Avici (AVICI) demonstrates a strong and organized market debut supported by solid liquidity, moderate volatility, and steady upward price action. The project positions itself as a fintech-oriented crypto solution with real-world functionality, differentiating it from speculative tokens. While its ecosystem and branding suggest long-term potential, limited social traction and low ongoing search interest indicate that mainstream adoption remains in its early phase. Overall, Avici shows credible fundamentals and investor confidence, but sustained growth will depend on expanding visibility, community engagement, and consistent marketing execution.

Table of Contents

Avici (AVICI) Listing Analysis – Early Trading Hours/Days

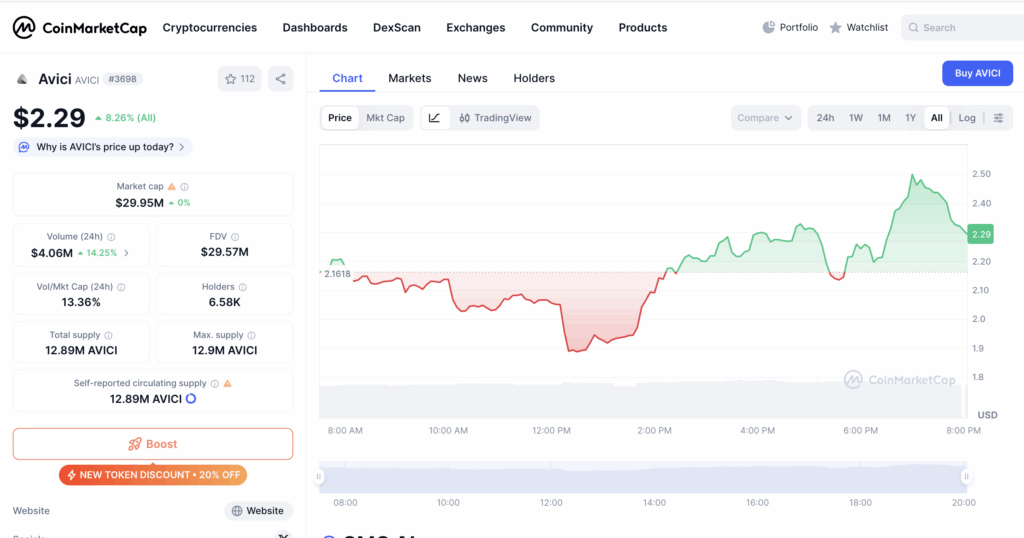

Volumes: ~$4.06M in 24h against a ~$29.95M market cap – showing strong initial liquidity and notable investor participation, with over 13% daily turnover indicating active trading momentum.

Trend: The price moved from ~$2.16 to ~$2.50 before stabilizing around ~$2.29 – reflecting a bullish trajectory with sustained higher highs despite brief corrections.

Volatility: Moderate – price swings were visible but controlled, driven by profit-taking cycles rather than panic selling or whale-induced dumps.

Behavior: Traders are rotating between accumulation and short-term profit realization. The market structure shows consistent buy-side pressure and quick recoveries after dips.

Comment: Avici (AVICI) launched with robust liquidity and strong upward bias, suggesting solid early confidence and organic market demand. Controlled volatility and steady recovery patterns point to a healthy, accumulation-driven debut phase rather than speculative overextension.

