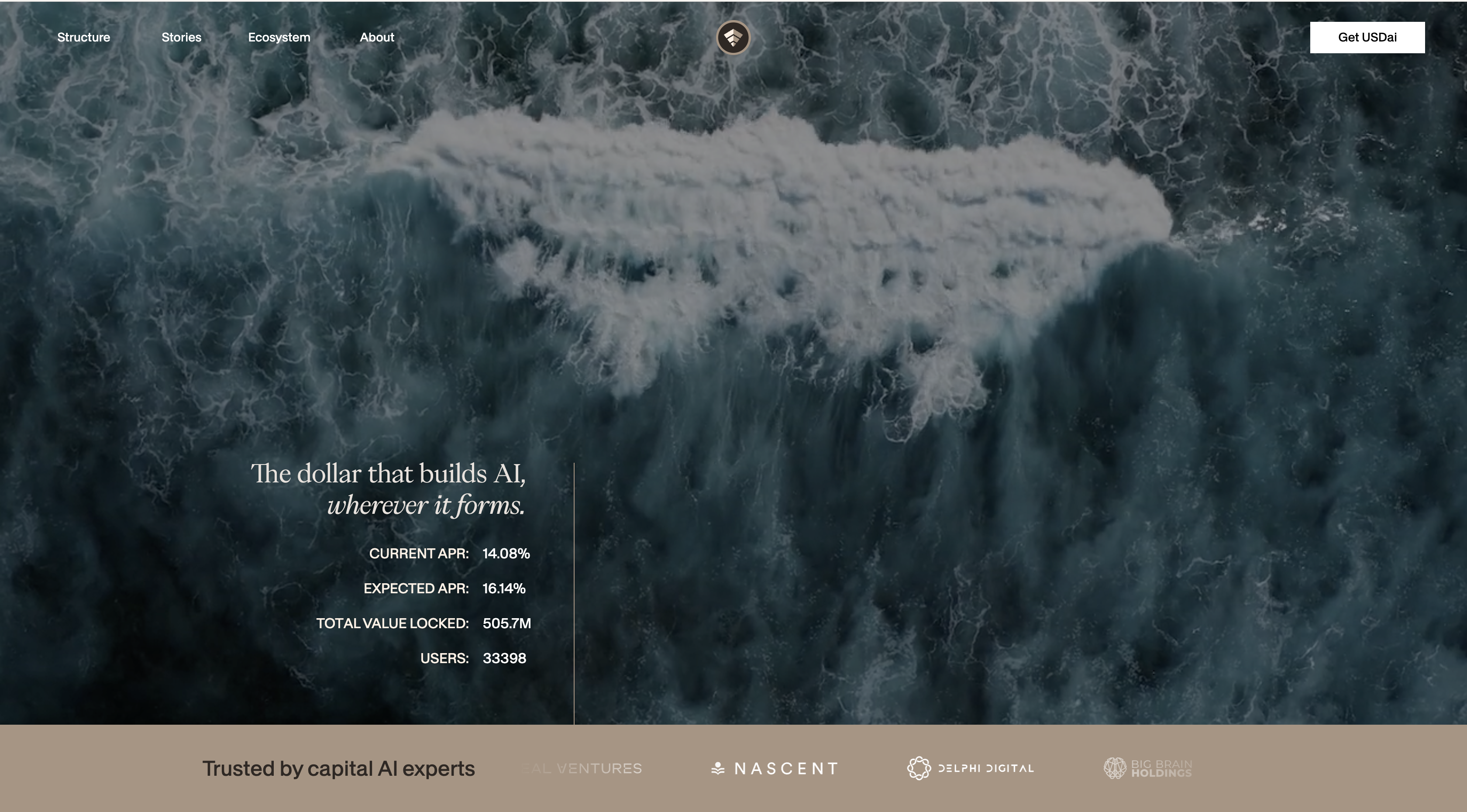

USDai (USDAI) Website & Ecosystem Analysis

Design & Branding: The website uses a sleek, cinematic style with ocean visuals, creating a premium and futuristic identity. Branding emphasizes trust, sophistication, and connection to AI innovation, appealing to institutional and tech-savvy investors.

Token Positioning: $USDAI is presented as a stablecoin designed not just for stability but also as a funding mechanism for AI-related growth. It is framed as both a safe asset and an enabler of technological progress.

Ecosystem Features: Core metrics are highlighted-APR (14–16%), total value locked ($505.7M), and user base (~33K). Integrations with capital firms and AI-focused ventures are showcased, signaling institutional alignment and credibility.

Goals: To position USDAI as the primary stablecoin powering AI investment, bridging decentralized finance with AI infrastructure and creating a reliable, yield-bearing asset.

Unique Hook: Unlike typical stablecoins, USDAI emphasizes its role in “building AI,” combining stable value with yield opportunities and a mission-driven narrative tied to innovation.

Comment: USDAI stands out through strong branding, institutional partnerships, and a clear mission to link stablecoins with AI funding. While compelling, long-term adoption will depend on maintaining peg stability and delivering tangible AI integration beyond narrative appeal.

