Tensora (TORA) demonstrates an ambitious technical concept blending AI and blockchain infrastructure, but current market data signals an early speculative phase rather than organic growth. Trading activity is abnormally high compared to market cap, indicating short-term speculation and weak accumulation. Despite strong branding and innovative positioning, visibility and community engagement remain minimal. Until Tensora proves real AI utility, builds a sustainable user base, and stabilizes price action, it should be viewed as a high-risk, high-potential early-stage project with speculative upside but limited current traction.

Table of Contents

Tensora (TORA) Listing Analysis – Early Trading Hours/Days

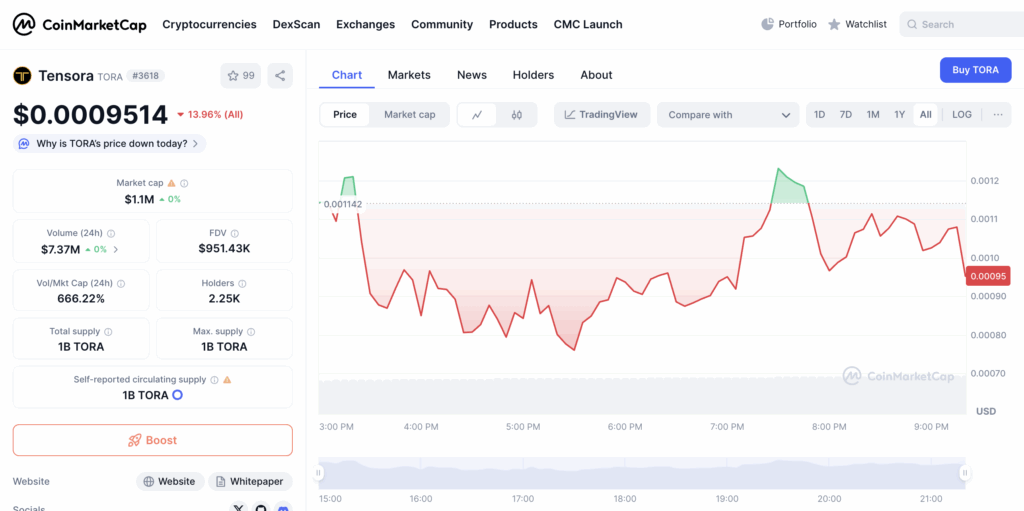

Volumes: ~$7.37M in 24h vs ~$1.1M market cap – extremely high 666% Vol/Mkt Cap ratio, signaling intense trading activity and short-term speculation.

Trend: Opened near ~$0.00114 and quickly retraced toward ~$0.00095, showing strong selling pressure after initial spikes.

Volatility: High – frequent price swings of 10-20% within hours indicate active scalping and unstable sentiment.

Behavior: Early traders took profits aggressively, while buy-side support appeared inconsistent, leading to sharp intraday drops and partial recoveries.

Comment: TORA’s debut shows speculative overtrading with thin stability layers – high liquidity but volatile order flow. Until consistent accumulation emerges, price remains highly reactive to short-term volume spikes.

Tensora (TORA) Website & Ecosystem Analysis

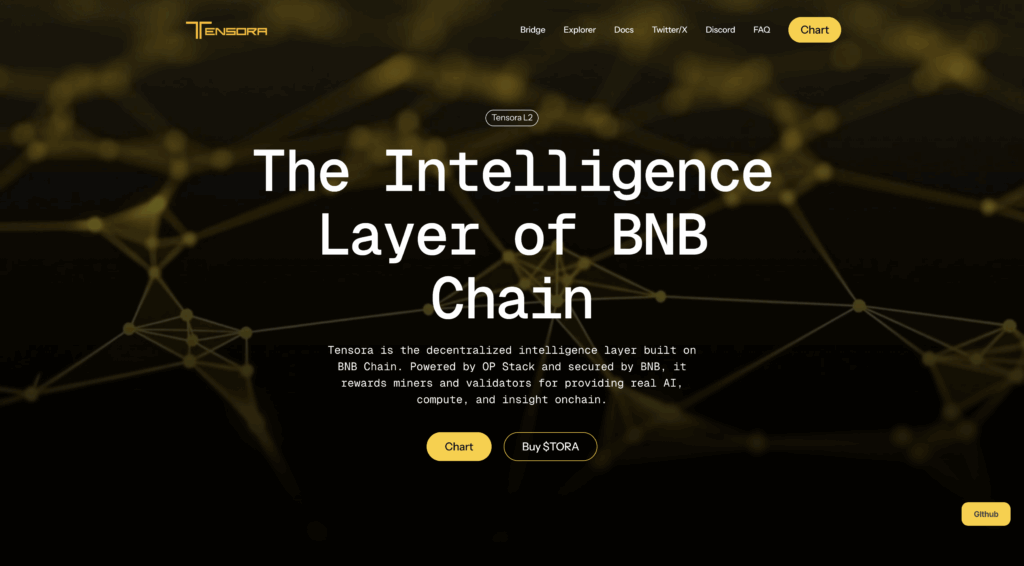

Design & Branding:

Modern, high-tech visual identity with a dark AI-inspired aesthetic. The yellow-on-black color palette reinforces sophistication and innovation, while clean typography emphasizes professionalism and credibility.