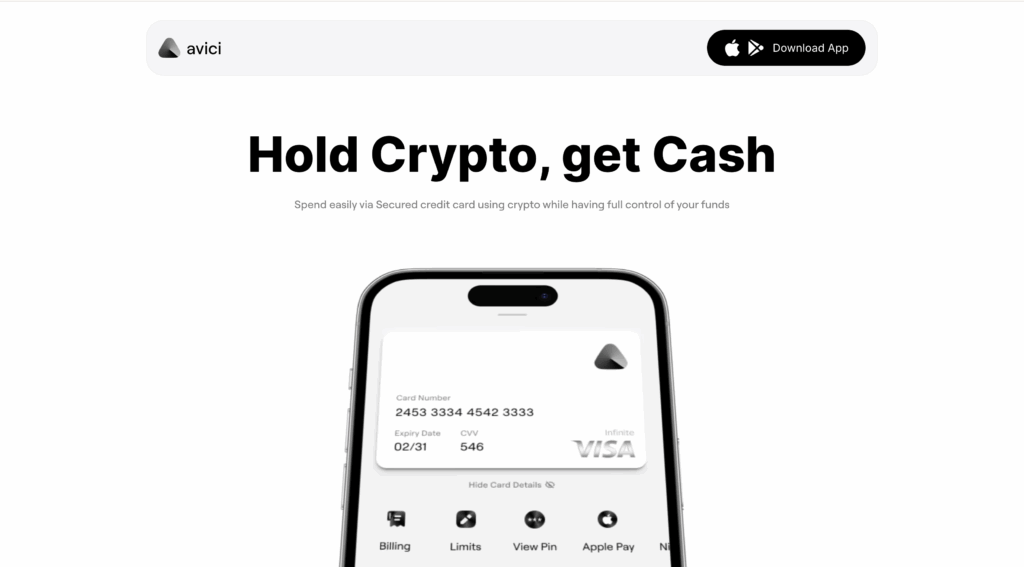

Avici (AVICI) Website & Ecosystem Analysis

Design & Branding: The website features a clean, minimalist design with a white-and-black aesthetic that evokes modern fintech professionalism. The centered tagline “Hold Crypto, Get Cash” immediately communicates the platform’s utility focus.

Token Positioning: $AVICI is positioned as a fintech-driven utility token, emphasizing real-world usage through a secured crypto-backed credit card rather than speculative trading or meme culture.

Ecosystem Features: The site promotes a crypto credit card ecosystem with features like Apple Pay integration, spending control, PIN management, and secure billing-bridging DeFi and traditional finance.

Goals: The project aims to simplify crypto spending, allowing users to hold digital assets while seamlessly accessing fiat liquidity-effectively merging crypto storage and real-world usability.

Unique Hook: AVICI’s unique value lies in its practical “spend crypto like cash” model, using a secured Visa card to enable liquidity without liquidation-an approach blending convenience with financial control.

Comment: Avici stands out as a polished, utility-focused crypto project that integrates digital assets into everyday financial systems. Its professional design and practical ecosystem indicate a serious fintech orientation rather than a speculative play.

