Stakefy (SFY) shows strong structural integrity for an early-stage low-cap token. Its gradual price increase, controlled volatility, and consistent liquidity suggest organic accumulation rather than hype-driven speculation. The project’s professional branding and focus on Web3 banking utility provide credibility and long-term potential. However, limited online visibility, absence of social traction, and low search interest indicate that broader awareness and community adoption are still lacking. Overall, SFY presents a promising foundation with steady fundamentals but requires stronger marketing and ecosystem expansion to achieve significant price growth.

Table of Contents

Stakefy (SFY) Listing Analysis – Early Trading Hours/Days

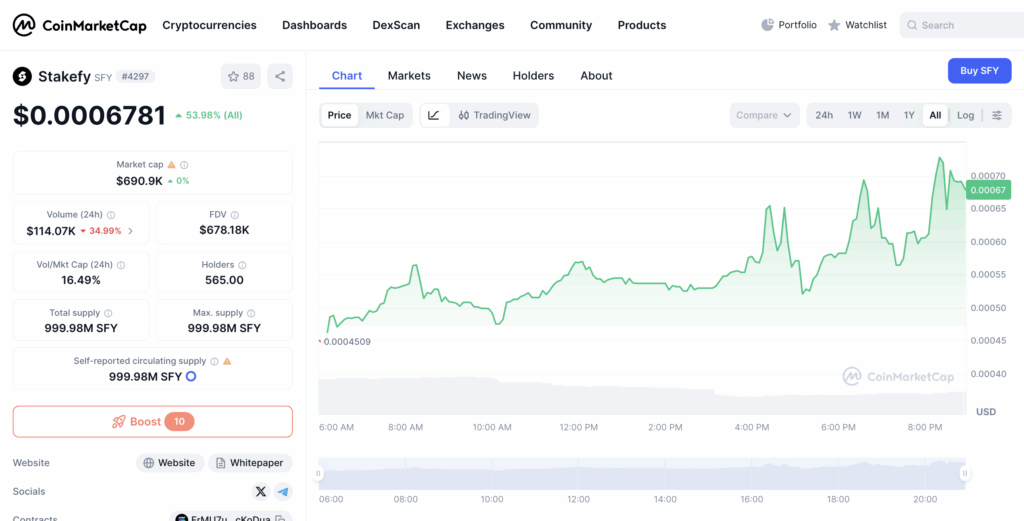

Volumes: ~$114K in 24h against a ~$690K market cap – indicating moderate but consistent trading activity with decent liquidity for a low-cap token.

Trend: Price opened near ~$0.00045, gradually climbed toward ~$0.00068 with multiple upward consolidations – showing a steady bullish structure without sharp retracements.

Volatility: Mild to moderate – intraday swings are controlled, suggesting organic accumulation rather than speculative spikes or dumps.

Behavior: Early trading reflects steady buying pressure with minor corrections, signaling accumulation behavior and growing investor confidence.

Comment: Stakefy (SFY) demonstrates a healthy early market structure with sustainable upward momentum. The lack of aggressive selling and the gradual rise in price indicate organic interest rather than short-term hype, making it a potentially stable early-phase performer.

Stakefy (SFY) Website & Ecosystem Analysis

Design & Branding: Stakefy’s website uses a sleek, minimalist aesthetic with a black-and-white palette that projects professionalism and fintech credibility. The typography and layout evoke a premium, Web3 banking feel aimed at trust and simplicity.

Token Positioning: $SFY is positioned as the utility and value backbone of a decentralized financial infrastructure for Web3 banking, focusing on yield optimization and capital efficiency rather than speculation.

Ecosystem Features: The platform emphasizes automated yield systems and passive income generation, hinting at staking or liquidity management protocols that let users “earn while they spend.” The presence of a waitlist suggests early-stage exclusivity and controlled onboarding.

Goals: Stakefy aims to reinvent personal finance in Web3 by merging DeFi tools with user-friendly financial autonomy-making digital capital productive and accessible in everyday use.

Unique Hook: The “Financial Engine for Web3 Banking” narrative differentiates Stakefy as a bridge between decentralized finance and traditional financial usability, blending yield automation with spending flexibility.

Comment: Stakefy positions itself as a next-gen Web3 fintech solution, prioritizing design, usability, and passive income mechanics. Its refined branding and conceptual clarity suggest strong potential appeal to users seeking simplicity and sophistication in DeFi adoption.