Token Positioning:

$TORA is positioned as the native asset of a decentralized AI and compute network on BNB Chain. It represents utility within Tensora’s ecosystem, powering validator incentives, AI computation rewards, and governance participation.

Ecosystem Features:

Built on OP Stack and secured by BNB, Tensora functions as an AI-enhanced Layer 2 network that rewards miners and validators for providing real compute and machine learning resources. Integrations with BNB infrastructure add scalability and interoperability.

Goals:

To become the “intelligence layer” of the BNB ecosystem by merging blockchain infrastructure with decentralized AI computation, enabling on-chain data analytics, machine learning, and intelligent dApps.

Unique Hook:

Tensora combines L2 scalability with AI compute distribution – a blend of blockchain consensus and artificial intelligence execution that few competitors currently offer in the BNB ecosystem.

Comment:

Tensora positions itself at the intersection of AI and Web3 infrastructure with a strong technical concept and clear branding. However, success will rely on actual AI utility adoption and sustained validator participation beyond speculative hype.

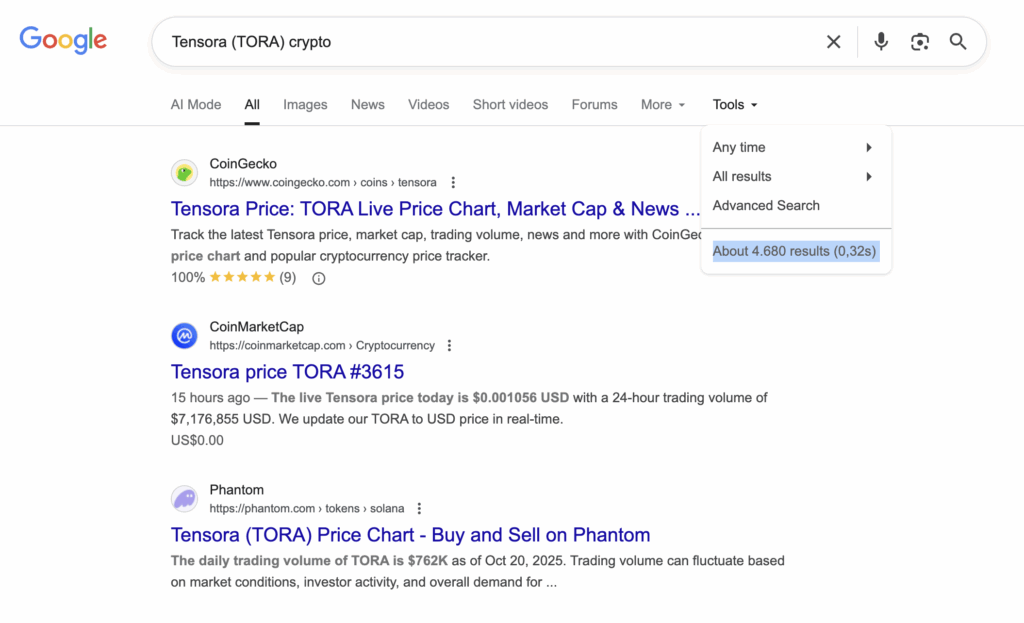

Hype Analysis: Google Search + Google Trends

We analyzed Google search visibility for “Tensora (TORA) crypto” and found approximately 4,680 indexed results. From an analytical perspective, this is a very low level of online presence, indicating that the project is still in its early visibility stage. Such a small number of mentions suggests limited market awareness and minimal media traction. In crypto terms, this level of exposure reflects a project that has yet to establish strong community engagement or broad recognition. However, it also implies potential upside if Tensora continues to grow its ecosystem and marketing reach, since early-stage visibility can expand rapidly once adoption and news coverage increase.