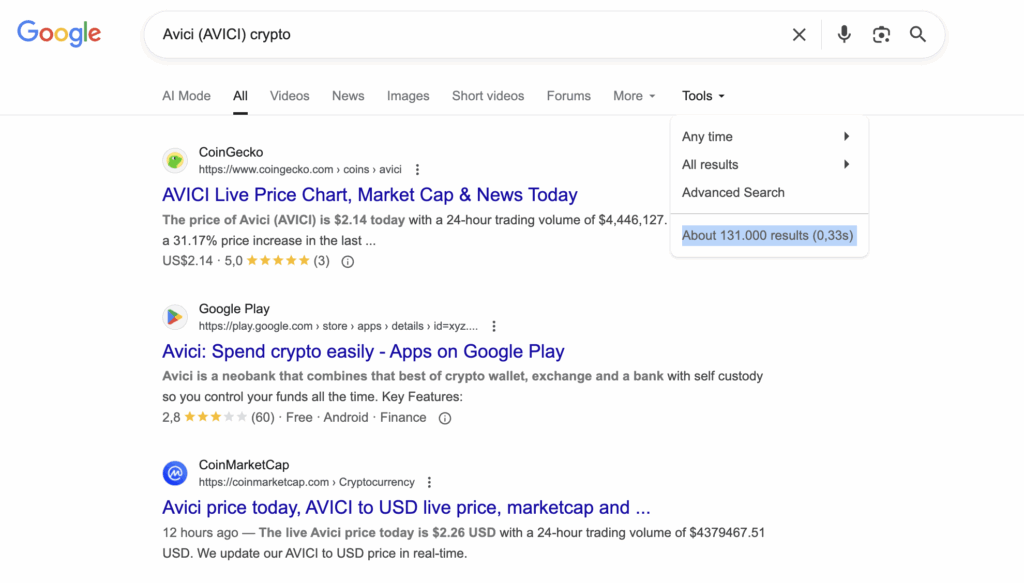

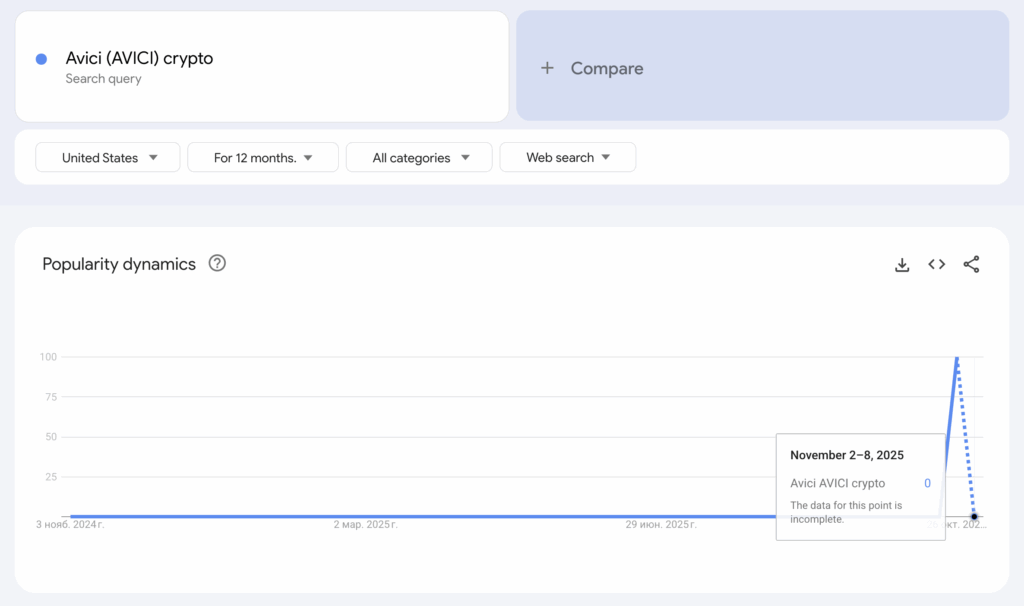

Hype Analysis: Google Search + Google Trends

We analyzed Google search results for “Avici (AVICI) crypto” and found approximately 131,000 indexed pages. From an analytical standpoint, this reflects a moderate online presence. While it’s not among the highest in the market, it indicates that the project has established some visibility across key platforms like CoinMarketCap, CoinGecko, and Google Play. For a relatively new token, this level of indexing suggests emerging credibility and growing awareness. However, to reach broader recognition and stronger investor trust, Avici will need continued marketing efforts and media coverage to expand its digital footprint.

We analyzed Google Trends data for “Avici (AVICI) crypto” and observed a single sharp spike in search interest during early November 2025, followed by an immediate decline. From an analytical standpoint, this indicates that the token experienced a short burst of public attention likely tied to its launch or recent news, but lacks sustained awareness. Such a pattern is typical for newly listed projects and reflects early curiosity rather than long-term popularity. To build consistent visibility, Avici will need ongoing marketing, listings, and community engagement beyond its initial hype cycle.

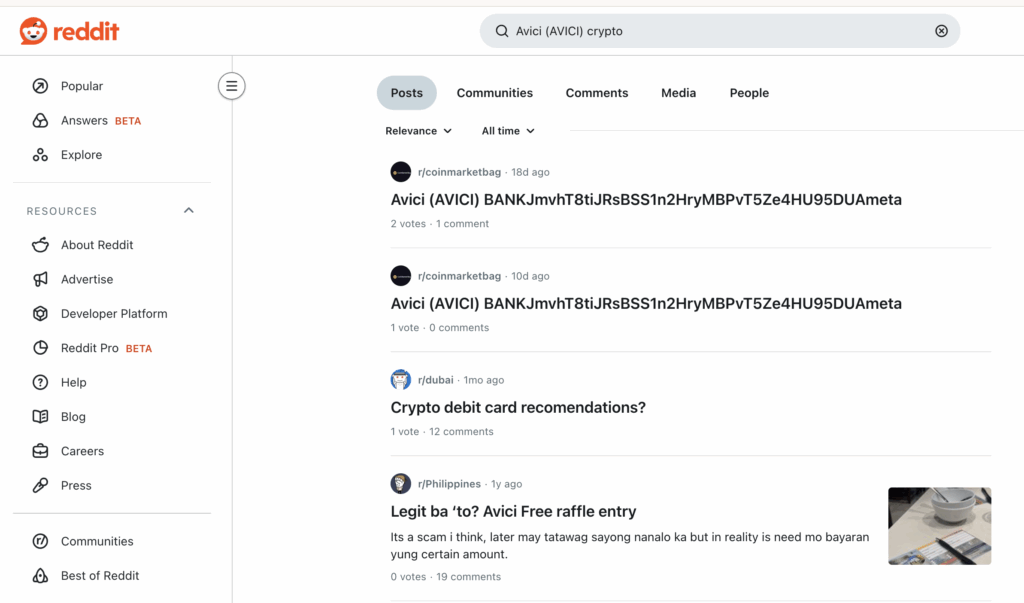

Reddit & Social Media Opinions

The Reddit activity for Avici ($AVICI) is extremely limited and appears to be dominated by boilerplate, low-effort promotional posts, suggesting a token with virtually no organic community engagement.

