Syndicate (SYND) demonstrates a structured and confident market debut supported by strong liquidity, institutional interest, and mature branding. The project positions itself as a foundational Web3 infrastructure token with credible partnerships and long-term potential. While current volatility is moderate and social traction remains limited, its high visibility, professional execution, and ecosystem depth suggest solid fundamentals. Overall, SYND shows early signs of stability and sustainable growth potential, making it a mid-risk, high-upside asset contingent on continued adoption and broader market sentiment.

Table of Contents

Syndicate (SYND) Listing Analysis – Early Trading Hours/Days

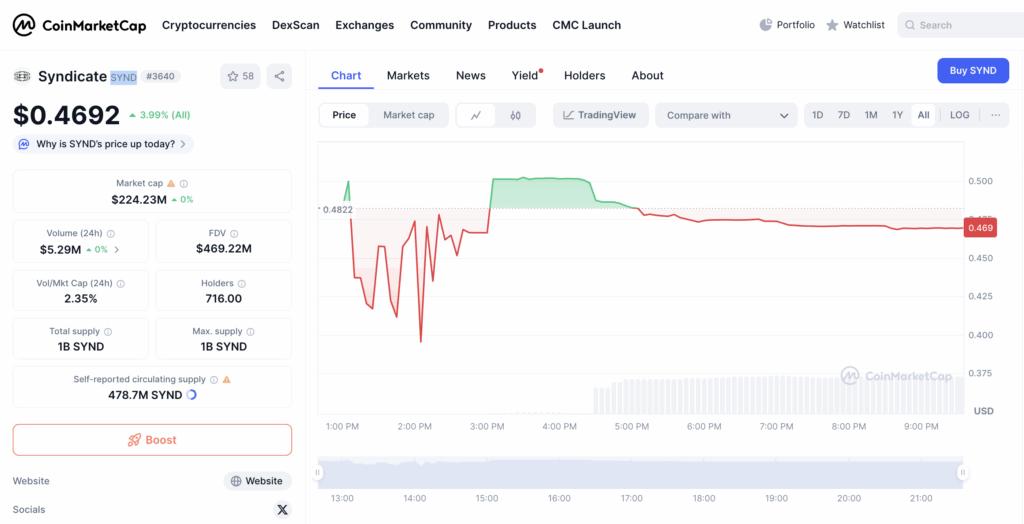

Volumes: 24h trading volume reached approximately $5.29M, indicating a moderate but consistent influx of capital during early trading hours. The Vol/Mkt Cap ratio of 2.35% suggests steady liquidity without aggressive speculation.

Trend: The token opened near $0.48, briefly surged above $0.49, and then experienced a correction to around $0.46. The pattern shows an initial buyer push followed by quick stabilization, implying early consolidation.

Volatility: Moderate – short-term fluctuations were visible in the first few hours, but no signs of extreme dumps or panic selling. Price action remained within a tight $0.045 range, reflecting healthy stabilization.

Behavior: Early trading behavior appears balanced, with measured entries from institutional or informed participants rather than impulsive retail buying. The absence of deep wicks or sharp sell-offs signals confidence in price levels.

Comment: Syndicate (SYND) launched with strong capitalization and controlled market behavior. Despite slight corrections, the token maintained composure with sustainable liquidity and moderate volatility, suggesting structured trading and early-stage stability rather than speculative chaos.

Syndicate (SYND) Website & Ecosystem Analysis

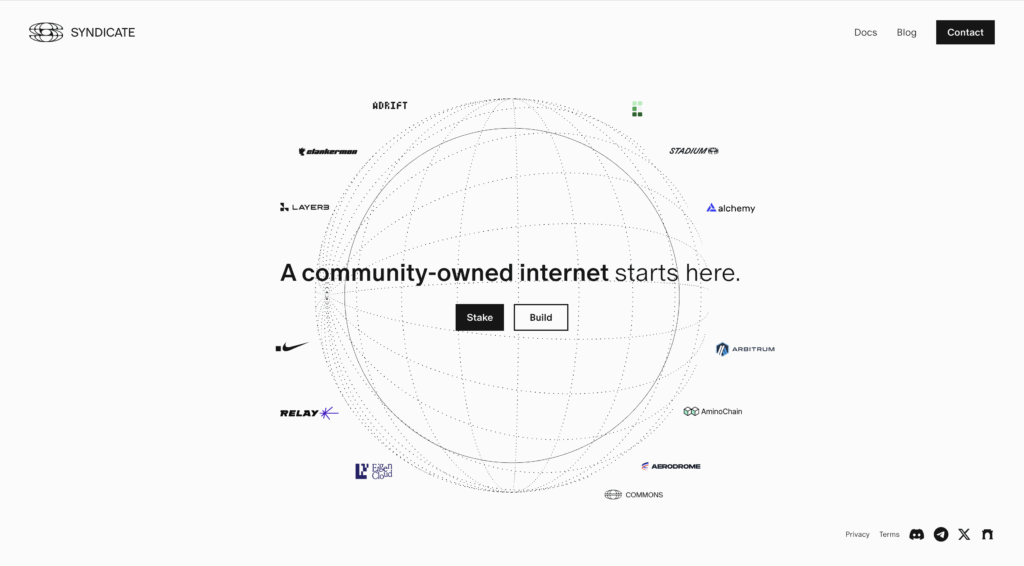

Design & Branding: The Syndicate website uses a minimalistic and futuristic aesthetic built around a globe motif, symbolizing decentralization and global connectivity. Its clean typography and black-and-white color scheme convey professionalism, trust, and a Web3-native identity.