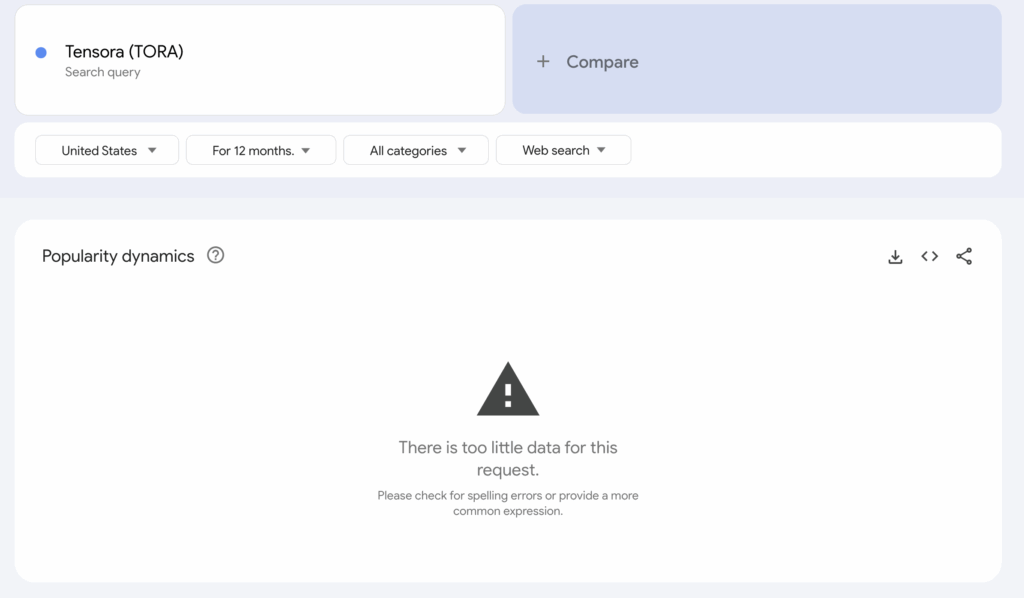

We analyzed Google Trends data for “Tensora (TORA)” and found that there is currently too little data to display measurable popularity dynamics. From an analytical perspective, this indicates that the project has not yet reached a meaningful level of public awareness or search interest. This is typical for newly launched or niche blockchain projects that are still building their visibility. In market terms, low trend activity means limited mainstream traction, but it also presents room for growth if Tensora begins consistent marketing efforts, listings, and community engagement to expand its presence.

Reddit & Social Media Opinions

Based purely on the available Reddit data, Tensora ($TORA) is a nascent project with minimal organic community engagement at this time. The current social presence is dominated by repetitive, promotional content announcing its identity as an “AI Layer-2 That Brings Machine Intelligence to BSC”. This uniform messaging across several crypto-related subreddits within a 13-hour window suggests an orchestrated marketing push rather than genuine community-driven conversation.

The low engagement metrics (minimal comments and votes outside of one subreddit) confirm that this project has not yet captured significant attention from the broader retail crypto audience. As an analyst, this lack of spontaneous discussion and user-generated content (reviews, technical analysis, specific price speculation, or long-form questions) indicates a high-risk profile common for tokens in the initial launch or pre-marketing phase. Future analysis should monitor for a shift from promotional posts to independent discussions to gauge genuine adoption and market interest.

Tensora (TORA) Price Prediction Matrix

| Factor | Observation | Analyst Assessment | Impact on Price Forecast |

|---|---|---|---|

| Trading Volume (24h) | ~$7.37M vs ~$1.1M market cap (666% Vol/Mkt Cap) | Extremely high speculative activity and liquidity turnover | Positive short-term momentum but unstable long-term base |

| Price Trend | Declined from ~$0.00114 to ~$0.00095 after spikes | Early sell-offs and profit-taking dominate | Negative – weak accumulation phase |

| Volatility | 10–20% intraday swings | High volatility reflecting speculative trading and low depth | Negative – unstable price discovery phase |

| Market Behavior | Profit-taking, inconsistent buy support | Overheated order flow, minimal holding behavior | Negative – short-term driven sentiment |

| Website & Branding | Sleek AI-themed design, strong tech aesthetic | Professional presentation supports legitimacy | Slightly Positive – enhances credibility for investors |

| Token Positioning | AI-powered L2 with compute rewards and governance | Innovative positioning but early-stage proof | Neutral – strong concept yet unproven execution |

| Ecosystem Features | Built on OP Stack, integrates AI compute and BNB Chain | Technically advanced, offers interoperability | Positive – potential for ecosystem traction |

| Search Visibility (Google) | ~4,680 results | Very limited exposure, early awareness phase | Negative – low visibility reduces traction |

| Google Trends | Insufficient data for measurable trend | Low awareness and minimal public interest | Strongly Negative – lacks organic search volume |

| Social Media (Reddit, etc.) | Mostly promotional posts, minimal engagement | Artificial hype, no genuine community traction | Strongly Negative – weak social foundation limits growth |

Tensora (TORA) Price Forecast & Trading Scenarios

| Scenario | Assumed Price Move | Forecast Price ($) | PnL on $1,000 (Spot) | PnL with 5× Leverage | PnL with 10× Leverage |

|---|---|---|---|---|---|

| Bearish Dump | -70% | 0.00029 | -$700 | -$3,500 | -$7,000 |

| Mild Correction | -30% | 0.00067 | -$300 | -$1,500 | -$3,000 |

| Sideways / Stable | 0% | 0.00095 | $0 | $0 | $0 |

| Moderate Pump | +50% | 0.00143 | +$500 | +$2,500 | +$5,000 |

| Strong Pump | +150% | 0.00238 | +$1,500 | +$7,500 | +$15,000 |

| Extreme Hype Run | +400% | 0.00475 | +$4,000 | +$20,000 | +$40,000 |