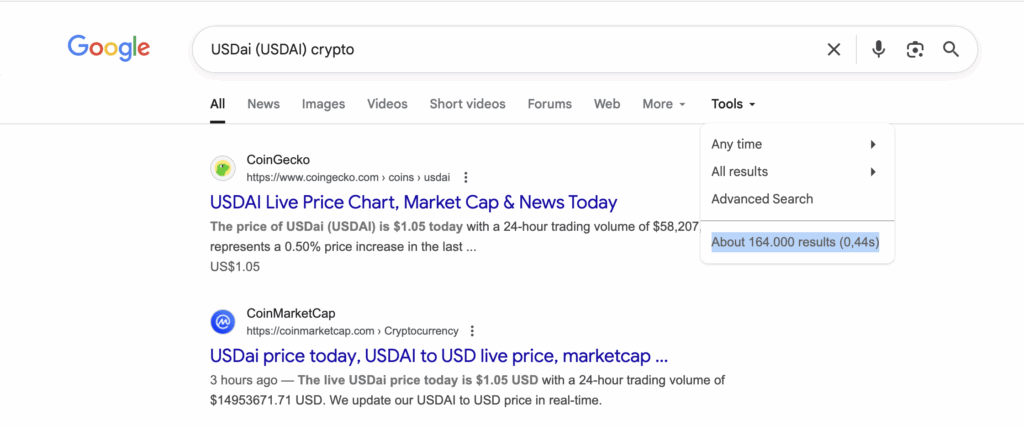

Hype Analysis: Google Search + Google Trends

We analyzed Google search visibility for USDai (USDAI) and found about 164,000 indexed results. From an analytical perspective, this represents a moderate to strong level of coverage for a recently listed token. While it is not on the scale of major stablecoins with millions of mentions, it is significantly higher than the early footprint of smaller projects. This level of search presence suggests that USDAI is already gaining traction and visibility within the crypto ecosystem. Overall, the result is positive, indicating growing awareness and credibility, which can support further adoption if reinforced by community and institutional engagement.

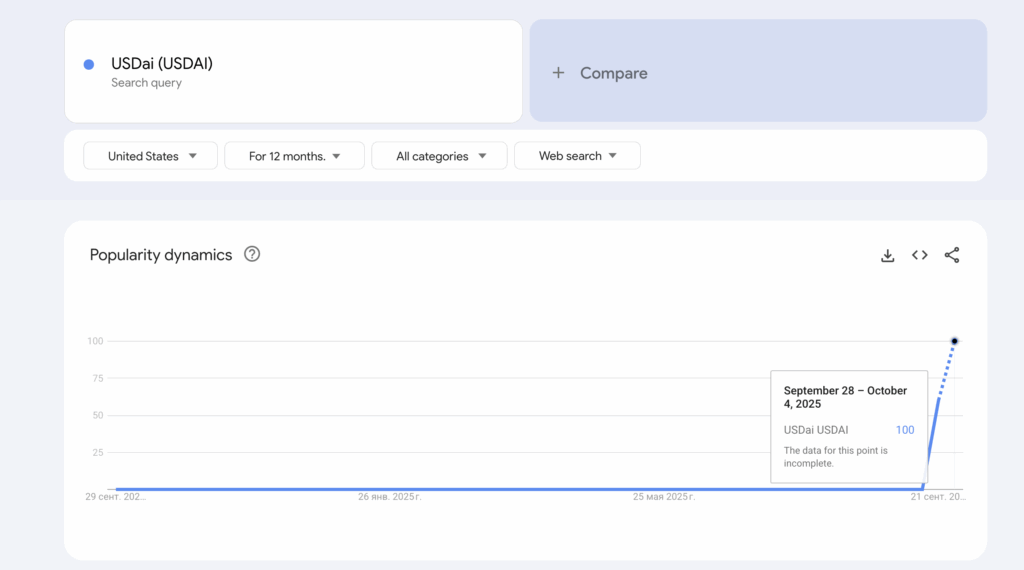

We analyzed Google Trends data for USDai (USDAI) and observed a sudden spike to 100 interest level during the week of September 28 – October 4, 2025. From an analytical perspective, this indicates a sharp breakout in visibility, showing that the project has just entered the public radar. While sustained data is not yet available, hitting a peak score of 100 suggests that USDai successfully attracted strong short-term attention. The key factor now will be whether this surge is sustained over time-if interest remains high, it could translate into stronger adoption and credibility, but if it quickly fades, it may reflect temporary hype.