Token Positioning: The SYND token is positioned as an infrastructure asset powering a decentralized internet. It represents governance and staking utility within a protocol that enables users to stake, build, and participate in decentralized networks.

Ecosystem Features: The ecosystem includes staking mechanisms, DAO tools, and builder frameworks for decentralized applications. Partnerships with projects like Arbitrum, Alchemy, and Layer3 highlight strong technical integration and cross-chain functionality.

Goals: Syndicate aims to create a community-owned digital infrastructure where users and developers can co-govern and co-build the decentralized web. Its focus is on enabling permissionless collaboration, staking, and innovation in the on-chain economy.

Unique Hook: The project stands out for its blend of institutional-grade design and grassroots decentralization ethos. By merging staking, governance, and developer tools under one ecosystem, it positions itself as a foundational layer for the Web3 economy.

Comment: Syndicate delivers a mature and visionary ecosystem, emphasizing decentralization, credibility, and collaboration. The strong visual identity and partnerships suggest long-term sustainability, positioning SYND as a serious player in the next phase of Web3 infrastructure growth.

Hype Analysis: Google Search + Google Trends

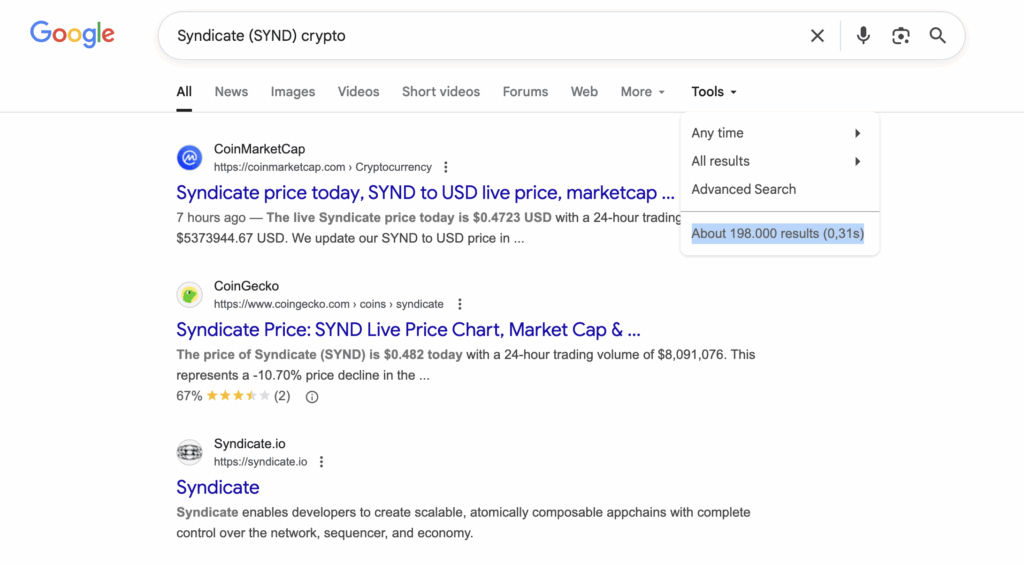

We analyzed Google search results for “Syndicate (SYND)” and found about 198,000 indexed pages. From an analytical standpoint, this indicates a strong online presence and high visibility for a recently launched or emerging project. Such a volume of indexed results reflects significant media coverage, integration into major crypto platforms, and active mentions across news outlets and communities.

In comparison to similar early-stage Web3 infrastructure tokens, this level of exposure is above average. It suggests growing market trust, strong SEO footprint, and rising awareness among both retail and institutional audiences. In short, Syndicate is clearly on the radar – its visibility level supports long-term credibility and positions it for sustained ecosystem growth.