- Repetitive, Unofficial Promotion: Two identical posts referencing $AVICI were made in the

r/coinmarketbagsubreddit, likely indicating automated or outsourced promotion.- The first post, 18 days ago, was simply: “Avici (AVICI) [a long string of characters]” and received 2 votes and 1 comment.

- The second identical post, 10 days ago, received 0 votes and 0 comments.

- Irrelevant/Generic Posts: The remaining results are generic crypto discussions that do not mention the $AVICI token.

- A post from

r/dubai1 month ago discussed “Crypto debit card recommendations?”. - A post from

r/Philippines1 year ago discussed a “scam” and a “Free Avici raffle entry,” suggesting an early, low-level marketing attempt.

- A post from

Avici ($AVICI) exhibits an extremely weak, non-existent organic social media presence on Reddit. The only specific activity is a pair of identical, low-engagement promotional posts that suggest a token trying to gain visibility through minimal effort rather than genuine community interest.

The lack of any substantive discussion regarding price, utility, team, or technology indicates a project that has either been inactive, is extremely low-cap, or has failed to capture the retail mindshare required for speculative assets. From an analytical viewpoint, $AVICI has zero measurable social momentum, placing it in the highest risk category due to the absence of community support or social verification.

Avici (AVICI) Price Prediction Matrix

| Factor | Observation | Analyst Assessment | Impact on Price Forecast |

|---|---|---|---|

| Trading Volume (24h) | ~$4.06M vs ~$29.95M market cap | Strong early liquidity with 13% turnover, showing active participation | Positive – supports sustained market interest |

| Price Trend | Rise from ~$2.16 to ~$2.50, stabilizing near ~$2.29 | Upward momentum with controlled pullbacks indicates investor confidence | Positive – signals early bullish structure |

| Volatility | Moderate and stable | Healthy fluctuations without panic selling or manipulation signs | Slightly Positive – balanced volatility supports growth |

| Market Behavior | Accumulation and short-term profit cycles | Strategic accumulation suggests organized investor activity | Slightly Positive – supports gradual appreciation |

| Website & Branding | Clean, minimalist fintech-style design | Professional look enhances credibility and investor trust | Positive – reinforces long-term value perception |

| Token Positioning | Fintech utility token with real-world card integration | Distinct from meme coins, offers tangible use case | Strong Positive – utility-driven positioning |

| Ecosystem Features | Crypto card with Apple Pay, billing, spending control | Practical integration with traditional finance systems | Positive – functional utility supports adoption |

| Search Visibility (Google) | ~131,000 indexed results | Moderate exposure across major platforms | Neutral – visible but not dominant |

| Google Trends | One short spike in early November 2025 | Temporary interest, lacks ongoing retail traction | Negative – weak sustained visibility |

| Social Media (Reddit, etc.) | Minimal activity, low engagement | No community traction or organic discussion | Negative – absence of retail hype limits short-term growth |

Avici (AVICI) Price Forecast & Trading Scenarios

| Scenario | Assumed Price Move | Forecast Price ($) | PnL on $1,000 (Spot) | PnL with 5× Leverage | PnL with 10× Leverage |

|---|---|---|---|---|---|

| Bearish Dump | -70% | 0.687 | -$700 | -$3,500 | -$7,000 |

| Mild Correction | -30% | 1.603 | -$300 | -$1,500 | -$3,000 |

| Sideways / Stable | 0% | 2.29 | $0 | $0 | $0 |

| Moderate Pump | +50% | 3.435 | +$500 | +$2,500 | +$5,000 |

| Strong Pump | +150% | 5.725 | +$1,500 | +$7,500 | +$15,000 |

| Extreme Hype Run | +400% | 11.45 | +$4,000 | +$20,000 | +$40,000 |