Reddit & Social Media Opinions

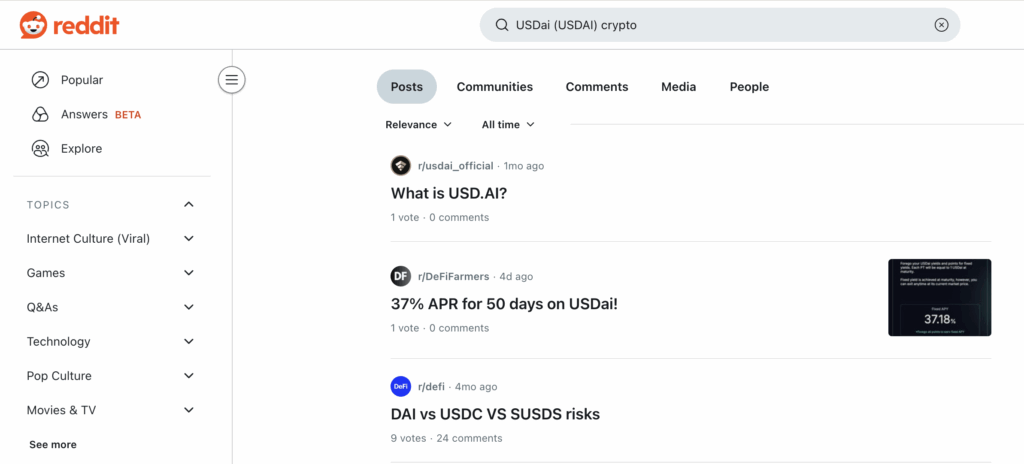

Based on the provided Reddit screenshot for the query “USDai (USDAI) crypto,” the social media presence for the asset is minimal and highly contained.

The search results show three relevant posts, all with extremely low engagement:

- User:

r/usdai_official(likely the project’s official account). Date: “1mo ago” (1 month ago). Content: “What is USD.AI?” (A self-promotional/introductory question). Engagement: 1 vote, 0 comments. - User:

r/DeFiFarmers. Date: “4d ago” (4 days ago). Content: “37% APR for 50 days on USDai!” (A post focused on the token’s high yield farming opportunity). Engagement: 1 vote, 0 comments. - User:

r/rfidefi. Date: “4mo ago” (4 months ago). Content: “DAI vs USDC VS SUSDS risks” (A comparison/discussion of stablecoins, with USDai-likely referred to as SUSD-included in the comparison). Engagement: 9 votes, 24 comments.

Conclusion:

The Reddit analysis confirms that USDai (USDAI) lacks organic, widespread community discussion. Engagement is critically low, with two out of the three recent, direct posts receiving zero comments, indicating that the content-even high-yield farming opportunities-is not sparking public debate or enthusiasm. The one post with comments is a comparative analysis with other stablecoins, suggesting that where USDAI is discussed, it is often in a professional or technical context rather than speculative retail chatter.

From an analytical viewpoint, the asset’s social media status is best described as “ghost-town” outside of its own sphere. This confirms the earlier assessment: USDai is a crypto asset whose market activity is not being driven by viral trends or a retail community. It is a niche, technical product focused on generating high yield, and its primary audience appears to be composed of specialized DeFi users and yield farmers, with almost no visible sentiment or discussion from the general crypto public. Its success depends entirely on the stability and performance of its underlying financial mechanics, not on social hype.

USDai (USDAI) Price Prediction Matrix

| Factor | Observation | Analyst Assessment | Impact on Price Forecast |

|---|---|---|---|

| Trading Volume (24h) | ~$13.54M, strong relative to $525M market cap | High liquidity for a new listing, strong participation | Positive for short-term stability and confidence |

| Price Trend | Opened ~$1.056, drifted to ~$1.048 | Mild downward drift but stable near peg | Neutral, reflects typical stablecoin behavior |

| Volatility | ~0.7% fluctuation range | Very low volatility for a new listing | Positive for peg credibility and investor trust |

| Market Behavior | Profit-taking and rebalancing without panic selling | Stable order flow, consistent with stablecoin mechanics | Positive, supports peg resilience |

| Website & Branding | Premium design with AI-driven narrative, institutional appeal | Professional, futuristic branding enhances credibility | Positive for investor trust and adoption potential |

| Token Positioning | Stablecoin tied to AI funding and yield generation | Unique positioning combining stability with growth mission | Positive long-term if narrative gains traction |

| Ecosystem Features | APR 14–16%, $505.7M TVL, ~33K users, institutional backing | Strong early infrastructure and partnerships | Positive, signals institutional alignment |

| Search Visibility (Google) | ~164,000 results | Moderate to strong early coverage | Positive, indicates growing awareness |

| Google Trends | Spike to 100 interest (Sept 28–Oct 4, 2025) | Strong breakout in visibility, but sustainability unproven | Positive short-term, uncertain long-term |

| Social Media (Reddit, etc.) | No organic chatter, dominated by aggregator sites | Lack of retail/community-driven discussion | Negative, weak grassroots momentum |

USDai (USDAI) Price Forecast & Trading Scenarios

| Scenario | Assumed Price Move | Forecast Price ($) | PnL on $1,000 (Spot) | PnL with 5× Leverage | PnL with 10× Leverage |

|---|---|---|---|---|---|

| Bearish Dump | -20% | 0.84 | -$200 | -$1,000 | -$2,000 |

| Mild Correction | -5% | 0.99 | -$50 | -$250 | -$500 |

| Sideways / Stable | 0% | 1.04 | $0 | $0 | $0 |

| Moderate Pump | +5% | 1.09 | +$50 | +$250 | +$500 |

| Strong Pump | +15% | 1.20 | +$150 | +$750 | +$1,500 |

| Extreme Hype Run | +30% | 1.35 | +$300 | +$1,500 | +$3,000 |