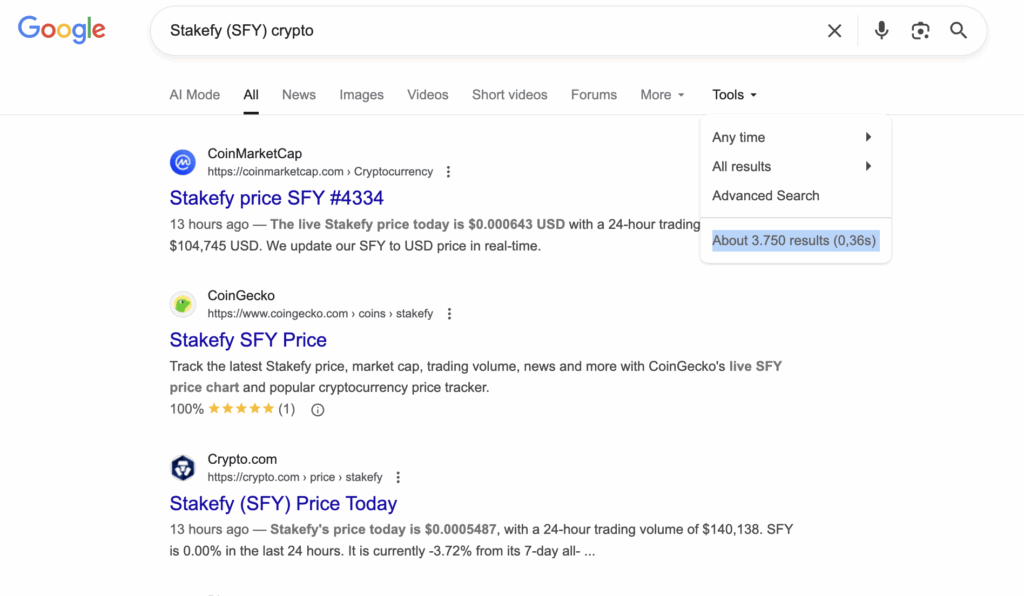

Hype Analysis: Google Search + Google Trends

We analyzed Google search visibility for “Stakefy (SFY) crypto” and found approximately 3,750 indexed results. From an analytical perspective, this represents a relatively low level of online presence. Such a number indicates early-stage exposure and limited media coverage, which is typical for newly launched or niche projects. While not yet a sign of broad market traction, it also means Stakefy is still in its discovery phase. As awareness grows and listings expand, this number can be expected to increase, improving the token’s visibility and perceived credibility over time.

We analyzed Google Trends data for “Stakefy (SFY)” and found that there is currently too little search activity to generate measurable results. From an analytical standpoint, this indicates very low public awareness and limited mainstream traction at this stage. Such results are typical for newly launched projects that have not yet entered broader market attention. To increase visibility and investor confidence, Stakefy will need to focus on marketing exposure, partnerships, and consistent community engagement to build momentum over time.

Reddit & Social Media Opinions

Based on the available data, Stakefy ($SFY) has no social media presence on Reddit. The search query returned generic, topical discussions related to staking, which is a common crypto activity, and references to traditional finance platforms that happen to use the word “Stake”.

The complete lack of any posts mentioning “Stakefy,” the ticker “$SFY,” or any project details indicates that the token is either extremely new, entirely inactive, or so low-cap that it has failed to penetrate public crypto discussion channels. From an analytical perspective, there is zero community sentiment to evaluate, and any investment would be made without the foundational layer of retail support or hype common to successful speculative assets.

Stakefy (SFY) Price Prediction Matrix

| Factor | Observation | Analyst Assessment | Impact on Price Forecast |

|---|---|---|---|

| Trading Volume (24h) | ~$114K vs ~$690K market cap | Moderate liquidity for a low-cap project, showing consistent participation | Slightly Positive – supports stable early growth |

| Price Trend | Gradual rise from ~$0.00045 to ~$0.00068 | Controlled, bullish structure with healthy consolidation | Positive – indicates organic accumulation |

| Volatility | Mild to moderate | Stable intraday movements, no signs of manipulation or panic | Positive – stable structure attracts cautious investors |

| Market Behavior | Steady buying with minor corrections | Reflects confidence-driven accumulation phase | Slightly Positive – steady hands in the market |

| Website & Branding | Minimalist, premium fintech style | Strong trust-focused identity aligned with DeFi professionalism | Positive – enhances credibility and investor appeal |

| Token Positioning | Web3 banking and yield efficiency | Clear narrative emphasizing utility over hype | Positive – potential for long-term sustainability |

| Ecosystem Features | Automated yield and passive income systems | Functional focus, controlled onboarding, strong conceptual clarity | Slightly Positive – credible foundation for expansion |

| Search Visibility (Google) | ~3,750 indexed results | Early-stage visibility, low but growing awareness | Neutral – needs media traction to improve trust |

| Google Trends | No measurable search volume | Very low public awareness outside niche users | Negative – requires aggressive marketing to gain traction |

| Social Media (Reddit, etc.) | No posts or mentions detected | Absence of community activity or engagement | Negative – limited retail interest or viral potential |

Stakefy (SFY) Price Forecast & Trading Scenarios

| Scenario | Assumed Price Move | Forecast Price ($) | PnL on $1,000 (Spot) | PnL with 5× Leverage | PnL with 10× Leverage |

|---|---|---|---|---|---|

| Bearish Dump | -70% | 0.000203 | -$700 | -$3,500 | -$7,000 |

| Mild Correction | -30% | 0.000475 | -$300 | -$1,500 | -$3,000 |

| Sideways / Stable | 0% | 0.000678 | $0 | $0 | $0 |

| Moderate Pump | +50% | 0.001017 | +$500 | +$2,500 | +$5,000 |

| Strong Pump | +150% | 0.001695 | +$1,500 | +$7,500 | +$15,000 |

| Extreme Hype Run | +400% | 0.00339 | +$4,000 | +$20,000 | +$40,000 |