SigmaDotMoney (SIGMA) demonstrates strong early liquidity and speculative interest but lacks sustainable support or organic growth signals. The sharp post-listing decline, extreme volatility, and fragmented social sentiment point to a high-risk, momentum-driven asset rather than a fundamentally backed project. While the concept of volatility tranching is innovative within DeFi, current visibility and community traction remain weak. Until consistent accumulation, clearer branding, and credible partnerships emerge, SIGMA’s outlook remains bearish to neutral in the short term.

Table of Contents

SigmaDotMoney (SIGMA) Listing Analysis – Early Trading Hours/Days

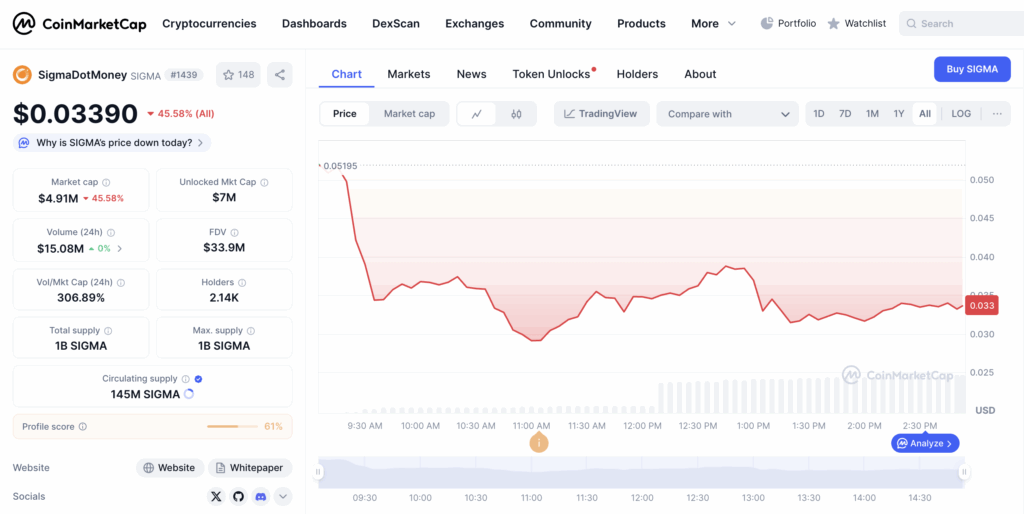

Volumes: ~$15.08M in 24h vs ~$4.91M market cap – an extreme ~307% Vol/Mkt Cap indicating very heavy turnover and hot money flows.

Trend: Opened near ~$0.052 and slid to ~$0.033 with brief mid-session bounces – a clear post-listing dump with shallow recoveries.

Volatility: High – intraday swings >25% with a low near ~$0.028 before rebounding, signaling unstable price discovery.

Behavior: Aggressive profit-taking and rotation dominated order flow; buyers appeared tactical, fading spikes rather than building positions. Low float vs FDV and visible unlock narratives likely amplified pressure.

Comment: SIGMA’s debut shows speculative churn and downside skew – strong liquidity but no sustained bid yet. Until accumulation replaces reactive scalping, price risk remains to the downside despite quick relief rallies.

SigmaDotMoney (SIGMA) Website & Ecosystem Analysis

Design & Branding: The website features a sleek, futuristic aesthetic with a dark background and vibrant orange accents. The visual identity emphasizes precision, technology, and finance, aligning with DeFi sophistication and algorithmic innovation.

Token Positioning: $SIGMA is positioned as a DeFi yield and volatility management token. It underpins a “Yield Engine” that leverages volatility tranching – effectively targeting both risk-seeking and stability-focused investors within decentralized finance.

Ecosystem Features: The ecosystem integrates trading, earning, leaderboards, and performance dashboards. The platform combines yield optimization tools with volatility-based risk segmentation, offering structured DeFi products similar to traditional financial derivatives.

Goals: To redefine yield generation by introducing volatility tranching – a system that redistributes risk and reward dynamically, creating more predictable and sustainable DeFi returns.

Unique Hook: Sigma’s “Build Stability – Embrace Volatility” concept merges DeFi yield farming with volatility engineering, a niche approach bridging traditional quant finance and decentralized markets.

Comment: Sigma presents a strong technical identity with a clear quant-finance narrative. However, its adoption will depend on user understanding of complex mechanisms like tranching and consistent performance delivery in volatile DeFi conditions.

