$SILVER demonstrates a strong and structured launch phase with controlled volatility, solid liquidity, and consistent buying pressure. The project’s branding and positioning as a “digital silver” asset create a clear and trustworthy narrative supported by credible integrations. Its massive online visibility (136M results) signals strong market exposure, though low Google Trends activity and weak social engagement highlight early-stage community growth challenges. Overall, $SILVER shows stable fundamentals and high brand potential, but long-term success will depend on expanding real-world utility, community traction, and verified asset backing.

Table of Contents

SILVER ($SILVER) Listing Analysis – Early Trading Hours/Days

Volumes: ~$47.3K in 24h vs ~$414K market cap – ~11.3% Vol/Mkt Cap shows modest but healthy early liquidity.

Trend: Opened near ~$0.01266 and trended steadily up toward ~$0.01297 with shallow pullbacks – clear accumulation bias.

Volatility: Low to moderate – tight intraday range with brief dips quickly bid back.

Behavior: Buyers controlled tape, stepping in on every dip while sellers were passive – no evidence of panic or large unlocks.

Comment: $SILVER launched with disciplined order flow and sustained bid support – early confidence, organic price discovery, and no dump signals but depth still thin so moves can amplify on larger orders.

SILVER ($SILVER) Website & Ecosystem Analysis

Design & Branding: Sleek and metallic visual concept built around the idea of digital silver. The interface is minimalist, professional, and aligned with commodity symbolism, emphasizing stability and value preservation.

Token Positioning: $SILVER is positioned as a digital asset mirroring the qualities of physical silver – stability, scarcity, and trust. It aims to blend traditional commodity value with blockchain transparency.

Ecosystem Features: Integrated with major DeFi platforms like PancakeSwap, Binance, and CoinMarketCap, enabling trading and liquidity operations. Includes LP lock verification for transparency and market trust.

Goals: To digitize the value of silver and offer a stable, asset-backed crypto alternative for DeFi users seeking low-volatility exposure within a decentralized ecosystem.

Unique Hook: The project’s message “1 SILVER = 1 $SILVER” connects real-world asset stability with on-chain empowerment, appealing to users looking for tangible value representation in crypto.

Comment: $SILVER presents a clear, trust-based concept with strong branding and credible integrations. However, long-term success will depend on proof of asset backing, liquidity growth, and broader utility beyond symbolic commodity linkage.

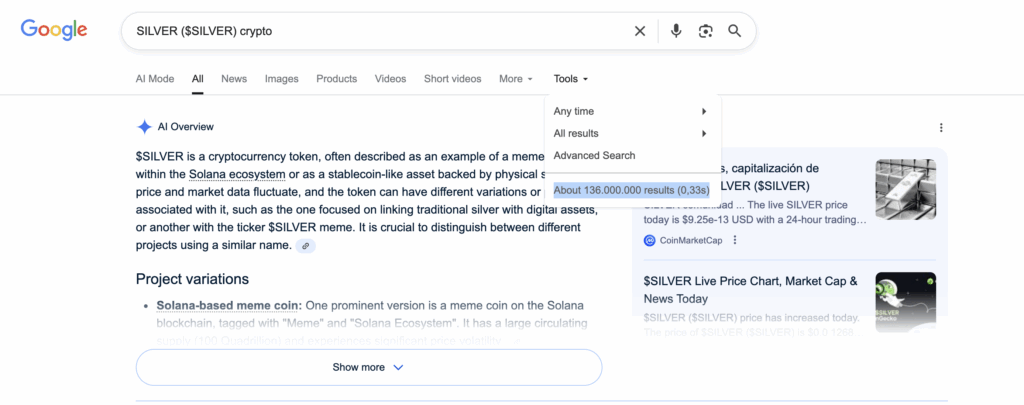

Hype Analysis: Google Search + Google Trends

We analyzed Google search visibility for “SILVER ($SILVER) crypto” and found approximately 136 million indexed results. From an analytical perspective, this is an exceptionally high figure, signaling massive online exposure and widespread recognition. Such volume indicates strong SEO traction, broad media coverage, and significant community engagement. Tokens with this level of visibility are generally seen as highly trusted or at least widely discussed, which strengthens brand credibility and long-term growth potential. In short, $SILVER’s online presence is extremely strong, positioning it well above the average emerging cryptocurrency in terms of market awareness.

