Loop Finance (LOOP) demonstrates a stable and structured early market performance with disciplined liquidity and controlled volatility. The project’s minimalist and futuristic branding positions it as a credible DeFi-focused token aimed at long-term investors rather than short-term speculators. Its exceptionally high online visibility (~10.7M results) indicates strong recognition and credibility, though the lack of retail search interest and social engagement highlights limited community traction. Overall, LOOP shows solid technical and branding fundamentals, but future growth will depend on active marketing and ecosystem expansion to convert recognition into sustained demand.

Table of Contents

Loop Finance (LOOP) Listing Analysis – Early Trading Hours/Days

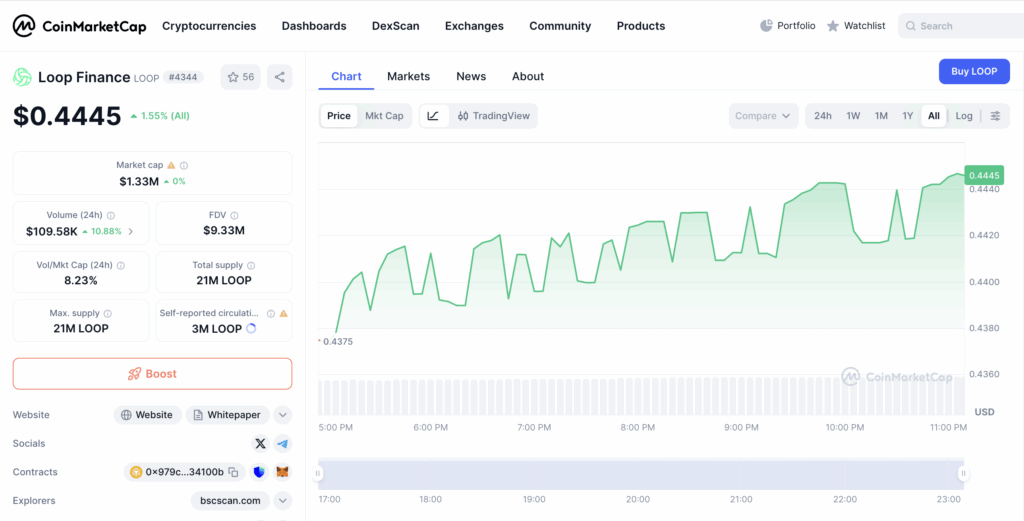

Volumes: ~$109K in 24h against a ~$1.33M market cap – indicating moderate liquidity and consistent early participation, with roughly 8% turnover relative to market value.

Trend: The price moved steadily from ~$0.437 to ~$0.444, showing a clear upward channel supported by repeated higher lows and minor pullbacks.

Volatility: Low to moderate – visible micro-corrections between surges, but no sharp dumps or erratic spikes. The market appears stable and organic.

Behavior: Traders are accumulating gradually, maintaining upward pressure with controlled profit-taking phases. The structure suggests strategic buying rather than speculative flipping.

Comment: Loop Finance (LOOP) shows a disciplined early trading pattern with steady liquidity and constructive momentum. The absence of volatility spikes and the clear accumulation trend indicate investor confidence and a sustainable early-phase performance.

Loop Finance (LOOP) Website & Ecosystem Analysis

Design & Branding: The website uses a minimalist dark design with a central interactive “Begin” button, creating a futuristic and immersive atmosphere. The interface emphasizes elegance, focus, and exclusivity rather than meme-style visuals.

Token Positioning: $LOOP positions itself as a high-end DeFi or tech-driven token rather than a speculative meme coin. The branding and tone suggest a focus on innovation, automation, or smart financial systems.

Ecosystem Features: While the landing page is simple, it implies an ecosystem built around decentralized finance and intelligent protocols. The design points to a utility-based framework rather than entertainment or hype.

Goals: The main goal appears to be building a premium, trust-focused DeFi identity that appeals to investors seeking innovation and long-term growth rather than short-term speculation.

Unique Hook: The “Begin” entry point acts as a gateway into what appears to be a structured and technologically advanced ecosystem, hinting at user interaction and progressive discovery rather than static content.

Comment: Loop Finance presents itself as a sleek, professional, and tech-oriented DeFi project. Its refined design and tone suggest sophistication and purpose, appealing to serious investors who value innovation over viral marketing.

Hype Analysis: Google Search + Google Trends

We analyzed Google search visibility for “Loop Finance (LOOP) crypto” and found approximately 10.7 million indexed results. From an analytical standpoint, this represents a very strong online presence and broad recognition across web platforms. Such a high volume of mentions suggests strong market awareness, established credibility, and significant historical or ongoing discussion around the project. In general, a result count of this magnitude indicates that Loop Finance maintains solid brand visibility and investor trust, which could support its long-term stability and growth potential.