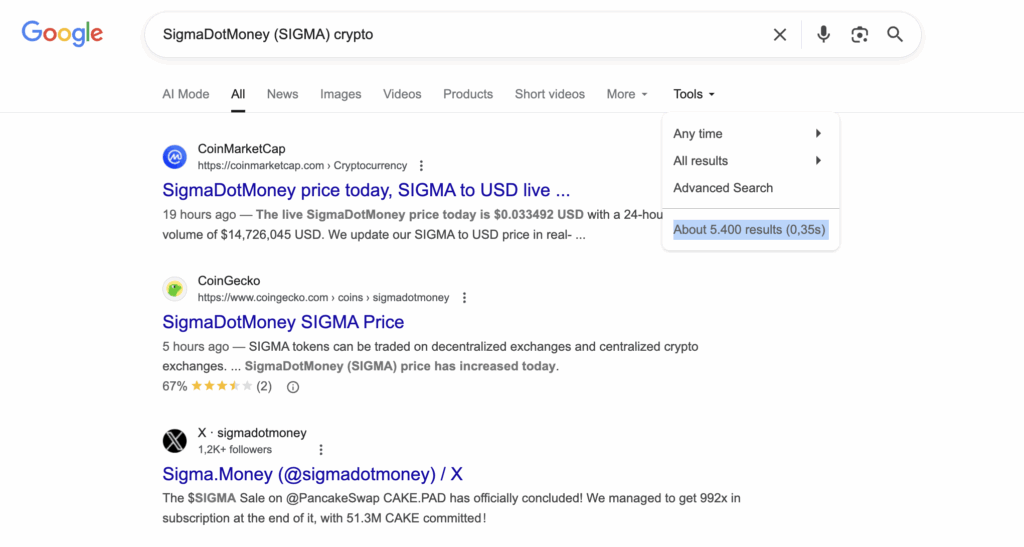

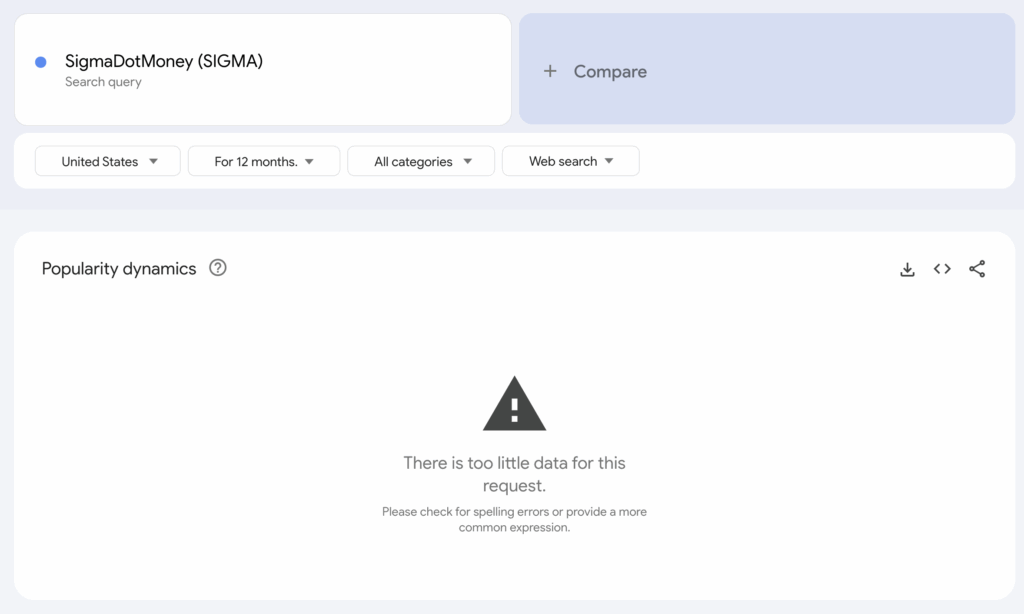

Hype Analysis: Google Search + Google Trends

We analyzed Google search visibility for “SigmaDotMoney (SIGMA) crypto” and found approximately 5,400 indexed results. From an analytical perspective, this indicates a relatively low level of online presence. Such a number suggests that the project is still in its early awareness phase, with limited exposure across media outlets and crypto-related discussions. For a newly launched token, this is typical but highlights that SIGMA has yet to establish strong visibility or community traction. As coverage, listings, and user engagement expand, this metric could grow significantly, improving the project’s credibility and perceived trust in the market.

We analyzed Google Trends data for “SigmaDotMoney (SIGMA)” and found that there is currently too little data to display measurable popularity dynamics. From an analytical standpoint, this indicates that public search interest in the project is still minimal. This is typical for early-stage or newly listed cryptocurrencies that have yet to gain mainstream attention. While low search activity reflects limited visibility at the moment, it also suggests potential upside if marketing efforts, listings, and community growth begin to accelerate.