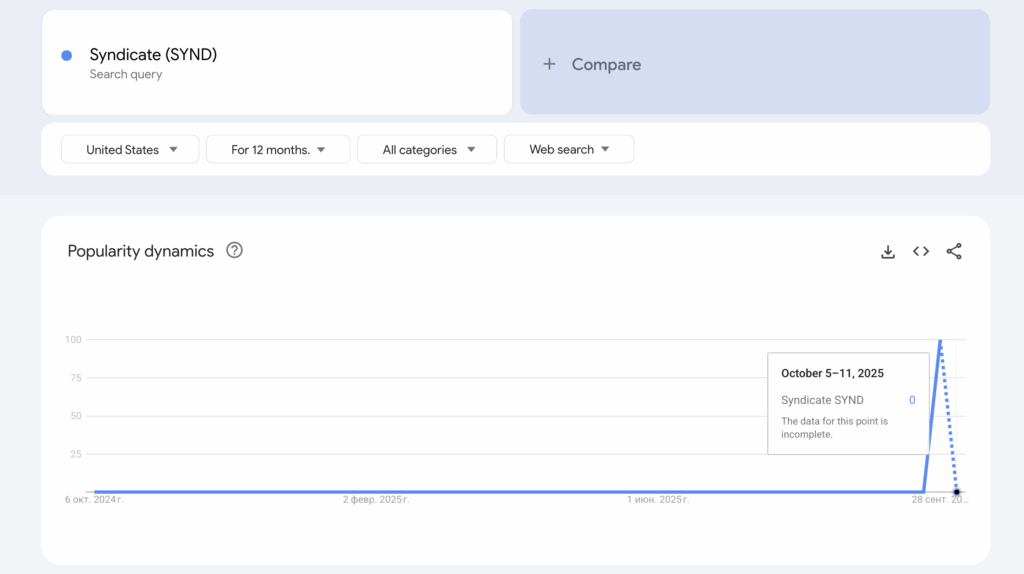

We analyzed Google Trends data for “Syndicate (SYND)” and observed a sharp spike in search interest during the week of October 5-11, 2025. From an analytical standpoint, this indicates a recent surge in public attention, likely linked to the project’s listing or major announcements.

However, since this is the first significant increase after a long period of zero activity, the trend reflects early-stage awareness rather than sustained popularity. In other words, interest is starting to build but remains limited to the crypto community. Consistent growth in this metric would be necessary to confirm broader market traction and long-term visibility.

Reddit & Social Media Opinions

The social media footprint for Syndicate (SYND) is professional and market-centric, rather than community-driven. Reddit activity is minimal and heavily biased toward technical speculation or irrelevant posts, indicating that a significant grassroots community has not yet formed or is not actively engaging on that platform. However, the project’s price is demonstrably influenced by general social sentiment across all major platforms, which analysts actively track, suggesting a high degree of market efficiency and sensitivity to social hype and news.

SYND should be viewed as an infrastructure play with significant venture capital and institutional attention, evidenced by its backing from major investors, its roadmap listing on Coinbase, and its focus on the technically demanding “appchain thesis”. Its price volatility since launching in September 2025, including a significant drop from its ATH, confirms that even well-backed projects are subject to aggressive market forces and rapid sentiment shifts, despite a current “bullish” community outlook. The analysis points to a project with strong fundamentals and backing, but with trading dynamics heavily influenced by broad crypto market sentiment and news flow, overshadowing any visible organic retail adoption.

Syndicate (SYND) Price Prediction Matrix

| Factor | Observation | Analyst Assessment | Impact on Price Forecast |

|---|---|---|---|

| Trading Volume (24h) | $5.29M with a Vol/Mkt Cap ratio of 2.35% | Stable liquidity and balanced inflow during early trading | Slightly Positive – supports sustainable market behavior |

| Price Trend | Opened near $0.48, corrected to $0.46 after short surge | Early consolidation phase with controlled movement | Neutral to Positive – indicates early stability |

| Volatility | Moderate short-term fluctuations within $0.045 range | Healthy market dynamics without speculative extremes | Neutral – stable environment for accumulation |

| Market Behavior | Balanced participation, no signs of panic or manipulation | Controlled trading suggests informed investor base | Positive – reflects confidence and organic growth |

| Website & Branding | Minimalistic, professional, and futuristic with global theme | High credibility and strong institutional-grade design | Positive – builds investor trust and long-term brand strength |

| Token Positioning | Infrastructure and governance token powering Web3 ecosystem | Clear technical purpose beyond speculation | Positive – strong foundation for long-term valuation |

| Ecosystem Features | Includes staking, DAO tools, and builder frameworks | Technologically advanced and integrated with major partners | Positive – enhances utility and adoption potential |

| Search Visibility (Google) | ~198,000 indexed results | High visibility and SEO presence across crypto media | Strongly Positive – supports market awareness and credibility |

| Google Trends | Sharp interest spike in early October 2025 | Early-stage awareness, still building long-term traction | Neutral to Slightly Positive – potential for expansion |

| Social Media (Reddit, etc.) | Low organic activity but visible institutional attention | Limited community strength, market driven by sentiment | Slightly Negative – vulnerable to macro sentiment shifts |

Syndicate (SYND) Price Forecast & Trading Scenarios

| Scenario | Assumed Price Move | Forecast Price ($) | PnL on $1,000 (Spot) | PnL with 5× Leverage | PnL with 10× Leverage |

|---|---|---|---|---|---|

| Bearish Dump | -70% | 0.141 | -$700 | -$3,500 | -$7,000 |

| Mild Correction | -30% | 0.328 | -$300 | -$1,500 | -$3,000 |

| Sideways / Stable | 0% | 0.469 | $0 | $0 | $0 |

| Moderate Pump | +50% | 0.704 | +$500 | +$2,500 | +$5,000 |

| Strong Pump | +150% | 1.173 | +$1,500 | +$7,500 | +$15,000 |

| Extreme Hype Run | +400% | 2.345 | +$4,000 | +$20,000 | +$40,000 |