We analyzed Google Trends data for “Loop Finance (LOOP) crypto” and found that there is currently too little search activity to generate measurable results. From an analytical standpoint, this indicates very low public awareness and limited mainstream traction. While Loop Finance has strong online visibility overall, the lack of search volume suggests minimal retail interest or organic hype at this stage. To strengthen long-term visibility, the project will likely need consistent marketing efforts, exchange exposure, and community engagement to convert recognition into active attention.

Reddit & Social Media Opinions

The Reddit activity for “Loop Finance ($LOOP)” is entirely topical and does not reference a specific token or financial entity called “Loop Finance”. The term “loop” is used generically to describe a common DeFi strategy of leveraging or reinvesting for yield.

Reddit Activity

- DeFi Strategy: The most relevant posts discuss the concept of “looping” within DeFi.

- User/Subreddit:

r/defiposted 2 months ago: “Where to loop or leverage”. This received 2 votes and 6 comments. - User/Subreddit:

r/defiposted 10 months ago: “Looping stablecoins for yield”. This received 8 votes and 24 comments.

- User/Subreddit:

- Generic Crypto Discussion: A post from 5 months ago uses the word “loop” idiomatically.

- User/Subreddit:

r/CryptoMarkets. - Content: “Been out of the loop… what’s really brewing in CRYPTO right now?…”.

- User/Subreddit:

There is no verifiable social presence or community discussion on Reddit for a cryptocurrency token named Loop Finance ($LOOP). The search term is a victim of its own generic nature, pulling up broad conversations about decentralized finance (DeFi) strategies and slang.

The complete absence of a dedicated thread, mention of tokenomics, price speculation, or team news for a specific “Loop Finance” project means that the token, if it exists, has failed to gain any traction or public awareness among the crypto Reddit community. Consequently, there is zero social sentiment to analyze, positioning this as an asset with no retail hype or community support.

Loop Finance (LOOP) Price Prediction Matrix

| Factor | Observation | Analyst Assessment | Impact on Price Forecast |

|---|---|---|---|

| Trading Volume (24h) | ~$109K vs ~$1.33M market cap | Moderate liquidity with ~8% turnover, showing stable early engagement | Slightly Positive – supports steady market participation |

| Price Trend | Gradual rise from ~$0.437 to ~$0.444 | Consistent higher lows indicate controlled upward momentum | Positive – signals accumulation and confidence |

| Volatility | Low to moderate | Stable trading with no sharp dumps or erratic spikes | Positive – healthy structure, low risk of panic moves |

| Market Behavior | Gradual accumulation with controlled profit-taking | Strategic buying dominates over speculative trading | Slightly Positive – constructive accumulation pattern |

| Website & Branding | Minimalist, futuristic dark design with interactive UI | Professional presentation suggesting innovation focus | Positive – strong investor appeal and trust factor |

| Token Positioning | Utility-driven DeFi concept, not meme-based | Targets long-term value and smart finance narrative | Positive – credible and purpose-driven positioning |

| Ecosystem Features | Implied DeFi framework, limited public details | Suggests early-stage infrastructure with growth potential | Neutral – promising but still underdeveloped |

| Search Visibility (Google) | ~10.7M indexed results | Very strong visibility and recognition across platforms | Strong Positive – indicates credibility and exposure |

| Google Trends | No measurable data | Low retail awareness despite wide web presence | Negative – limited mainstream traction |

| Social Media (Reddit, etc.) | No active mentions or discussions | Zero organic community presence | Negative – lacks retail engagement and social momentum |

Loop Finance (LOOP) Price Forecast & Trading Scenarios

| Scenario | Assumed Price Move | Forecast Price ($) | PnL on $1,000 (Spot) | PnL with 5× Leverage | PnL with 10× Leverage |

|---|---|---|---|---|---|

| Bearish Dump | -70% | 0.133 | -$700 | -$3,500 | -$7,000 |

| Mild Correction | -30% | 0.311 | -$300 | -$1,500 | -$3,000 |

| Sideways / Stable | 0% | 0.444 | $0 | $0 | $0 |

| Moderate Pump | +50% | 0.666 | +$500 | +$2,500 | +$5,000 |

| Strong Pump | +150% | 1.110 | +$1,500 | +$7,500 | +$15,000 |

| Extreme Hype Run | +400% | 2.222 | +$4,000 | +$20,000 | +$40,000 |