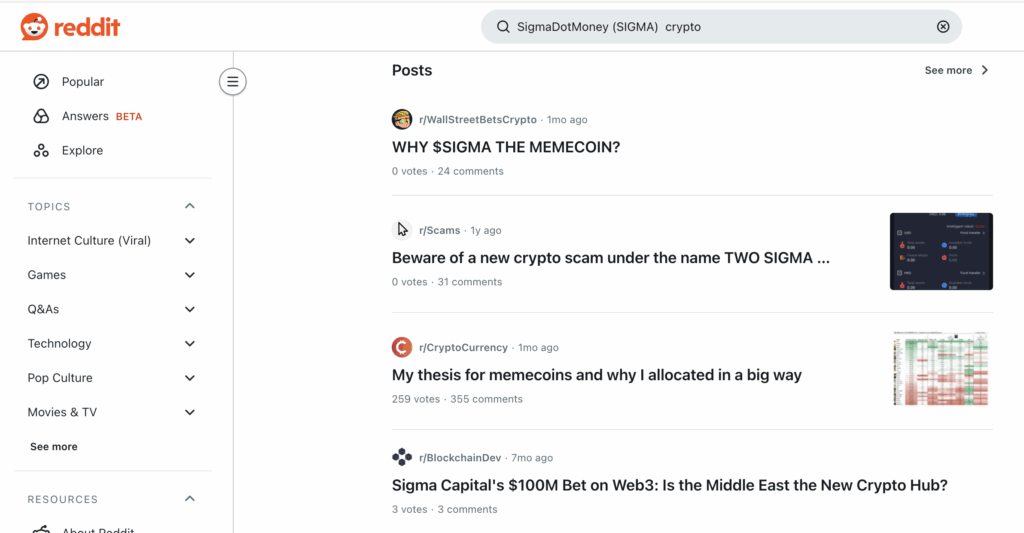

Reddit & Social Media Opinions

The social narrative surrounding the token or entity referred to as SigmaDotMoney ($SIGMA) is highly fragmented and contradictory. On one hand, there is recent retail speculation classifying it as a “memecoin”. On the other hand, there are older, more serious discussions linking the “Sigma” name to a major venture capital bet in Web3, and a significant scam warning related to “TWO SIGMA”.

The overall low vote counts on the specific $SIGMA posts, despite reasonable comment volume, suggest that the token lacks a strong, unified community identity or widespread organic interest outside of niche speculation. The high degree of name ambiguity, ranging from VC fund activity to scam alerts, creates an extremely opaque environment for potential investors. Given the presence of an explicit, unrefuted scam warning and the current status as a low-engagement “memecoin,” the social sentiment is overwhelmingly indicative of an extremely high-risk, unverified asset.

SigmaDotMoney (SIGMA) Price Prediction Matrix

| Factor | Observation | Analyst Assessment | Impact on Price Forecast |

|---|---|---|---|

| Trading Volume (24h) | ~$15.08M vs ~$4.91M market cap (~307% Vol/Mkt Cap) | Extremely high turnover showing speculative trading and liquidity churn | Slightly Positive – liquidity present but driven by short-term speculation |

| Price Trend | Dropped from ~$0.052 to ~$0.033 after launch | Clear post-listing dump with shallow bounces | Negative – strong sell pressure dominates |

| Volatility | >25% intraday swings, low near ~$0.028 | High volatility signals unstable sentiment and speculative behavior | Negative – unstable price discovery |

| Market Behavior | Aggressive profit-taking, weak buy-side support | No evidence of accumulation, only reactive scalping | Strongly Negative – no base formation yet |

| Website & Branding | Sleek design with fintech aesthetic and professional branding | Strong DeFi identity and credibility in presentation | Slightly Positive – supports legitimacy perception |

| Token Positioning | DeFi yield token using volatility tranching | Innovative but complex concept for average retail investors | Neutral – sophisticated idea with niche appeal |

| Ecosystem Features | Integrated trading, leaderboard, volatility-based yield tools | Structured and unique DeFi model resembling TradFi products | Slightly Positive – strong differentiation potential |

| Search Visibility (Google) | ~5,400 results | Low online presence, early awareness phase | Negative – limited visibility and traction |

| Google Trends | Insufficient data for measurable trend | Minimal search interest, not yet gaining public attention | Strongly Negative – low awareness level |

| Social Media (Reddit, etc.) | Fragmented narrative with scam warnings and memecoin confusion | Highly risky sentiment, no unified or engaged community | Strongly Negative – credibility risk and weak community support |

SigmaDotMoney (SIGMA) Price Forecast & Trading Scenarios

| Scenario | Assumed Price Move | Forecast Price ($) | PnL on $1,000 (Spot) | PnL with 5× Leverage | PnL with 10× Leverage |

|---|---|---|---|---|---|

| Bearish Dump | -70% | 0.01017 | -$700 | -$3,500 | -$7,000 |

| Mild Correction | -30% | 0.02373 | -$300 | -$1,500 | -$3,000 |

| Sideways / Stable | 0% | 0.03390 | $0 | $0 | $0 |

| Moderate Pump | +50% | 0.05085 | +$500 | +$2,500 | +$5,000 |

| Strong Pump | +150% | 0.08475 | +$1,500 | +$7,500 | +$15,000 |

| Extreme Hype Run | +400% | 0.16950 | +$4,000 | +$20,000 | +$40,000 |