We analyzed Google Trends data for “SILVER ($SILVER)” and found that there is currently too little data to display measurable popularity dynamics. From an analytical standpoint, this indicates that public search activity for the token remains very low. This level of visibility is typical for newly listed or niche cryptocurrencies that have not yet reached mainstream awareness. To gain stronger market traction, $SILVER will need active marketing, community engagement, and partnerships to drive organic search growth and improve overall visibility.

Reddit & Social Media Opinions

The social media and Reddit landscape does not show any widespread, organized community discussion or significant retail hype for a specific non-stablecoin, speculative cryptocurrency token labeled ‘$SILVER’. Instead, the vast majority of “silver token” mentions are tied to in-game economies or are part of broader macroeconomic debates comparing the physical commodity, silver (XAG), to cryptocurrencies like Bitcoin and Ethereum.

The most relevant online conversation centers on silver’s recent price rally, which analysts attribute to strong physical and industrial demand, global supply shortages, and a flight to hard assets amid economic uncertainty. This trend has even led to a comparison where some sources claim silver’s market capitalization briefly surpassed Bitcoin’s, underscoring its role as a traditional safe-haven asset in relation to volatile crypto markets. Any perceived investment buzz in “$SILVER” is almost certainly a reflection of the commodity’s recent performance and the general market interest in the tokenization of real-world assets (RWA).

Therefore, any investment strategy targeting a speculative ‘memecoin’ or novel altcoin under the ticker $SILVER would be lacking in observable social momentum. The tokenization of silver is an ongoing trend, but the search results do not point to a single, dominant crypto project that has captured significant retail attention under this generic name. Investors should exercise extreme caution, as the generic ticker likely creates confusion with legitimate silver-backed digital assets or traditional silver ETFs.

SILVER ($SILVER) Price Prediction Matrix

| Factor | Observation | Analyst Assessment | Impact on Price Forecast |

|---|---|---|---|

| Trading Volume (24h) | ~$47.3K vs ~$414K market cap (11.3% Vol/Mkt Cap) | Moderate early liquidity showing healthy participation | Neutral – sufficient volume for stability but still shallow depth |

| Price Trend | Gradual rise from ~$0.01266 to ~$0.01297 | Consistent upward momentum with controlled dips | Positive – steady accumulation supports gradual appreciation |

| Volatility | Tight intraday range with quick rebounds | Low to moderate volatility indicates disciplined trading | Slightly Positive – stable movement fosters investor confidence |

| Market Behavior | Buyers dominated, minimal selling pressure | Early organic accumulation, no panic selling | Positive – reflects early confidence and accumulation phase |

| Website & Branding | Professional metallic design, commodity-themed | Strong alignment with silver’s stability narrative | Positive – reinforces trust and legitimacy |

| Token Positioning | Digital silver concept linking real-world value | Solid positioning as a stable-value DeFi alternative | Slightly Positive – clear vision but limited innovation |

| Ecosystem Features | Integrated with major DeFi and liquidity platforms | Functional infrastructure but early-stage adoption | Neutral – foundation ready but needs scaling |

| Search Visibility (Google) | ~136 million indexed results | Extremely high exposure and recognition | Strongly Positive – major visibility supports brand trust |

| Google Trends | Insufficient data for measurable trend | Very low public search activity | Negative – low awareness may delay traction |

| Social Media (Reddit, etc.) | Minimal discussion, mostly unrelated mentions | Weak organic community and unclear narrative ownership | Strongly Negative – lack of community limits viral growth potential |

SILVER ($SILVER) Price Forecast & Trading Scenarios

| Scenario | Assumed Price Move | Forecast Price ($) | PnL on $1,000 (Spot) | PnL with 5× Leverage | PnL with 10× Leverage |

|---|---|---|---|---|---|

| Bearish Dump | -70% | 0.00389 | -$700 | -$3,500 | -$7,000 |

| Mild Correction | -30% | 0.00908 | -$300 | -$1,500 | -$3,000 |

| Sideways / Stable | 0% | 0.01297 | $0 | $0 | $0 |

| Moderate Pump | +50% | 0.01945 | +$500 | +$2,500 | +$5,000 |

| Strong Pump | +150% | 0.03243 | +$1,500 | +$7,500 | +$15,000 |

| Extreme Hype Run | +400% | 0.06485 | +$4,000 | +$20,000 | +$40,000 |