DEW (DEW) demonstrates the characteristics of a high-risk, high-reward speculative asset. The token launched with exceptional trading volume and strong early liquidity, showing clear market excitement. However, its extreme volatility, lack of organic community presence, and reliance on speculative momentum suggest that its current valuation is driven more by hype than fundamentals.

Table of Contents

While the project’s branding, zero-fee model, and meme-driven DEX concept are innovative, sustainability remains uncertain. DEW’s strong visibility and consistent search interest indicate solid short-term attention, but long-term stability will depend on whether the MoonEx ecosystem delivers genuine user adoption beyond speculative trading. In summary, DEW shows short-term upside potential but remains a speculative play with elevated market manipulation risk.

DEW (DEW) Listing Analysis – Early Trading Hours/Days

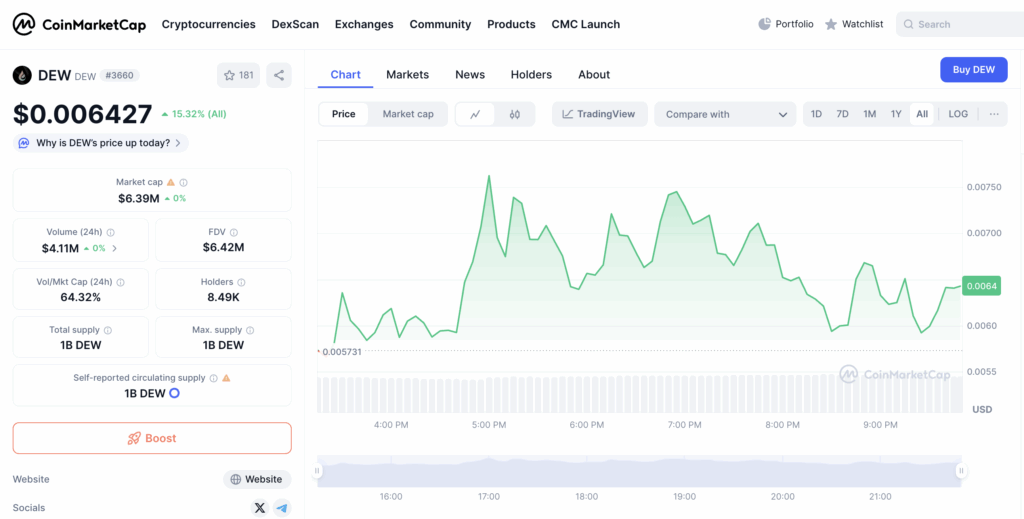

Volumes: 24h trading volume reached approximately $4.11M, which is notably high compared to its $6.39M market cap. The Vol/Mkt Cap ratio of 64.32% signals intense trading activity and strong early liquidity inflows.

Trend: The token showed a consistent upward trajectory, starting around $0.0057 and climbing above $0.0075 before consolidating near $0.0064. This reflects a strong buyer presence and early accumulation momentum.

Volatility: High – price movements fluctuated aggressively within a 30% intraday range. However, quick recoveries after dips indicate active trading and resilience rather than panic selling.

Behavior: Early trading appears speculative but healthy, with strong liquidity and active participation from both retail and possibly early adopters. There are no visible signs of coordinated dumping.

Comment: DEW (DEW) opened with robust volume and bullish sentiment. Despite high volatility, price action remained constructive, suggesting strong early confidence and potential for continued momentum if liquidity persists.

DEW (DEW) Website & Ecosystem Analysis

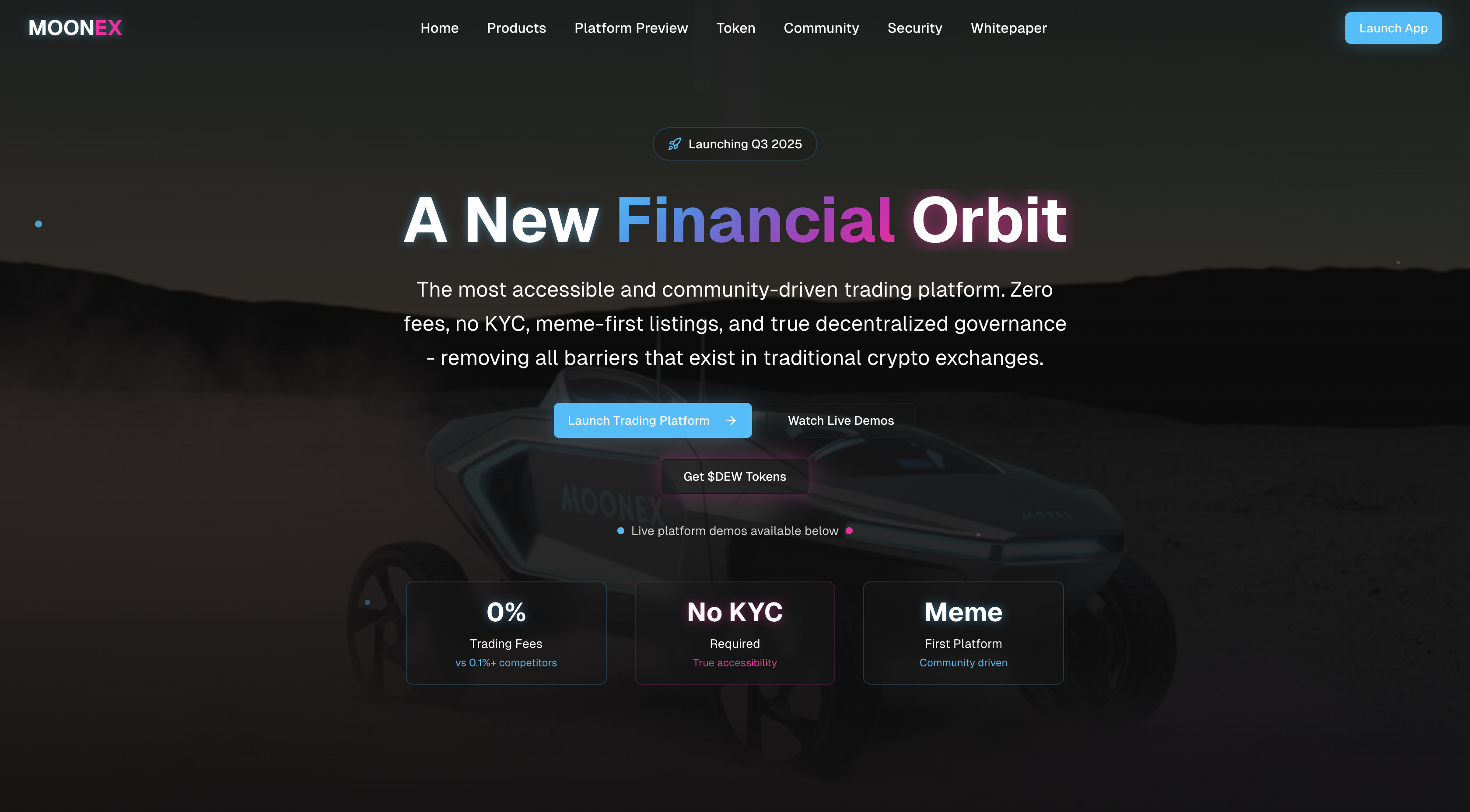

Design & Branding: The website has a futuristic and immersive design with neon gradients and dark tones that evoke a high-tech, space-inspired theme. It effectively communicates innovation and accessibility, appealing to the meme and retail trader audience.

Token Positioning: The $DEW token functions as the core asset of the Moonex ecosystem, supporting governance, trading incentives, and platform participation. It is branded as a community-first and fee-free token for decentralized trading.

Ecosystem Features: Moonex promotes zero-fee trading, no KYC requirements, meme-first listings, and community governance. These features aim to remove traditional exchange barriers and create a more inclusive and transparent trading environment.

Goals: The project seeks to democratize crypto trading by combining decentralization, accessibility, and entertainment-driven culture. Its mission is to redefine exchange participation through community ownership and gamified interaction.

Unique Hook: Moonex stands out as the first meme-driven decentralized exchange offering zero fees and full user anonymity. Its emphasis on accessibility and entertainment-based engagement differentiates it from institutional-style DEXs.

Comment: Moonex positions itself as a bold, culture-focused trading platform merging DeFi infrastructure with meme culture. Its appeal lies in simplicity, inclusivity, and community power, though long-term sustainability will depend on liquidity retention and continuous user engagement.

Hype Analysis: Google Search + Google Trends

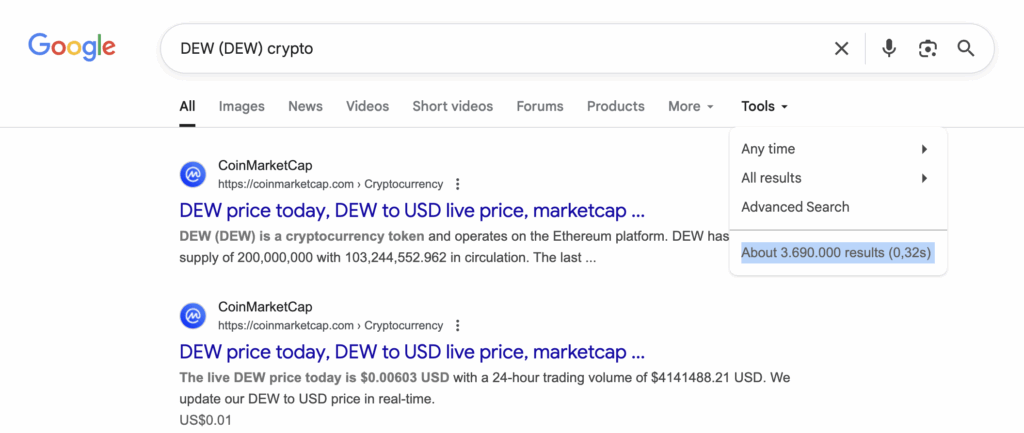

We analyzed Google search results for “DEW (DEW)” and found approximately 3,690,000 indexed pages. From an analytical standpoint, this is a remarkably high number for a newly trending crypto asset. Such strong visibility signals widespread media coverage, exchange listings, and active community engagement across platforms.

This level of online presence indicates that DEW has already achieved strong market awareness and early trust recognition. In crypto analytics, higher search volume and indexation often correlate with stronger investor confidence and higher potential for sustained growth. In short, DEW’s digital footprint is exceptionally strong – it’s clearly on the market’s radar and positioned for continued attention.

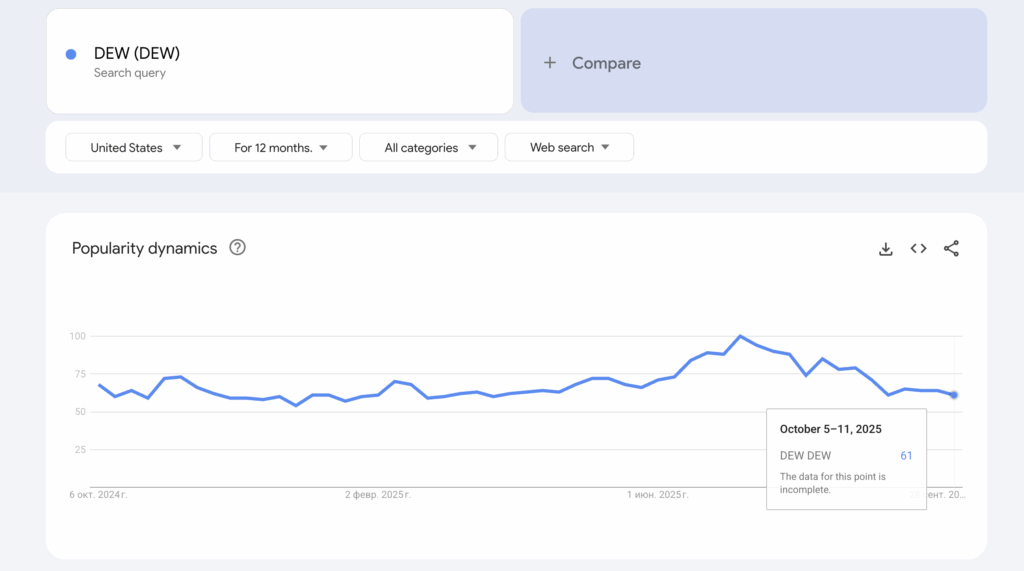

We analyzed Google Trends data for “DEW (DEW)” and observed a stable popularity level averaging between 60 and 80 throughout the past year, with only slight fluctuations. From an analytical perspective, this indicates consistently high awareness and ongoing public interest, which is uncommon for newer crypto projects.

Such sustained visibility shows that DEW maintains long-term recognition rather than relying solely on short-term hype. A score above 60 places it among the more actively searched assets in its category, reflecting strong brand presence and investor curiosity. In short, the trend data confirms that DEW enjoys healthy, stable attention — a positive sign for its long-term growth potential.

Reddit & Social Media Opinions

The social media and community analysis for the DEW (DEW) coin reveals a mixed and highly volatile landscape, with minimal organic discussion on Reddit contrasting with highly speculative trading activity.

In contrast to the weak community presence, market data points to highly aggressive and successful speculative activity. DEW is the native utility token of the MoonEx ecosystem, designed for governance (DewDAO), staking, and liquidity incentives. Critically, the token has shown extreme volatility and parabolic growth: it registered a staggering 7,178.80% price increase in the last 7 days as of one recent measurement, and is up 234.15% in the last 24 hours, with the community sentiment on CoinGecko currently reported as “bullish”. The trading volume is substantial, over $2.8 million in a 24-hour period, primarily on decentralized exchanges (DEXs) like PancakeSwap (v2). This massive short-term gain is characteristic of a low market cap token susceptible to market manipulation or a highly successful pump and dump scheme, which research shows is often linked to “artificial social media activity… known as bots” on platforms like X or Discord.

The DEW token exhibits the signature signs of an intensely speculative, high-risk asset. The project is positioned as a utility token for the MoonEx ecosystem, but its price action is completely detached from visible community-driven adoption. The negligible organic Reddit discussion, coupled with the extraordinary 7,000%+ price surge over the last week, strongly suggests that the market activity is driven by centralized, coordinated trading—likely on DEXs—rather than genuine retail interest in its stated utility (governance, staking). This dynamic classifies DEW as an extremely high-risk investment, where the immense volatility is the primary feature, not a byproduct of fundamental growth or widespread social adoption.

DEW (DEW) Price Prediction Matrix

| Factor | Observation | Analyst Assessment | Impact on Price Forecast |

|---|---|---|---|

| Trading Volume (24h) | $4.11M with a Vol/Mkt Cap ratio of 64.32% | Exceptionally strong liquidity for a small-cap token, showing high speculative interest | Strongly Positive – supports near-term price momentum |

| Price Trend | Rose from $0.0057 to $0.0075 before consolidating near $0.0064 | Upward trajectory indicates active accumulation and bullish sentiment | Positive – signals short-term continuation potential |

| Volatility | 30% intraday swings with fast recoveries after dips | High volatility suggests aggressive trading but also strong market engagement | Neutral to Positive – short-term trading potential, high risk |

| Market Behavior | Strong participation from retail and early adopters, no major dumps | Speculative but stable behavior indicates organized accumulation | Slightly Positive – may sustain short-term confidence |

| Website & Branding | Futuristic design, meme-oriented, highly retail-focused | Strong visual identity, well-aligned with meme culture and accessibility | Positive – attracts community-driven traders |

| Token Positioning | Core governance and utility token for MoonEx ecosystem | Practical use cases exist but overshadowed by speculative trading | Neutral – long-term unclear, short-term hype-driven |

| Ecosystem Features | Zero fees, no KYC, meme-first DEX model | Unique DeFi concept, but sustainability depends on execution | Slightly Positive – innovative but untested structure |

| Search Visibility (Google) | ~3.69M indexed results | Extremely strong online presence and awareness for a new token | Strongly Positive – reinforces credibility and visibility |

| Google Trends | Stable popularity (60–80 score) over 12 months | Consistent long-term interest, rare for new projects | Positive – supports brand trust and recognition |

| Social Media (Reddit, etc.) | Minimal organic discussion, dominated by speculative hype | Lacks grassroots community, likely driven by coordinated activity | Strongly Negative – high risk of market manipulation and volatility |

DEW (DEW) Price Forecast & Trading Scenarios

| Scenario | Assumed Price Move | Forecast Price ($) | PnL on $1,000 (Spot) | PnL with 5× Leverage | PnL with 10× Leverage |

|---|---|---|---|---|---|

| Bearish Dump | -70% | 0.0019 | -$700 | -$3,500 | -$7,000 |

| Mild Correction | -30% | 0.0045 | -$300 | -$1,500 | -$3,000 |

| Sideways / Stable | 0% | 0.0064 | $0 | $0 | $0 |

| Moderate Pump | +50% | 0.0096 | +$500 | +$2,500 | +$5,000 |

| Strong Pump | +150% | 0.0160 | +$1,500 | +$7,500 | +$15,000 |

| Extreme Hype Run | +400% | 0.0320 | +$4,000 | +$20,000 | +$40,000 |